Emeco

The main market targets of Emeco Holdings Limited (ASX: EHL), which operates in a cyclical earth moving equipment industry, entail Australian rental as well as Workshops. The company’s revenue from the Australian rental segment witnessed the rise of 81.2% and stood at $355.2 million in FY2018 on the YoY basis. Its operating earnings before interest, tax, depreciation and amortization or EBITDA margin witnessed the rise to 47.3% during the same period while in the year ago period it was 32.9%. The factors which provided the boost are innovative contract structures as well as utilization, elevated rental rates. However, controlling the costs was also the contributor.

What EHL’s management has in mind?

In FY2018, Emeco Holdings Limited’s operating utilization witnessed a strong momentum on the YoY basis. The company ended FY 2018 with operating utilization of 62% while it ended the previous year with 56%. Apart from this, the robust momentum was also witnessed in the fleet size during the same period.

Moving forward, the company’s top management eyes further improvement in the operating utilization which are being advanced on rental basis. The company might also go for the redeployment of the underutilized fleet so that greater returns can be achieved. In FY2018, the company’s operating revenues stood at $381 million while in the previous year it was $233 million. In addition, the company also witnessed robust momentum in the rental revenues which stood at $324 million. In FY2017, it was $208.8 million. The reasons for the increase were Force acquisition, positive momentum with regards to rental rates as well as in the rental fleet’s operating utilization.

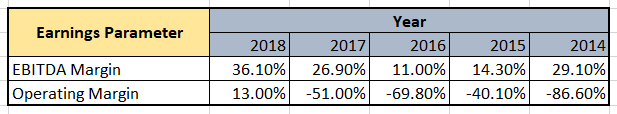

Margin Scenario over the years (Source: Company Reports and Thomson Reuters)

What’s Ahead for EHL?

The top management of Emeco Holdings Limited views positive momentum with respect to earnings as well as revenues in FY2019. This expected strong momentum would be on the back of more retail maintenance services, benefits from the Force acquisition and expected upward momentum in the rates as well as utilization. However, after the Matilda acquisition gets completed, it would also contribute to the company’s numbers.

Emeco Holdings Limited’s operating EBITDA stood at $153 million in FY2018 which reflects an increase of 83.2% on the YoY basis thanks to higher rates, utilization coupled with acquisitions as well as steps undertaken to control the costs. The group’s price to book value may go down from about 7.77 to 4.97 in FY19. Its return on equity has now fallen in positive domain at 8.8% against industry median of 15.3%. The stock has been also added to S&P /ASX All Australian 200 Index effective September 24, 2018, and has strong underlying fundamentals. We maintain a “Speculative Buy” on the stock at the current price of $ 0.36, which has respected support level of $0.34.

.png)

EHL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

Please wait processing your request...

Please wait processing your request...