This report is the updated version of the report uploaded on 7 November 2023 at 4:45 PM GMT +11

Domino's Pizza Enterprises Limited

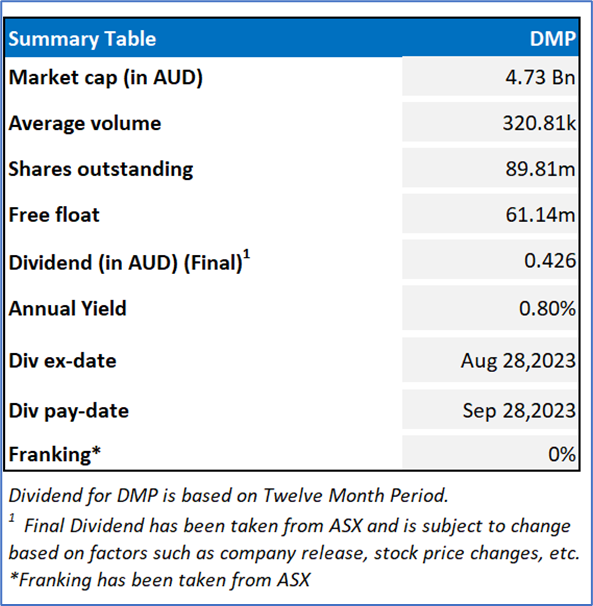

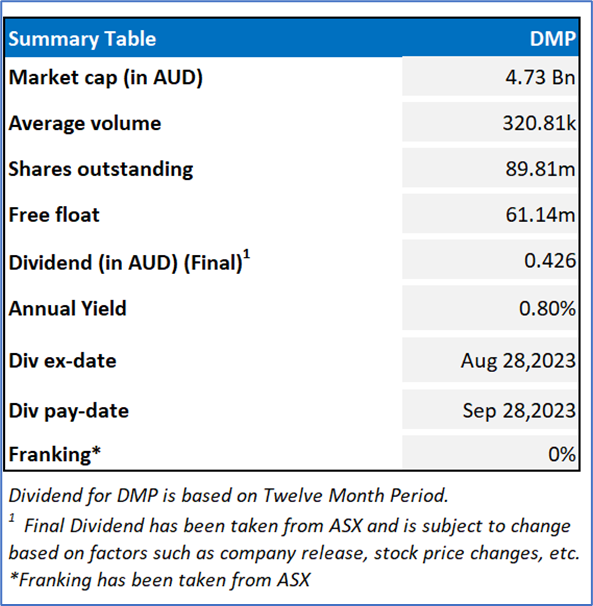

DMP Details

Domino's Pizza Enterprises Limited (ASX: DMP) is an Australia-based food retail chain who has outlets as well as franchise services worldwide.

Financial Results for FY 2023

- The company released its FY 2023 financial results and total food sales grew by 2.2%, but EBIT declined by 23.3%. The total sales growth came through higher menu prices, but fewer meals sold.

- DMP’s margins as well as earnings would be affected by the decision to increase menu prices in order to protect the sustainability of over 1,000 franchisee partners faced with extraordinary inflation.

- Its revenue increased 3.4% to $2.37 Bn, however, the underlying EBIT reduced 23.3% to $201.7 Mn.

Key Updates

DMP provided the trading update for the Financial Year to Date, with sales rising by 12.7% than the prior year. Notably, the same store sales were positive year-to-date in 10 of the company’s 12 markets, excluding Japan and Taiwan.

Outlook

The company’s earnings in the H1 FY 2024 are expected to be significantly higher than the prior Half Year (H2 FY 2023), with YoY growth for the Financial Year to be delivered in H2.

Key Risks

Weak global growth, volatility in the market, inflation, etc. are some of the risks the company is exposed to.

Fundamental Valuation

P/E Based Relative Valuation (Illustrative)

Stock Recommendation

Over the last three months, the stock has given a return of 4.92%. The stock has made a 52-week low and high of AUD 40.75 and AUD 76.95, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 53.62 (as of November 7, 2023, at 11:10 AM AEDT).

Technical Overview:

Domino's Pizza Enterprises Limited (ASX: DMP) is part of Kalkine’s Global Big Money product.

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on November 7, 2022. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...