Corporate Travel Management Limited (ASX: CTD)

CTD is an Australia-based company that provides travel management solutions and manages the purchase and delivery of travel services for the corporate market worldwide.

Recommendation Rationale – SELL at AUD 19.23

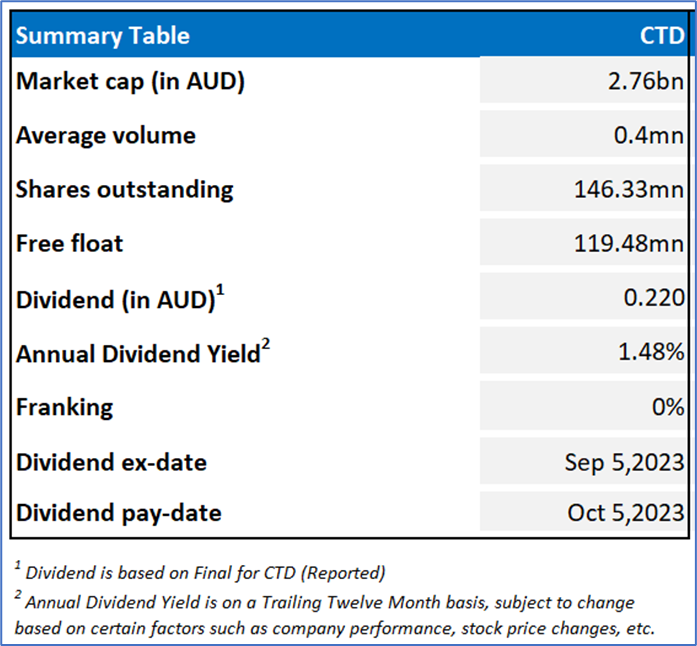

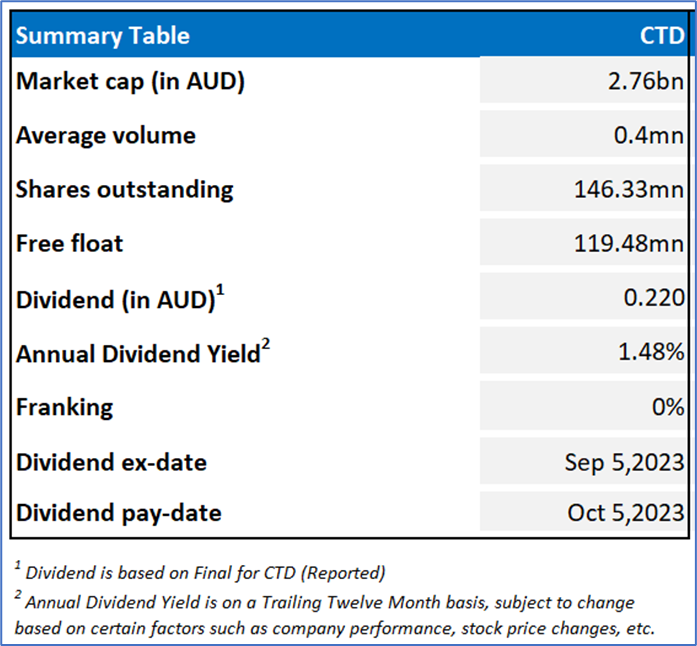

- Financial Performance: In FY23, the company’s revenue & other income went up by 69.8% YoY. In FY23, 89% of CTM revenues were derived from transactions. During the period, CTD saw high client wins: >97% client retention. The business won AUD 2.95bn of annualised new client wins in FY23.

- Outlook: CTD anticipates FY24 EBITDA to be between AUD 240-280mn, and revenue to be between AUD 770mn to AUD 850mn. Further, PBTa is expected to be within an ambit of AUD 193mn to AUD 233mn, buoyed by substantial client wins, supply chain stability, and rising productivity. The group has secured 15% of its FY24 global sales target in July 2023.

- Emerging Risks: Uncertain macroeconomic conditions resulting in inflation and higher interest rates could have a material adverse impact on the business or financial performance of CTD.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/Sales, EV/EBITDA, Price/Earnings, Price/Cash Flow, Price/Earnings and Price/Book) are higher than the average of the Consumer Cyclicals’ industry.

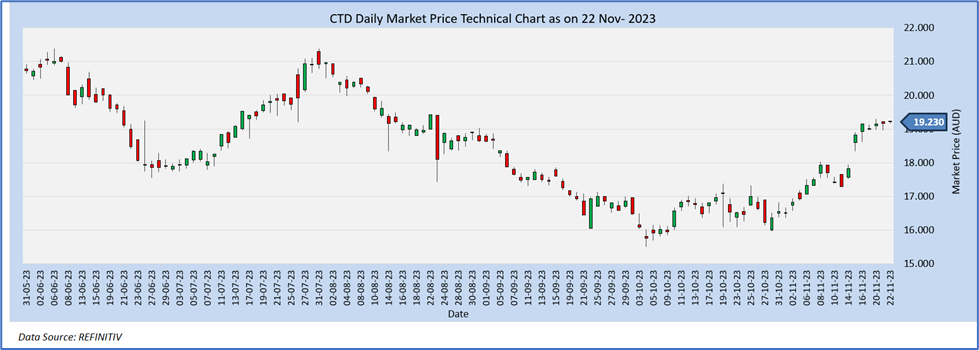

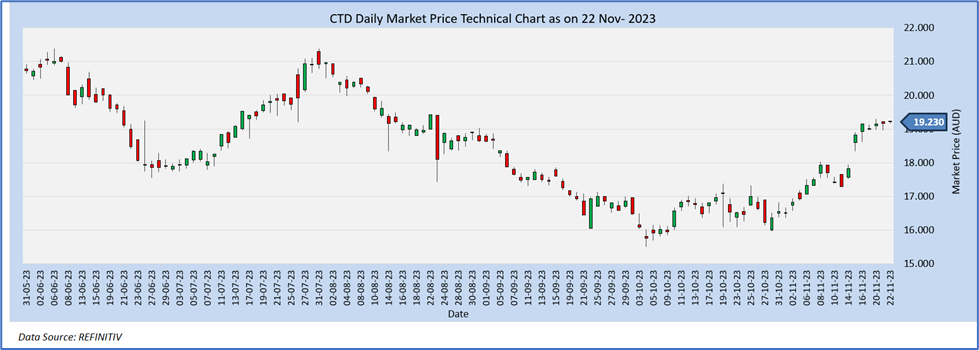

CTD Daily Chart

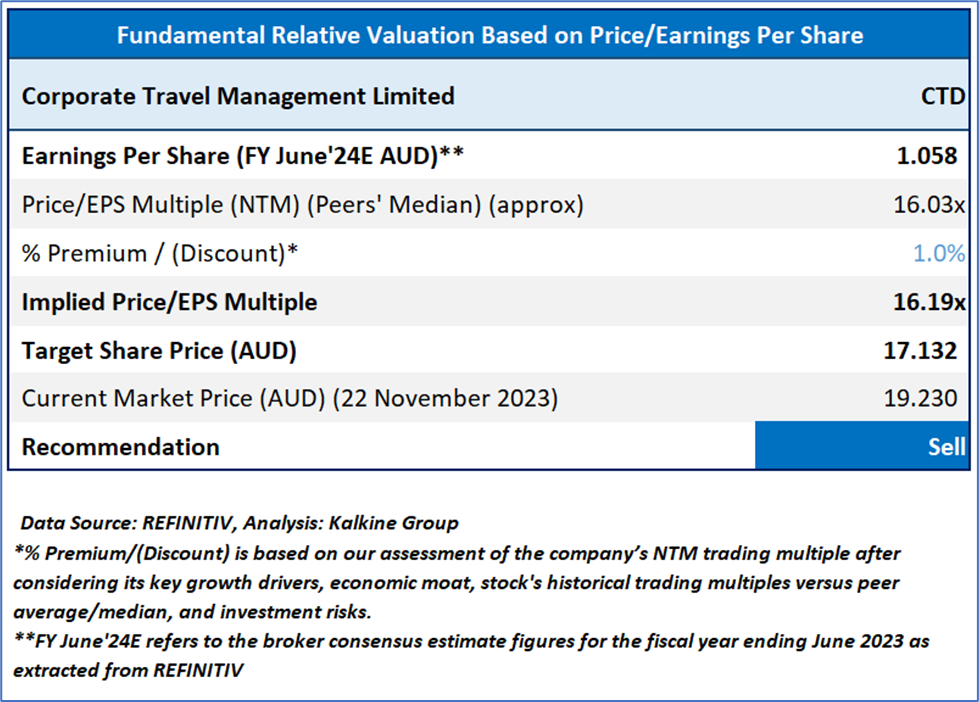

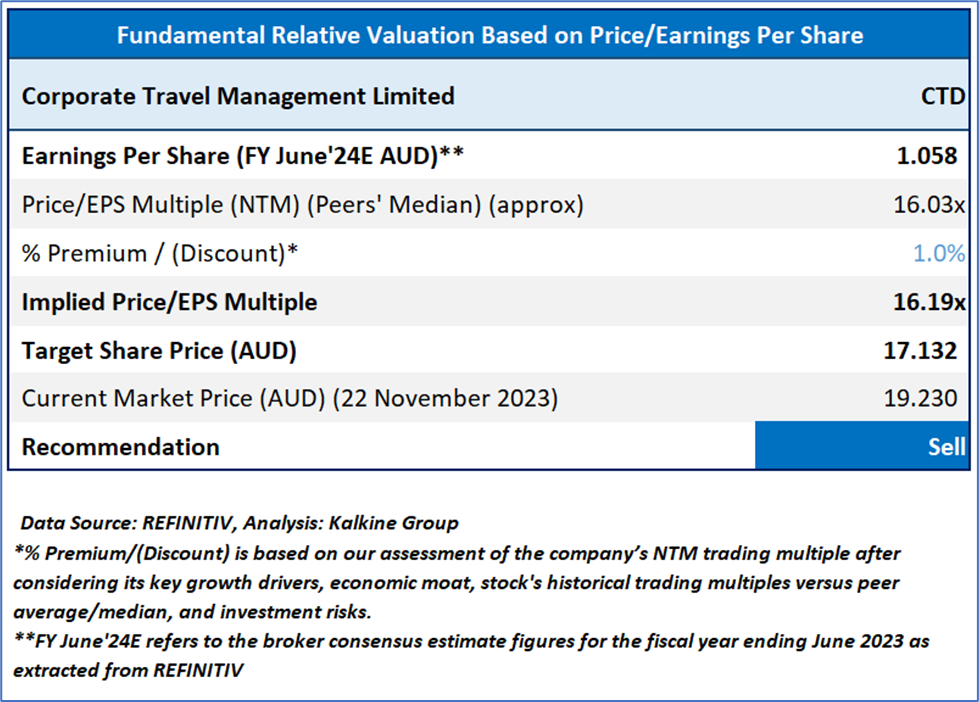

Valuation Methodology: Price/Earnings Approach (FY June'24E) (Illustrative)

Given the increase in top and bottom line, high client wins, excess staff capacity, the stock might trade at a slight premium to its peers. For valuation, few peers like Webjet Ltd (ASX: WEB), Flight Centre Travel Group Ltd (ASX: FLT), and Helloworld Travel Ltd (ASX: HLO) have been considered. Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 19.23 (as of November 22, at 10:00 AM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 22 November 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

AU

Please wait processing your request...

Please wait processing your request...