Kalkine has a fully transformed New Avatar.

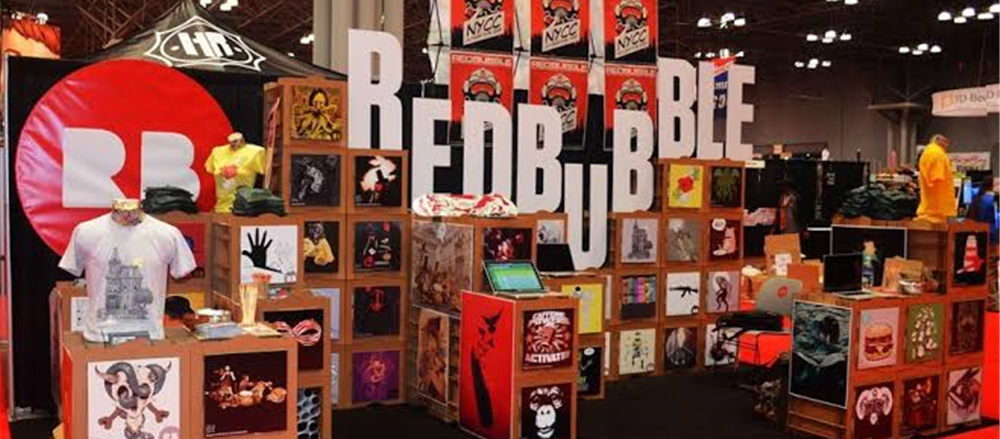

Redbubble Limited

1QFY20 Witnessed Decent Growth:Redbubble Limited (ASX: RBL) is a small-cap global online marketplace with the market capitalization of ~$500.69 million as on 04 November 2019. Recently, the company reported that one of its Directors, Martin Hosking disposed 6,000,000 shares by Jellicom Pty Ltd (as to 5,000,000 of the Shares) and Three Springs Foundation Pty Ltd (as to 1,000,000 of the Shares) for the total value of $11,580,000 via off-market trade. With this development, Mr Hosking retains a substantial beneficial holding of 19.6% in the Company.

RBL recently announced that Challenger Limited and its entities have made a change to their substantial holdings in the company, and the current voting power stands at 7.85% as compared to the previous voting power of 6.68% on 29th October 2019. In another update, the company stated that it has issued 1,100,000 fully paid ordinary shares at the consideration of $2,057,000 to Solium Nominees (Australia) Pty Ltd, as trustee of the Redbubble Limited Employee Share Trust.

Recently, the company has announced its results for Q1 FY20, wherein it mentioned that Group’s top-line (Revenue) continues to be fueled by strong growth rates seen from TeePublic. RBL delivered strong operating leverage with 48% gross profit growth, outpacing the growth of 22% in expenses during the quarter.

The Group is making decent progress in areas of strategic investment that are critical to long-term marketplace growth as well as profitability.It realised an amount of $1.3 million in synergies from the acquisition of TeePublic during the 8 months from deal close to the end of FY19 continues to progress with integration work. The following picture has been extracted from the investor presentation:

.png)

Redbubble Marketplace Revenue from Members Per Period (Source: Company Reports)

What to Expect:The Group is focused on executing throughout its four strategic initiatives and delivering on opportunities to propel the flywheel. It added that the business continues to demonstrate the progress on the key drivers of operating leverage.Now, the Group is focused on the upcoming holiday season.

As per the annual report, the business is focused on the strategic work to reach the milestone of $1 billion in sales.The Group is aiming long-term growth in a large addressable market. The business has demonstrated progress throughout numerous strategic initiatives, which are aimed at diversifying the Group’s sources of growth and profitability.

The company’s priority primarily remains to grow the customer base as well as to increase loyalty via personal “creative adventures” and member experiences, to launch and sell products that artists want to design and customers would love. The priorities also include maintaining strong growth and synergy value of TeePublic, leveraging new product, on-boarding content partnerships as well as geographic growth opportunities.

Stock Recommendation: The company stated that the total global online market for Apparel and Homewares is expected to grow between 10- 14% per annum to 2020. The company witnessed a CAGR growth of 44.15% in total revenue over the period of FY15-FY19 and, thus, it is possessing respectable capabilities to garner revenues. The Group reported a gross margin of 30.8%, reflecting YoY growth of 1.6% in FY 2019. On the stock’s performance front, it produced returns of 29.87% and 46.59% in the time span of one month and three months, respectively. Considering the growth scenario of the business, decent Q1 FY20 results, its capabilities to garner revenues, decent outlook, along with respectable progress with regards to strategic investments, we maintain our “Hold” rating on the stock at the current market price of A$1.910 per share, down 1.292% on 04 November 2019.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.