Brookfield Renewable Corporation

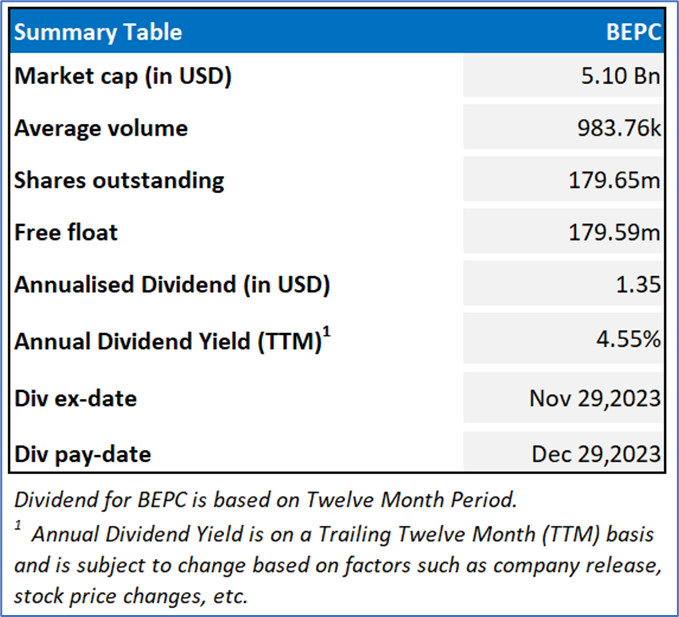

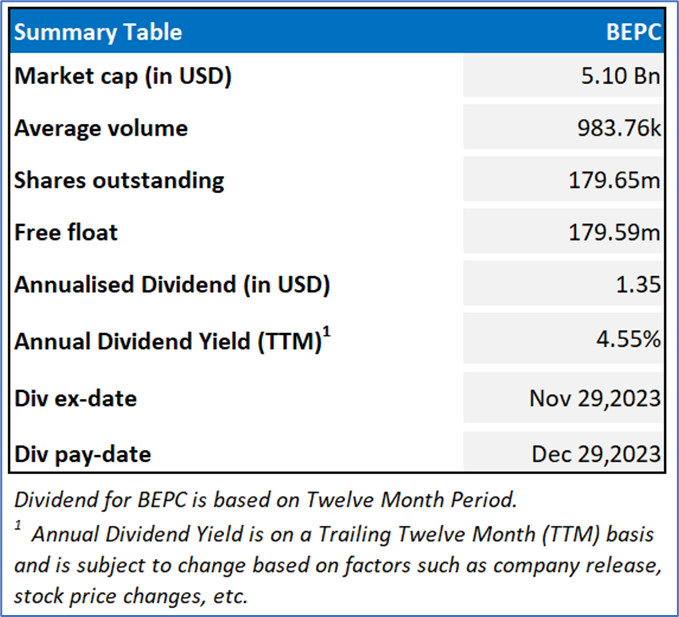

BEPC Details

Brookfield Renewable Corporation is the globally diversified multi-technology owner as well as operator of clean energy assets.

Financial Results for Q3 FY 2023

- The company has released financial results for the 3 months ended September 30, 2023. Its revenues totalled $934 Mn implies an increase of $38 Mn over the same period in the prior year because of the growth of business, stronger resources as well as higher realized prices, which were partially offset by the lower generation.

- Its net income totalled $1,370 Mn which implies a rise of $853 Mn over the prior year.

- Its property, plant and equipment totalled $39.2 Bn as at September 30, 2023 as compared to $37.8 Bn as at December 31, 2022, representing a rise of $1.4 Bn.

Outlook

In order to finance the large-scale development projects as well as acquisitions, the company would be evaluating variety of capital sources including proceeds from selling mature businesses, in addition to garnering money in the capital markets via equity, debt and preferred share issuances.

Key Risks

Electricity price risk, interest rate risk, foreign currency risk, etc. are some of the risks the company is exposed to.

Stock Recommendation

The stock has made a 52-week low and high of USD 36.16 and USD 21.77, respectively. The company’s performance is exposed to the risks related to the electricity price risk as well as interest rate risk. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 29.64 per share, up by 1.68% as on 5th January 2024.

Technical Overview:

Daily Price Chart

BEPC Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on January 5, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...