This report is an updated version of the report published on 30 December 2024 at 1:19 PM AEDT.

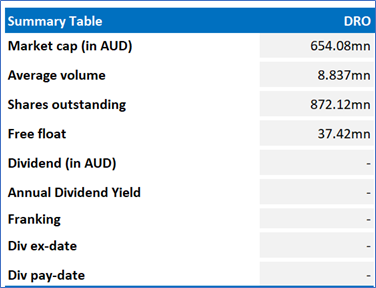

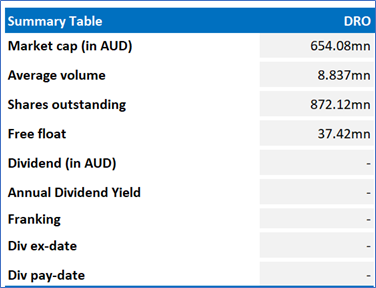

DroneShield Limited (ASX: DRO)

DroneShield Limited (ASX: DRO) specialises in the development and commercialization of counter-drone technologies. Its solutions are designed to detect, track, and mitigate the threat posed by unmanned aerial systems (UAS) or drones. The company's offerings cater to defense, government, and commercial clients worldwide.

Recommendation Rationale – SELL at AUD 0.800

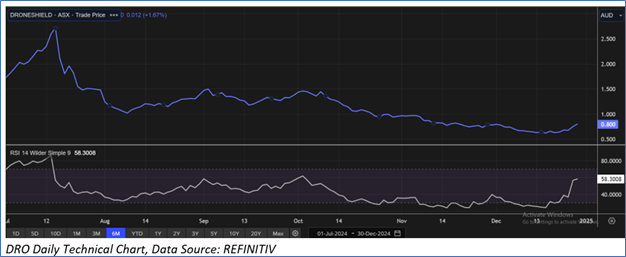

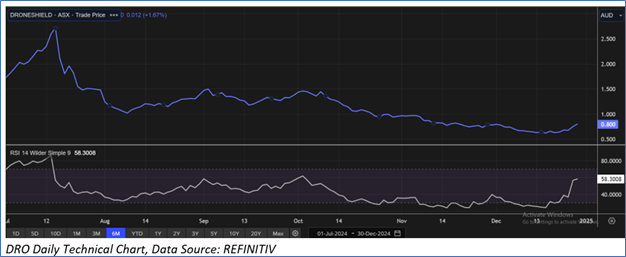

- Trading Around Resistance: DRO’s share price has crossed its R2 level, recommended on 19 December 2024.

- Overvalued Multiples: On a forward 12-month basis, the stock is trading at an EV/EBITDA multiple of 16.5x vs industry (Industrials) average of 5.8x

- Increase in Losses: In 1HFY24, the company incurred a net loss after tax of AUD 4.8 million, compared to a loss of AUD 2.9 million in the same period last year. The share-based payment expense surged by 207% to AUD 2.7 million, driven by the issuance of 51.4 million options, a significant increase from 3.8 million options in 1HFY23.

- Emerging Risks: DRO is exposed to risks including ongoing losses, changes in government policies, rapid technological advancements, and political instability. The company also faces potential delivery delays if its contract manufacturers fail to meet commitments, with reliance on a limited number of key manufacturers increasing the risk of further delays if any operational issues arise.

DRO Daily Chart

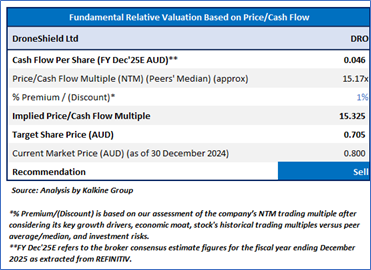

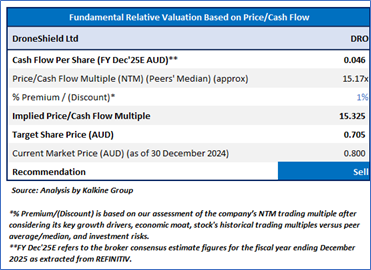

Valuation Methodology: P/CF Approach (FY Dec'25E) (Illustrative)

Considering the increasing demand for DRO's latest AI software, contract wins, rising demand for counter-unmanned systems (C-UxS), etc., the company might trade at a slight premium to its peers. For valuation, few peers like Electro Optic Systems Holdings Ltd (ASX: EOS), Austal Ltd (ASX: ASB), XRF Scientific Ltd (ASX: XRF), and others have been considered. Considering that the stock has crossed its R2 level, rally in share price movement, current trading level, downside indicated by the valuation and risks associated, it is prudent to book profit on the stock at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 0.800 (as of 30 December 2024, at 10:25 AM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 30 December 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Kalkine reports are prepared based on the stock prices captured either from REFINITIV or Trading View. Typically, REFINITIV or Trading View may reflect stock prices with a delay which could be a lag of 25-30 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...