The company made a placement to professional and sophisticated investors in accordance with section 708 a (6) of the Companies Act. Approximately 4.1 million shares amounting to 6.5% of the issued capital were issued and the company has raised approximately $ 15 million at a raising price of around $ 3.70 per share. This fresh funding is expected to accelerate growth opportunities in the TNZL business and enable the company to consider additional potential acquisition opportunities on a global basis to attain revenue and synergy growth.

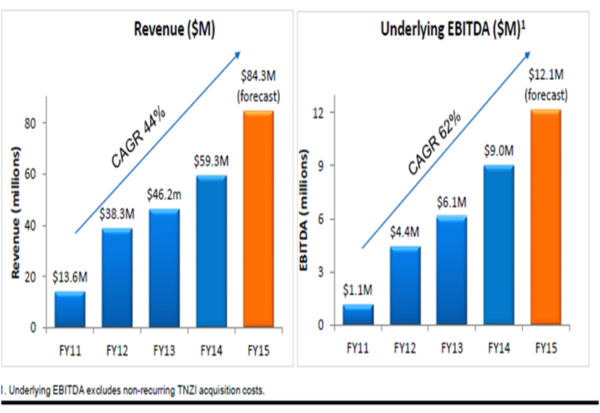

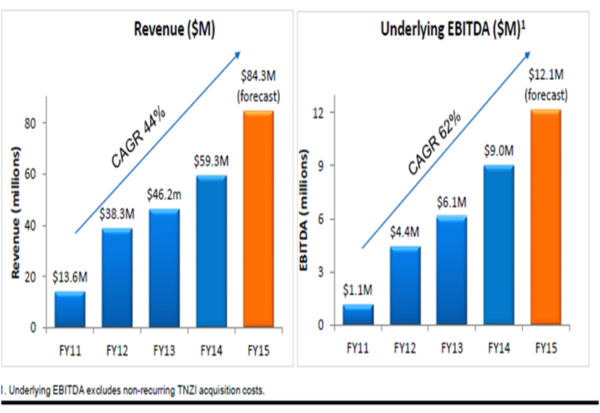

The company operates the largest VoIP network in Australia and carries over 6 billion minutes every year on a global basis. It has its own unique technical ecosystem along with its own portfolio of intellectual property and research and development capabilities. It features as a "Best under a billion" company in Forbes Asia. Revenues have grown at a CGAR of 44% and are forecast at $ 84.3 million compared to $ 59.3 million in FY 2014.

Revenue (Source: Company Reports)

Forecast for FY 2015 reaffirmed

The forecast for the financial year 2015 has been reaffirmed with revenue from MNF at $ 61.3 million and from TNZL at $ 23 million making a total of $ 84.3 million. The EBITDA will be $ 11.2 million and $ 0.9 million making a total of $ 12.1 million. The total NPAT is expected to be $ 7 million with an EPS of 11.1 cents per share. The forecast has been reaffirmed after taking into account the fourth quarter contribution from TNZL and the business is on track to meet the initial guidance of EBITDA of $ 3.5 million. EBITDA does not include non-recurring costs related to the acquisition and NPAT has not been adjusted. However, it has been adjusted to take into account new revenue and incorporates the additional depreciation, amortisation and interest expenses and the one off acquisition costs.

Capital raising

The size of the placement offer is approximately 4.1 million shares which amounts to 6.5% of the issued capital and has raised roughly $ 15 million. The offer price is $ 3.7 per share which is a 5.9% discount to the share price of 23 June 2015 of $ 3.93 and is a 5% discount to the 15 day VWAP of $ 3.89. The new shares are fully paid and will rank equally with the existing issued capital. The metrics after the capital raising will be 66.8 million and the share price $ 3.93 making a market capitalisation of $ 263 million and the forecast EPS for FY 2015 is expected to be 11.1 cents per share using the weighted average of ordinary shares throughout the financial year.

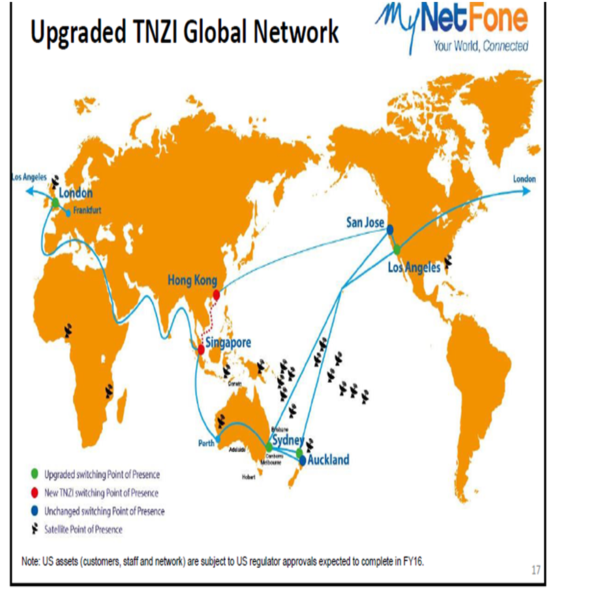

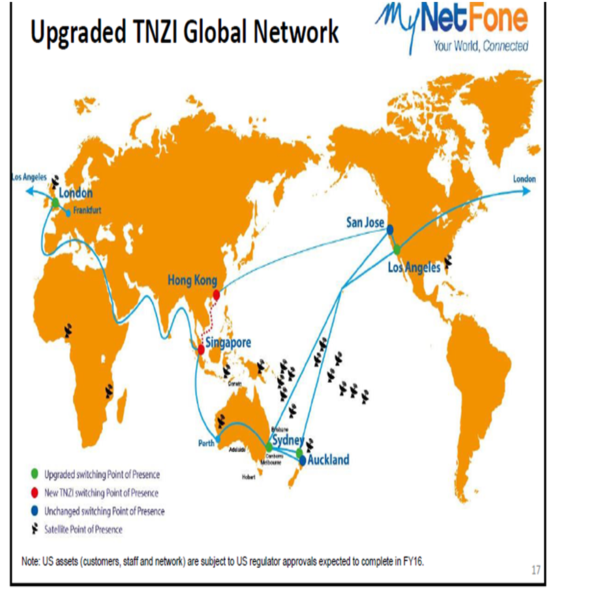

The use of funds from the capital raising will be $ 5 million for the global network expansion of TNZL which, among other things, will involve upgrading the existing technical Points of Presence in the UK, the USA and New Zealand and the deployment of new technical Points of Presence in Hong Kong and Singapore. Additional minutes trading capability and capacity will be added and a private cloud will be deployed for hosting SAAS services for the international markets. $ 10 million will be held in an acquisition reserve to augment the existing acquisition facility from the bank and to strengthen the strong cash flows generated organically. This will enable the company to be ready for potential short-term acquisition transactions and enable it to move quickly where required.

The growth outlook for the Australian operation will be unaffected by the TNZL acquisition because it is considered to be totally complementary to the other operations. The domestic focus will continue to remain virtual PBX, wholesale managed services and iBoss. The completion of the network upgrade means that utilisation tracking is currently at 50% and synergies from previous acquisitions have been optimised. In respect of the global operations, steady short-term operations are expected with margin and EBITDA growth emerging from the increases in volumes as well as cross selling. The focus for TNZL will be to immediately grow minutes revenue from increased volumes. The medium-term objective is to increase margins by the introduction of a high value mix of products using software capabilities of MNF, wholesale Managed Services and other products. The upgraded TNZL global network will look as follows:

TNZL Global Network (Source: Company Reports)

TNZL Global Network (Source: Company Reports)

The Global Network will provide coverage geographically that complements the existing MNF network and will be capable of high value incumbent connections with remote Tier 1 operators. The network will be built of high quality with the flexibility and opportunity to increase capacity quickly thanks to the in-house technology of MNF which will ensure a minimum of capital expenditure. The network will be profitable on the basis of the existing business with the opportunity to expand margins through incremental growth.

There are significant opportunities in the Asian region for growth in VoIP and SAAS products as well as building new technical Points of Presence in Hong Kong and Singapore to cater to the major regional markets. The existing TNZL relationships can be leveraged in the region to generate immediate trading growth in minutes while the longer term strategy will be to utilise new products and services to capture the emerging markets.

The company shows strong organic growth and the results demonstrate the benefits of operating leverage in which small increases in revenue can have a major impact on the bottom line. It has built a strong VoIP network results in customer benefits such as ease of operation and the reduced costs. It has the capability of adding customers to the network that it has already built which means that topline increases flow directly to the bottom line. One of the major attractions of its business is how easily it can be scaled up. It may look a little bit expensive at the current price but we believe that the track record and the potential for growth make it profitable to pay that little bit extra. We would recommend a Buy on the stock at the current price of $3.61.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376

AU

Please wait processing your request...

Please wait processing your request...