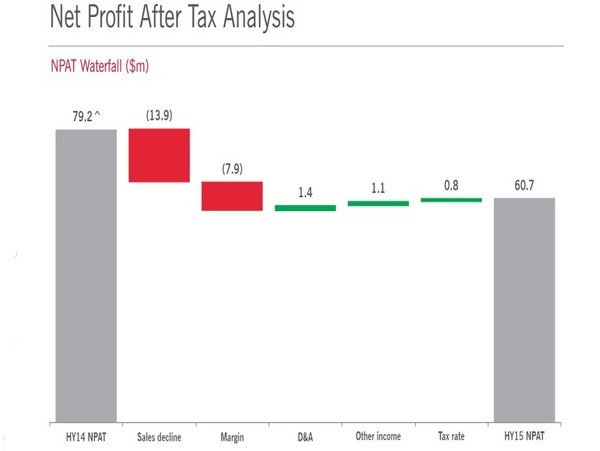

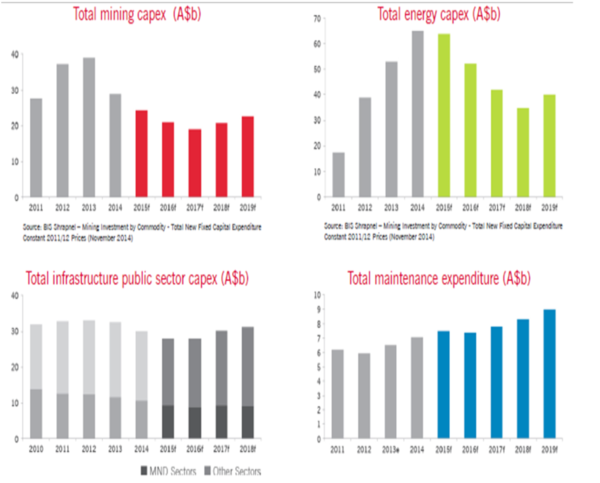

Monadelphous Group Limited (ASX: MND) sales revenues continued to witness pressure, and fell 17.6% on a year over year basis (yoy) to $1,052 million in the first half of 2015. The challenging Australian market conditions coupled with spending decrease from its customers led to the revenues decrease. Accordingly, the net profit after tax (NPAT) plunged 23.4% to $60.7million during the period, from $79.2 million in the first half of 2014. EBITDA margin fell by 0.9 percentage points to 9% in 1H15 as compared to 1H14. Earnings per share decreased by 24.3% on a year over year basis to 65.4 cents, while the dividend per share fell to 46 cents in 1H15 from 60 cents in 1H14. Cash flow from operations fell to $56.4 million from $78.1 million in 1H14, while the conversion rate reached 85%. Cash position also reduced by 9.5% yoy to $212.4 million in the first half of 2015.

Net profit after taxfirst half of 2015 performance (Source: Company Reports)

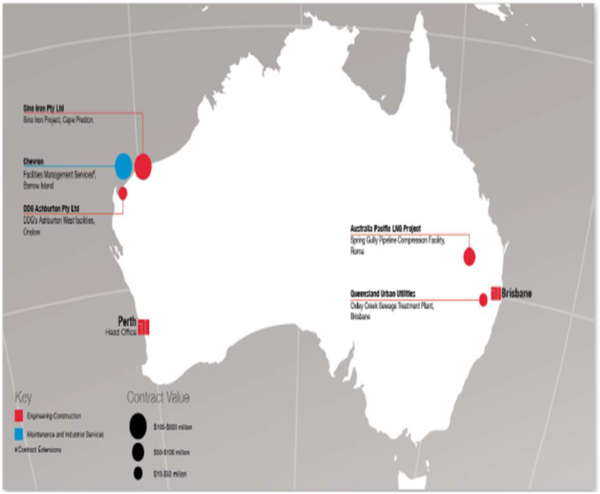

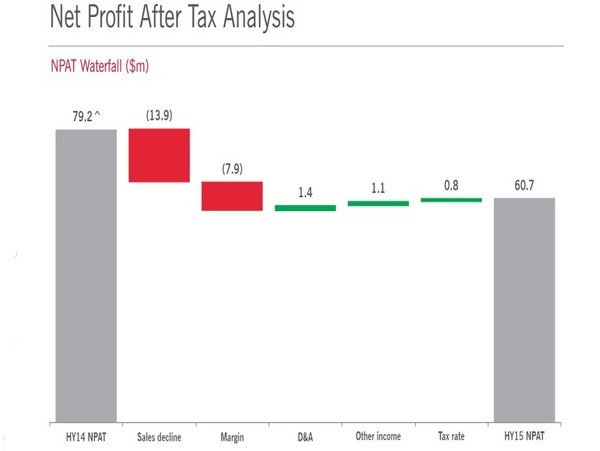

On the other hand, Monadelphous Group managed to win over $450 million of new contracts and contract extensions in the first half of 2015. The company was also able to improve its safety performance by 8% and achieved a savings of over $17 million per annum (included over $4 million of overheads). By acquiring Water Infrastructure Group, the company has further improved its infrastructure.

New Contract wins (Source: Company Reports)

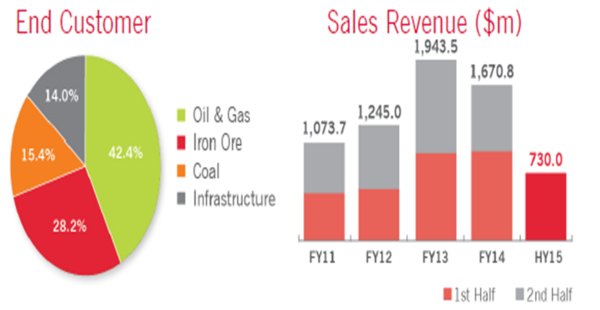

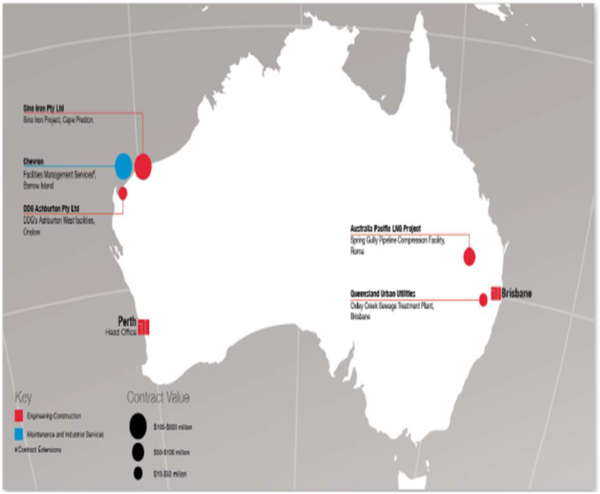

As per the divisional highlights, the group’s engineering construction segment reported a revenue of $730 million in the first half of 2015, and secured over $250 million worth of new contracts. The segment has been improving its presence in the water infrastructure. Over 42.4% of the end customers are from the oil & gas industry, followed by iron ore and coal industries which represent around 28.2% and 15.4% respectively.

Engineering Construction segment highlights (Source: Company Reports)

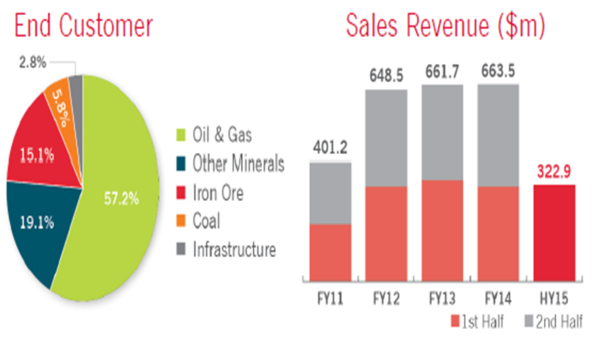

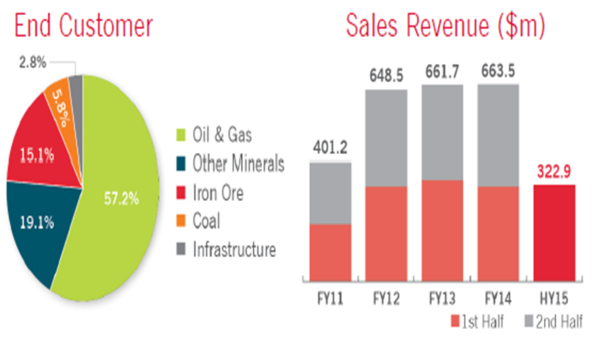

Maintenance and Industrial Services managed to improve its revenues to $322.9 million in the first half of 2015, despite tough market conditions. The division got a $200 million contract extension and has successfully closed major LNG. Oil & gas industry end customers represent a major share in the Maintenance and Industrial Services(57.2%), followed by other minerals and coal which accounts 19.1% and 15.1% share respectively.

Maintenance and Industrial Services segment highlights (Source: Company Reports)

Outlook

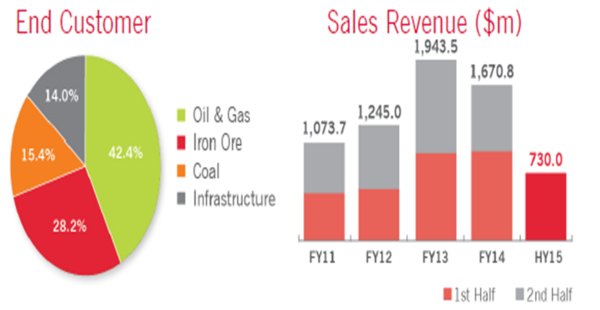

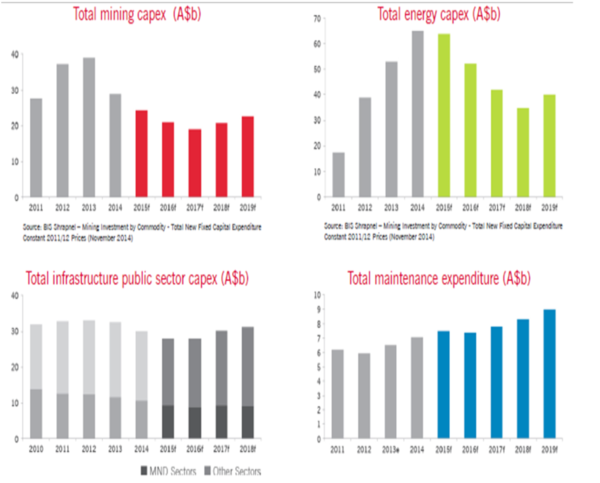

Monadelphous Group’s shares have been under pressure since 2013, due to tough market conditions and have plunged around 46% in the last fifty two weeks alone. The industry in which the company operates has been challenging from quite a while now, due to the falling spending on Australia’s resources and infrastructure. Meanwhile, this slowdown in the industry is expected to continue for another two years, before witnessing signs of recovery. Moreover, the challenging Chinese infrastructure industry is expected to further impact the group. Accordingly, Monadelphous Group also decreased its full year revenue forecast by 15% to 20%, as compared to the last year’s performance.

Monadelphous Group target Australia market conditions (Source: Company reports)

Meanwhile, the group’s stock had plunged 14.8% over the four weeks, impacted by the dispute from the Wiggins Island Coal Export Terminal (WICET) for the work completed by Monadelphous Group via its unincorporated joint venture, MMM. However, the company fought back by filing a counterclaim in the Supreme Court of Queensland against WICET. Wiggins Island Coal Export Terminal filed claims for around $130 million including the net of the proceeds of bank guarantees plus general damages, interest and costs. But, as a counter attack, Monadelphous Group had rejected WICET’s claims, as well as filed a counterclaim of approximately $200 million for recovering charges related to the changes in scope and nature of the works completion, as well as for the value of bank guarantees drawn down. Although Monadelphous Group claimed that this situation would not affect its full year or second half of 2015 earnings, we advise investors to be cautious before taking any positions in the stock further. Although the shares of Monadelphous Group have been beaten down from quite sometime, the poor full year performance, Wiggins Island Coal Export Terminal claims impact (if any) and challenging market environment is expected to put the stock under further pressure.

Based on the foregoing, we give an “Expensive” recommendation on the stock at the current levels of $8.55

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

Please wait processing your request...

Please wait processing your request...