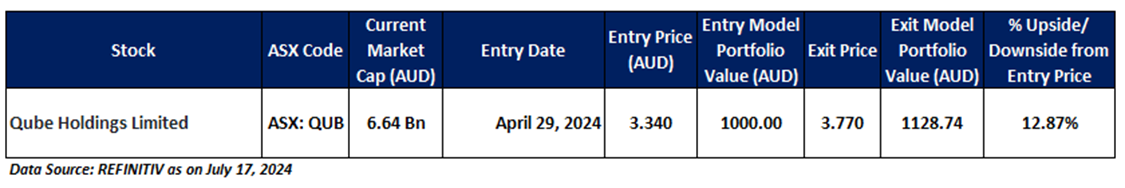

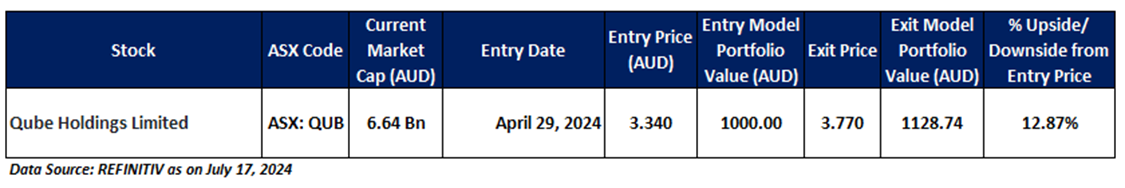

Exit Case: Qube Holdings Limited (ASX: QUB)

Overview: Qube Holdings Limited (ASX: QUB) is involved in providing solutions for handling containers, bulk, automotive and general cargo. QUB has been a part of the 'Momentum Model Portfolio' since April 29, 2024. Therefore, an 'Exit' stance from the Momentum Model Portfolio is recommended on the stock at the closing price of AUD 3.77 as on July 17, 2024.

QUB’s Daily Chart

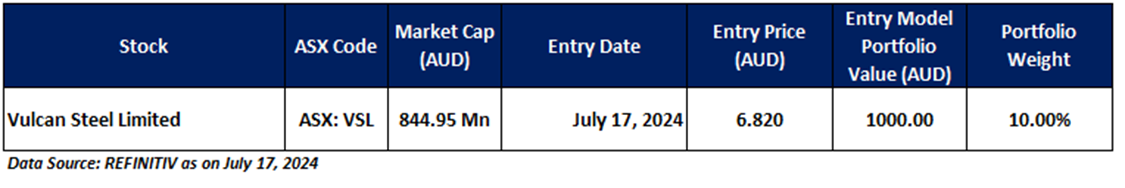

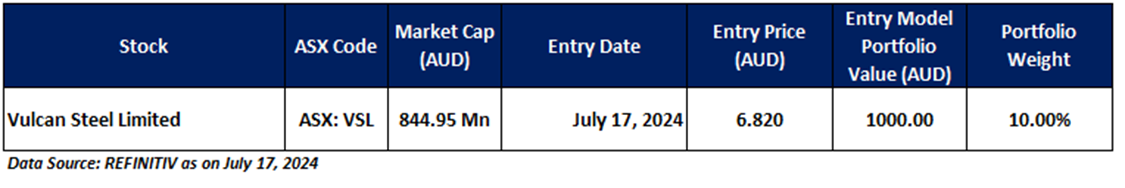

New Entry Case: Vulcan Steel Limited (ASX: VSL)

Overview: Vulcan Steel Limited (ASX: VSL) operates as an industrial product distributor and processor in Australia & New Zealand.

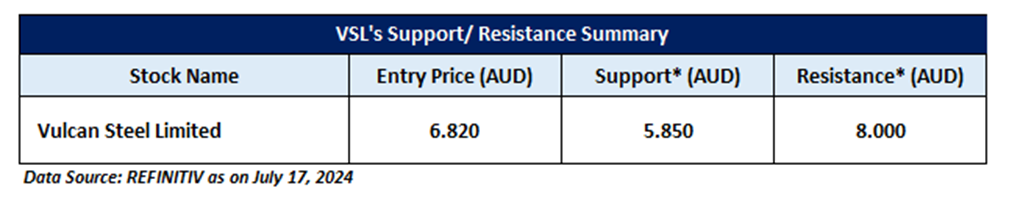

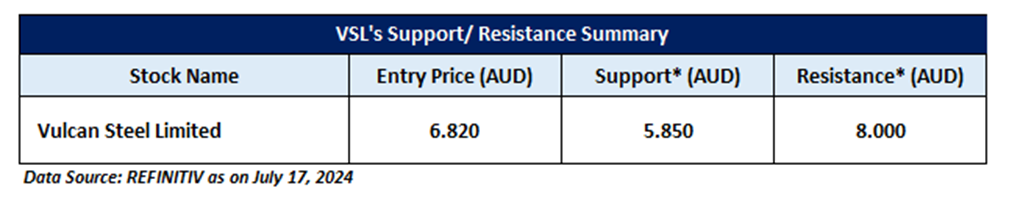

Technical Analysis: On the daily chart, VSL’s prices are trading above the downward sloping trendline breakout zone, indicating the possibility of an upside movement hereon. Moreover, the momentum oscillator RSI (14-period) is recovering from the lower levels and is showing a reading of ~57.46. The prices are above the trend following indicators 21-period SMA, further supporting a positive bias.

VSL is recommended as a new entry in the 'Momentum Model Portfolio' as on July 17, 2024. Considering the technical analysis, support and resistance levels, an 'Entry' is recommended in the 'Momentum Model Portfolio' at the closing price of AUD 6.82 as on July 17, 2024.

VSL’s Daily Chart

Support and Resistance Summary (As on July 17, 2024)

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency as of July 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings.

Disclaimer

This information should not be relied upon as personal financial advice by Kalkine on (i) the stocks or (ii) the use or suitability of the model portfolios. Only an investor knows about their circumstances to make an investment decision.

Model Portfolio has been prepared for illustrative purpose only and does not take into account the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Past performance is not necessarily indicative of future performance results. Actual investment returns will vary, and the value of investments can go up or down.

AU

Please wait processing your request...

Please wait processing your request...