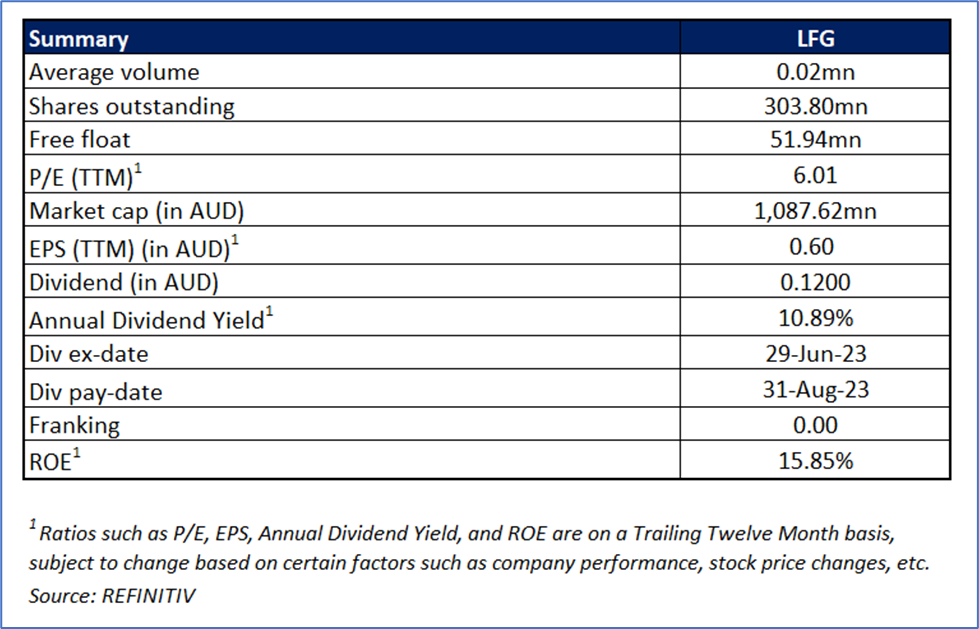

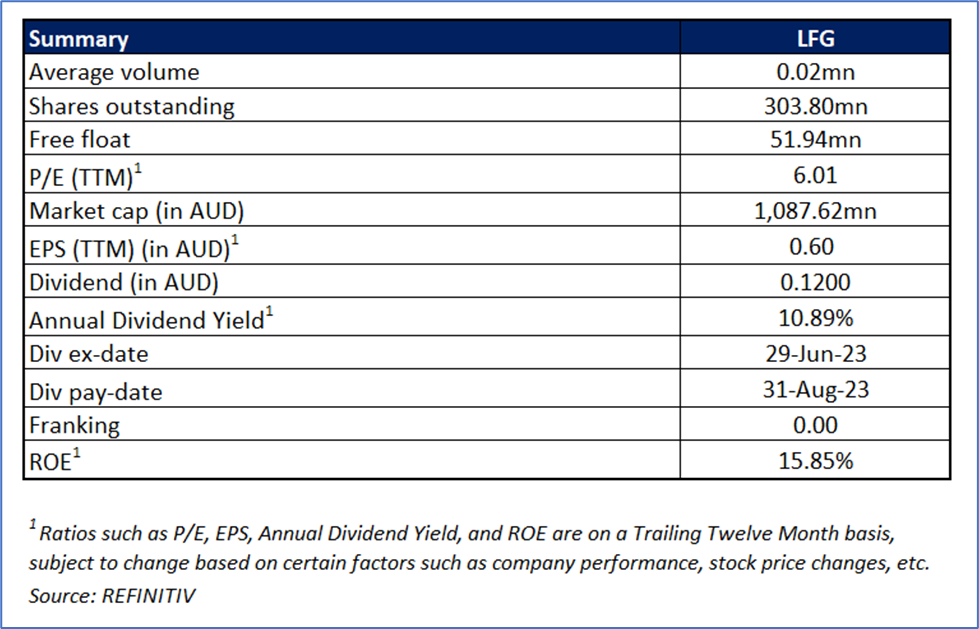

LFG Group Ltd (ASX: LFG) is involved in the financial services business in Australia and New Zealand. It operates in three segments: Residential Finance, Secured Finance, and Financial Services.

Recommendation Rationale – SELL at AUD 4.100

- Profit Booking: LFG’s share price has breached the Resistance 1 provided in the previous report on 2 October 2023; and thus, it is offering an exit opportunity.

- Overvalued Multiples: On a forward 12-month basis – key valuation multiples (EV/Sales, EV/EBITDA, and Price/Cash Flow) are higher than the median for Financials sector.

- Technical Standpoint: The momentum oscillator 14-day RSI (~61.10) is approaching the overbought zone; and thus, price can face retracement from the current levels.

- Financial Decline: During FY23, net revenue and underlying NPATA declined by 4% and 19% YoY, respectively.

- Interim Distribution: On 22 November 2023, LFG announced to pay unfranked trust distribution of 12 cents per security for the 5-month period (from 1 July 2023 to 30 November 2023). The distribution will be paid on 15 December 2023, while the record date is 30 November 2023.

- Management Commentary: In the annual report 2023, LFG’s Chairman commented that the likely continuation of lower demand for home finance and capital market pressures will continue to impact profitability for FY24.

LFG Daily Chart

(Source: REFINITIV; Analysis by Kalkine Group)

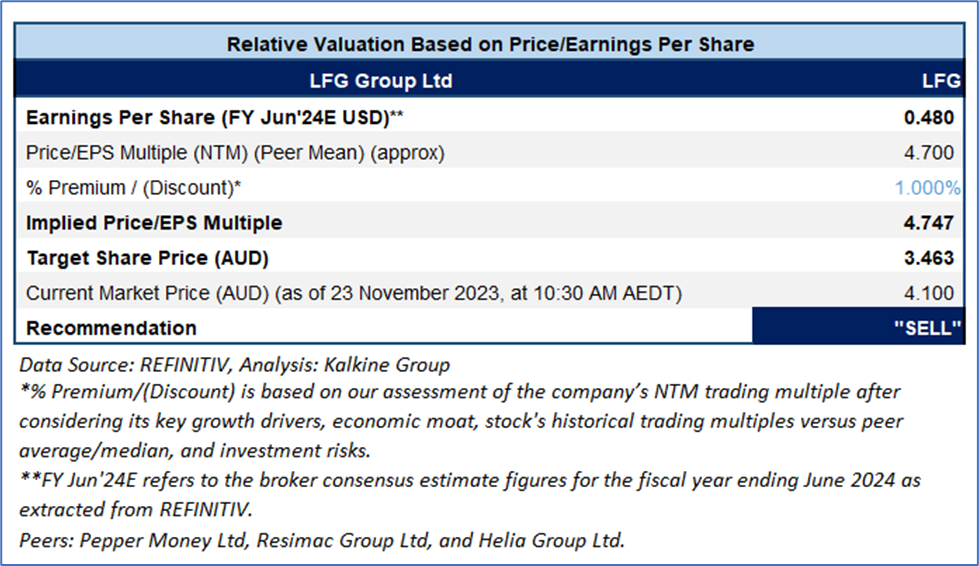

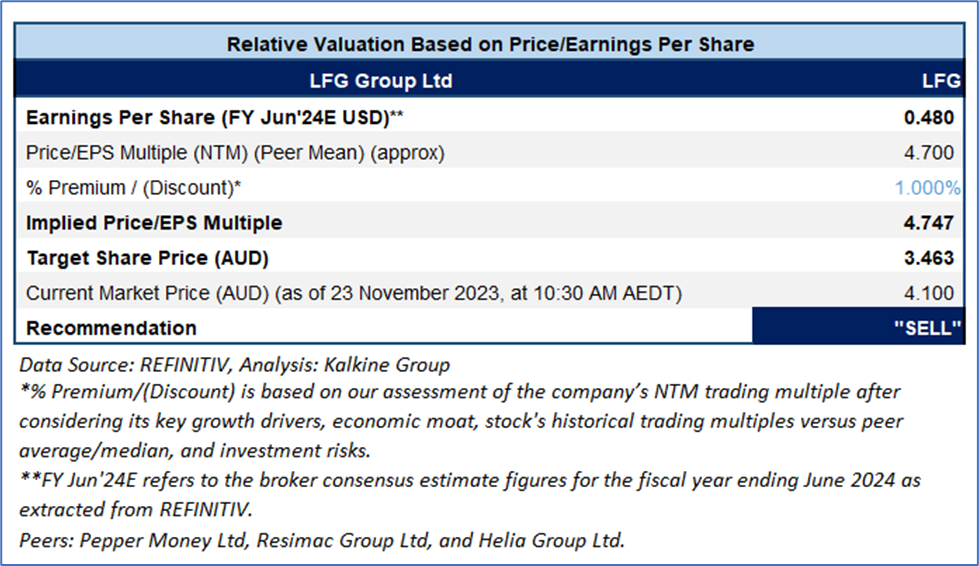

Valuation Methodology: Price/Earnings Approach (FY24E) (Illustrative)

Considering the trading levels, subdued outlook, and risks associated, it is prudent to exit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 4.100 (as of 23 November 2023, at 10:30 AM AEDT).

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 23 November 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

AU

Please wait processing your request...

Please wait processing your request...