Mixed performance: One of the Australia’s largest uranium producers and Australia’s longest continually operating uranium mine operators, Energy Resources of Australia Ltd (ASX: ERA) has witnessed a stock price fall of 54% in this year to date, as at July 18, 2018. However, the stock was seen to move up by 2.4% on July 19, 2018.

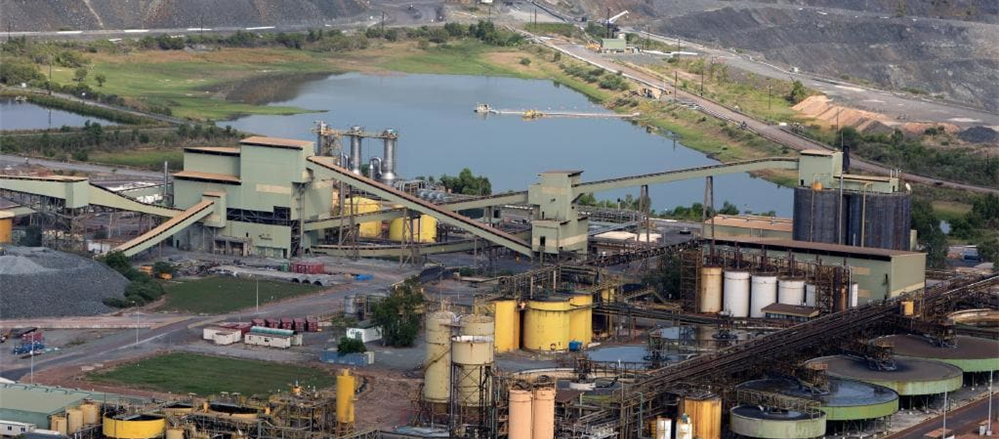

The group has released its Ranger Mine Closure Plan and lately reported for production of 400 tonnes of uranium oxide in the June 2018 quarter. This has been against the 442 tonnes produced in the March 2018 quarter. Its operation on the Ranger Project Area has continued in terms of progressive rehabilitation activities with closure feasibility study progressing (expected to be through by quarter 4 of 2018). However, annual plant maintenance shut down had impacted the production and the completion of laterite ore processing in the June 2018 quarter. While there was a fall in mill head grade, it is expected to re-track to the March 2018 quarter levels in the next quarter. The group has also based the mine plan as per processing of primary ore stockpiles. On the other hand, the Ranger 3 Deeps Exploration Decline is under care and maintenance. In the June quarter, the group did not incur any evaluation or exploration expenditure, and this has been as per March 2018 quarter.

ERA has maintained its production guidance for 2018 of between 1,600 to 2,000 tonnes of uranium oxide.The group has been able to mine uranium at its Ranger Project for over last thirty years and has produced in excess of 125,000 tonnes of uranium oxide.

In the month of May 2018, Energy Resources of Australia appointed Mr David Blanch as Chief Financial Officer, effective from 9 July 2018.

In the past one year, the group did not perform well on safety standards, but business generated positive cash-flow from operations of about $8 million. The company has however been impacted by the spot prices of uranium and currency exchange rates.The profit and operating margins along with return on equity (ROE) have been in the negative zone for the past three years (ROE of -19.7% was reported as at December 2017).

Given the mix of the scenario, we have a wait and watch view on this stock that trades at the current price of $0.42 as at July 19, 2018.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

Please wait processing your request...

Please wait processing your request...