Kalkine has a fully transformed New Avatar.

Novonix Limited

NVX Details

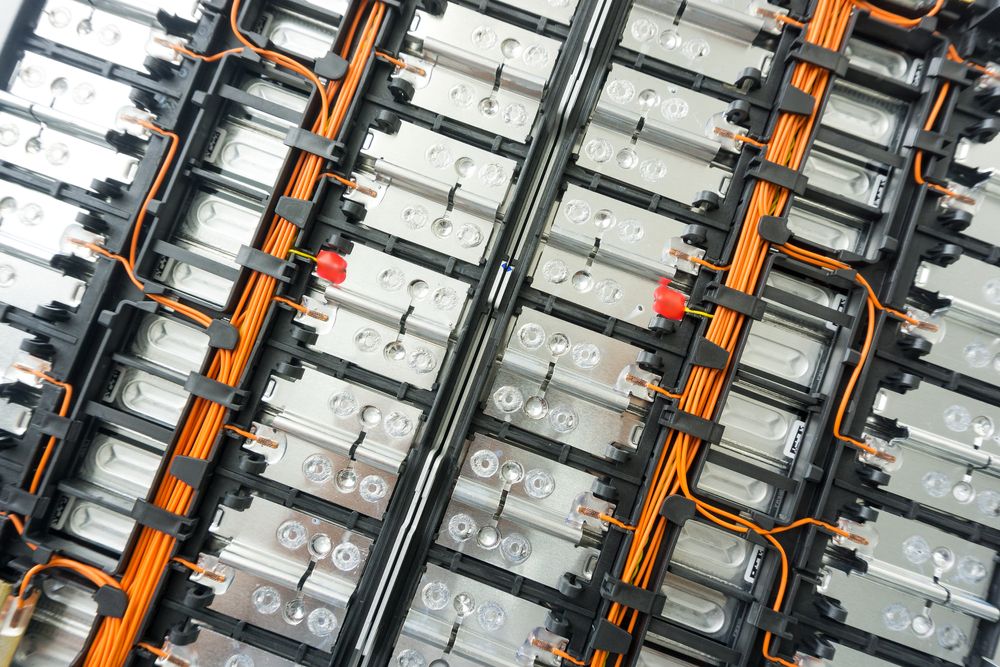

H1FY21 Result Highlights: Novonix Limited (ASX: NVX) is engaged in the business of the development of advanced battery materials and related technology services to cater to the requirements of lithium-ion battery market globally. The company has reported a 13.1% YoY decline in revenue from contracts with customers during H1FY21. Further, the company posted an increase in its net loss after tax of $10.8 million in H1FY21 from a net loss of $$7.0 million in H1FY20. Besides, the company also witnessed a reduction in its liquidity position with cash and cash equivalents at the end of the period stood at $25.3 million from $38.8 million at the end of 30 June 2020.

FY20 Results (Source: Company Reports)

Awarded US$5.57mn Grant from US Department of Energy: With the support from its innovative R&D capabilities along with the benefits of its proprietary technology as well as strategic relationship, the company seems well placed to deliver advanced battery technology to market. The company also has sales pact with Samsung SDI as well as MOU contract with SANYO for synthetic anode material. Meanwhile, the group has bagged US$5.57 million grant from the US Department of Energy. The funds will be utilised towards development of advanced furnace technology which will find application in lithium-ion battery synthetic graphite material. NVX on 19 February 2021 declared that it has formed partnership with Emera Technologies, towards creating energy storage systems, which will aid in targeting market prospects across North America.

Key Risks: The company is exposed to the risks associated to demand environment. Any slowdown in the demand of anode material globally could have an adverse impact on the company’s growth as well as expansion plans.

Outlook: The company anticipates its future growth opportunities to be driven by battery technology solutions, which continues to provide vital capital as well as technology support to boost growth of its anode materials business and cathode materials business. It also creates fresh prospects for future growth. Further the company has articulated a technology roadmap, wherein it focuses on shifting to Generation 2 along with development of Generation 3 furnace technology. This will provide the company a greater scalability. Additionally, NVX is on a verge of capacity expansion of battery-grade synthetic graphite material at its anode material business which will boost the plant’s capacity to 2,000 tonnes per annum by the end of CY21. To achieve this growth, it has utilised the funds generated form the capital raise initiative undertaken in June 2020.

On 26 February 2021, the company successfully finished the placement of fully underwritten new equity shares worth A$115 million to institutional investors. Apart from this, the company is looking to raise A$16.45 million through issue of shares to certain directors or associates of the directors of the company. The company is likely to utilise these funds from the capital raising to accelerate growth as well scale across business by catering to the capex and working capital requirements of its anode materials business, R&D in cathode business and to tap international growth prospects.

Valuation Methodology: Price/Sales Multiple Based Relative Valuation (Illustrative)

Data Source: Refinitiv, Thomson Reuters, Analysis by Kalkine Group

*% Premium/(Discount) is based on our assessment of the company’s NTM trading multiple after considering its key growth drivers, economic moat, stock's historical trading multiples versus peer average/median, and investment risks.

Stock Recommendation: The stock has delivered a significant positive return of ~91.70% in the past six months and a positive return of ~1,046.31% in the past one year. On the technical analysis front, the stock has a support level of ~$2.14 and resistance of ~$2.8. We have valued the stock using an price/sales multiple-based illustrative relative valuation and have arrived at low double-digit upside (in % terms). We have assigned slight discount to its peer average price/Sales (NTM Trading multiple), considering the weak profitability performance in H1FY21, and associated key risks. For the purpose, have taken peers such as Audinate Group Ltd (ASX: AD8), Brainchip Holdings Ltd (ASX: BRN), Catapult Group International Ltd (ASX: CAT), to name a few. Considering its growth strategies, focus towards gaining scale across business, capacity expansion plan and decent outlook, we give a “Buy” recommendation on the stock at the current market price of $2.31 per share, down by 3.348% on 6th April 2021.

NVX Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.