AGL Energy Ltd

.png)

AGL Dividend Details

2016 Outlook: AGL Energy Ltd.’s (ASX: AGL)major focus for financial year 2016 is to transform itself and deliver operating costs and cash benefits. AGL Energy foresees its operational efficiency to improve further and estimates over $200 million real benefits in its normalized cost base and around $100 million reduction in sustaining capital expenditure by financial year 2017. However, the group estimates most of the cost improvements by mid of 2016. Besides, AGL also targets $1 billion in non-strategic and under-performing asset divestments and $200 million working capital expenditures by the end of financial year 2017. In the first half of 2016, the sale of AGL’s 50% interest in the Macarthur Wind Farm is also expected to be completed. For the financial year 2016, underlying profit after tax is expected to be in the range of over $650 to $720 million. New energy business unit operating loss is expected to increase by $25 million while its break even target is revised to $20 million EBIT taking into account the transfer of Energy Services as part of the organizational restructure. Restructure costs of around $30 million pre-tax are expected to be booked as a significant item. Meanwhile, electricity, gas and REC wholesale prices are expected to rise modestly in 2016.

Leveraging the LNG opportunity: Recently, AGL Energy announced that it had executed an agreement with the GLNG Project participants, Total, PETRONAS, Santos & KOGAS, for the sale of 254 petajoules (PJ) of gas to the GLNG project. The gas will be supplied at Wallumbilla over a period of eleven years commencing from January 2017 with pricing based on an oil-linked formula. The annual quantities are profiled to sell up to 34 PJ/year in the period 2018 to 2020 and AGL has retained flexibility in its portfolio for future sales to its consumer market.

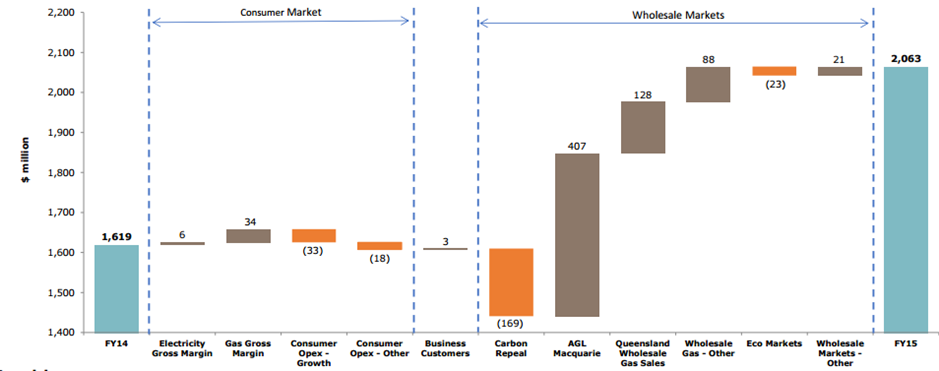

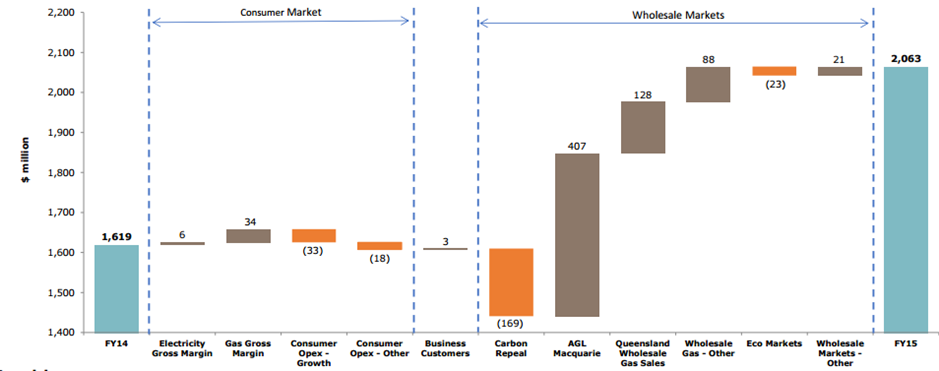

Higher generation and Queensland gas sales (Source: Company Reports)

Recent Management Transitions: In mid-December, it was known that AGL Energy's new energy division head, Marc England, would be leaving the company to join New Zealand based Genesis Energy as its chief executive. This could likely be a setback to the company's efforts towards the new, evolving distributed energy market. AGL planned to achieve one million smart connections by 2020 and wanted to be one of the leading providers of energy storage and home energy services. It aimed for 600 GWh of rooftop solar, and $400 million in revenue from the new energy division by 2020. Meanwhile, England will stay in his current role until the end of April 2016 to ensure a smooth transition, with Alistair Preston, currently the head of organisational transformation, to run the division on an interim basis.

Delivered a Positive Business performance: In the financial year 2014-2015, AGL Energy's financial performance was highlighted by its New Energy division through which it closed under-performing areas like closing AGL Smarter Living Stores in order to focus on connected products. Also, solar PV revenue recorded a 23% yoy increase during the period while commercial energy efficiency project revenue rose 41% on a yoy basis. AGL reported a final dividend of 34.0 cents per share, which brings the total dividend for the year 2015 to 64.0 cents per share, delivering one cent per share from 2014 levels. With the sale of Macarthur wind farm in first half of 2016, the proceeds are expected to repay $324 million of Loy Yang senior debt.

Financial Ratios (Source: Company Reports)

Stock performance: AGL Energy shares have recorded a gain of 15.67% in the past six months (as of December 31, 2015) while the stock has rallied 7.43% in the last four weeks alone and even reached close to its 52-week high levels. On the other hand, we believe that the stock has over rallied and trading at an expensive P/E.

The market price assumptions in 2016 for Brent crude oil and for West Texas Intermediate (WTI) crude look soft and may have an impact. Based on the foregoing, we believe that the stock is under pressure and accordingly give a “SELL” recommendation on the stock at the current price of $18.06

AGL Daily Chart (Source: Thomson Reuters)

Carsales.Com Ltd

.png)

CAR Dividend Details

Diversifying investments to build a strong geographic presence: Carsales.Com Ltd (ASX: CAR) stock is trading close to its 52-week high and delivered 17.39% in the last three months (as of December 31, 2015). CAR is still the leading online destination in buying as well as selling cars in Australia and accordingly the group’s core online advertising market rallied by 6% yoy in fiscal year of 2015. The group’s Dealer revenues rose 7% yoy to $112.9 million while Data, research and services revenues surged by 14% to $33 million driven by Livemarket and Livetrade products and Redbook Australia. Meanwhile, CAR is expanding its international presence via investments like Stratton, tyresales,

Webmotors and Auto Inspect. The group acquired

iCar Asia, SKENCARSALES.COM and SoloAutos in Mexico. Carsales along with Stratton acquired 20% of the Ratesetter business, a financier for short term or low priced vehicle finance for about $10 million. Dealers’ network in international segment rose through customer acquisitions as well as the group even enhanced its yield from September dealer price upsurge. The company has been able to add value to advertisers by virtue of audience reach and through the network platform, data could be sold back to car dealers.

.png)

Automotive Enquiry Volumes and Inventory (Source: Company Reports)

Guidance Commentary: CAR at its AGM, updated that the outlook provided at its FY15 results in August was reaffirmed with domestic trading performance in 1Q16 to be solid and continuity is expected to be maintained for the remaining first half subject to market conditions. CAR further updated that the international performance with Brazil and South Korea operations progressing well, has been on track. However, the company did not specifically provide any quantitative guidance in support. The company reiterated that FY 2015 margin is expected to remain consistent in the FY 2016 year. On the other hand, CAR did witness challenges with new cars with a number of car companies advising respective dealers to remove their inventory from online websites including carsales, although there has been some returning recently.

Stock performance: The stock performance has been boosted by CAR’s international markets’ performance coupled with domestic growth. At present, CAR is trading about its 52-week high price and at a relatively high P/E ratio, and has a dividend yield of about 3%. Given the trading scenario and the above guidance, we do not see a great upside in the near future and we give a “SELL” recommendation on the stock at the current price of $11.74

CAR Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...