.png)

MPL Details

Private health insurance premiums rise by Government: Medibank Private Ltd (ASX: MPL) Premium revenue growth has delivered a moderate rise of 4.6% year on year (yoy) to $3,080 million for the first half of 2016 on the back of the slowdown of the market conditions which impacted the group’s specific product management and sales performance. On the other hand, the Federal Minister for Health reported that the private health insurance premiums would be increasing across the industry starting from April 2016. This initiative by the government is expected to be a major boost to Medibank as they got approval from the Minister to enhance their premiums by an average of 5.64% across the group and ahm health insurance products. Moreover, Private health insurance premiums for all private health insurers have been regulated as well as all the changes have been approved by the Minister for Health annually.

.png)

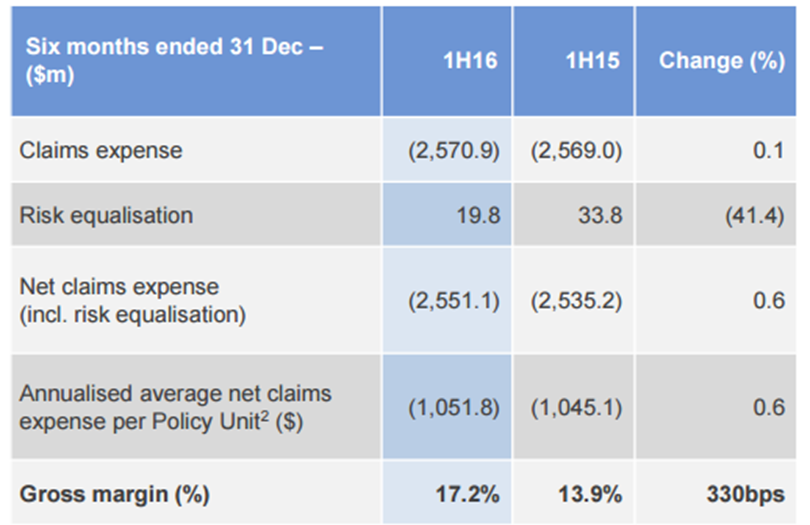

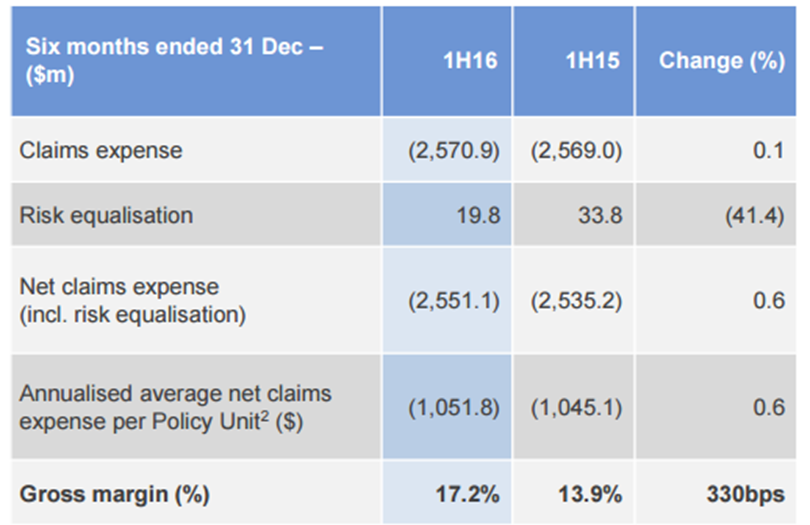

Health insurance performance for the first half (Source: Company Reports)

Enhancing margins: Medibank’s Health benefit claims management program is helping them to achieve cost savings across the group. The group also focused on improving the targeted areas from payment integrity program (like physio, optical, podiatry). MPL also enhanced the hospital contracting (e.g. audits). The group also received a claims provision of over $19 million before tax for the first half of 2016 as compared to the $14 million in the first half of 2015. These initiatives enhanced its gross margins by 17.2% for the first half of 2016 as compared to 13.9% in the prior corresponding period. MPL’s operating margin rose to 8.8% during the period against 5.8% in the first half of 2015. The group’s Health Insurance segment delivered a 58.8% rise in operating profit to $271.7 million for the first half of 2016 as compared to $171.1 million in the first half of 2015 on the back of its ongoing focus on health benefit claims management.

The group’s Complementary Services segment delivered a 27.8% rise in operating profit to $9.2 million during the period on the back of its changes and divestments given its strategic review. Accordingly, MPL reported an overall net profit after tax (NPAT) of $227.6 million for the first half of 2016 as compared to $143.8 million in prior corresponding period (pcp). The group declared an Interim dividend of 5.0 cents per share fully franked during the period. On the other hand, investment income decreased by 57.1% to $18.6 million impacted by the declining equity market returns during the period.

Gross Margins improvements (Source: Company Reports)

Stock Performance: The shares of MPL have been bullish this year and generated a year to date returns of 42.27% (as of April 22, 2016). The update from the health minister of increasing the premiums have also partly contributed to the strong stock performance. Recently, the group even appointed Craig Drummond as its Managing Director and Chief Executive Officer effective from July 04, 2016. The board reported that Craig comes with a strong reputation of leadership skills and possesses strategic thinking and are confident of leading the group effectively. The present Managing Director and CEO, George Savvides announced his retirement in October 2015 after serving the group for 14 years. On the other hand, Management expenses ratio increase has been a concern to the group which has been impacted by the timing differences between first half as well as the second half during FY15. Management expenses ratio rose by 30 basis points to 8.4% during the period from 8.1% in the first half of 2015. MPL’s volumes have also been decreasing due to challenging market conditions in the industry while the Revenue per Policy Unit for the first half of 2016 have been lower than the approved rate on the back of the group’s new sales mix and cover reductions.

Acquisition rate fell by 80 basis points to 4.4% for the first half of 2016 while the Policyholder growth declined by 150 basis points to a negative 1.2% during the period against 0.3% in pcp. Moreover, we believe that the stock has already factored in the positive news and is currently placed at high levels. MPL has a relatively high P/E as compared to its peers. Based on the foregoing, we give a “Sell” recommendation on this dividend yield stock at the current price of $3.07

MPL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

Please wait processing your request...

Please wait processing your request...