Kalkine has a fully transformed New Avatar.

Fuelcell Energy

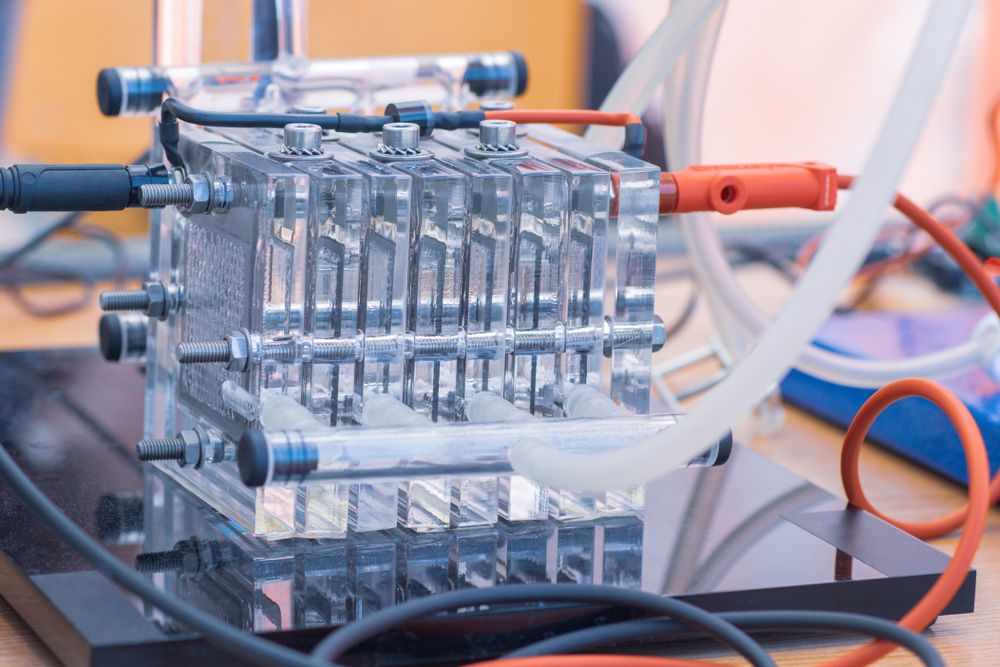

Fuelcell Energy (NASDAQ: FCEL) develops sustainable clean energy through proprietary fuel cell technology platforms.

Investment Rationale – WATCH at USD 10.09

Risk Assessments

Recent News

Additional Funding: On 4 May 2021, FCEL announced that it had received US$8 million from the US Department of Energy as Phase 2 funding for advancing its progress in solid oxide fuel cell technology.

Financial Highlights for the quarterly period ended 31 January 2021 (as on 16 March 2021)

(Source: Company Website)

Share Price Chart

(Analysis done by Kalkine Group)

Conclusion

As the Company has scored additional funding from the US Department of Energy for the technology that can convert chemical energy into electrical energy, it is a great aid for its commercialisation. However, FCEL has a history of losses and commercial viability or adoption of its solid oxide fuel cell technology is still uncertain and unproven. Moreover, the Company’s backlog has also seen a decrease of US$93.8 million in Q1 FY21, which can restrict its growth potential in the near term. In the absence of substantial growth catalysts, we are not recommending to punt on this stock presently, while we will keep a close watch over its triggering events to find an attractive opportunity to invest at the right price. The stock made a 52 week High and Low of USD 29.44 and USD 1.58, respectively.

Based on the subdued financial performance, macroeconomic uncertainties, and loss-making status, we have given a “WATCH” stance on Fuelcell Energy at the closing price of USD 10.09 (as on 1 June 2021), while we look forward to taking fresh position when we have material fundamentals or catalyst for future profitability.

*All forecasted figures and Industry Information have been taken from REFINITIV.

*The reference data in this report has been partly sourced from REFINITIV.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.