Kalkine has a fully transformed New Avatar.

Stocks’ Details

Titomic Limited

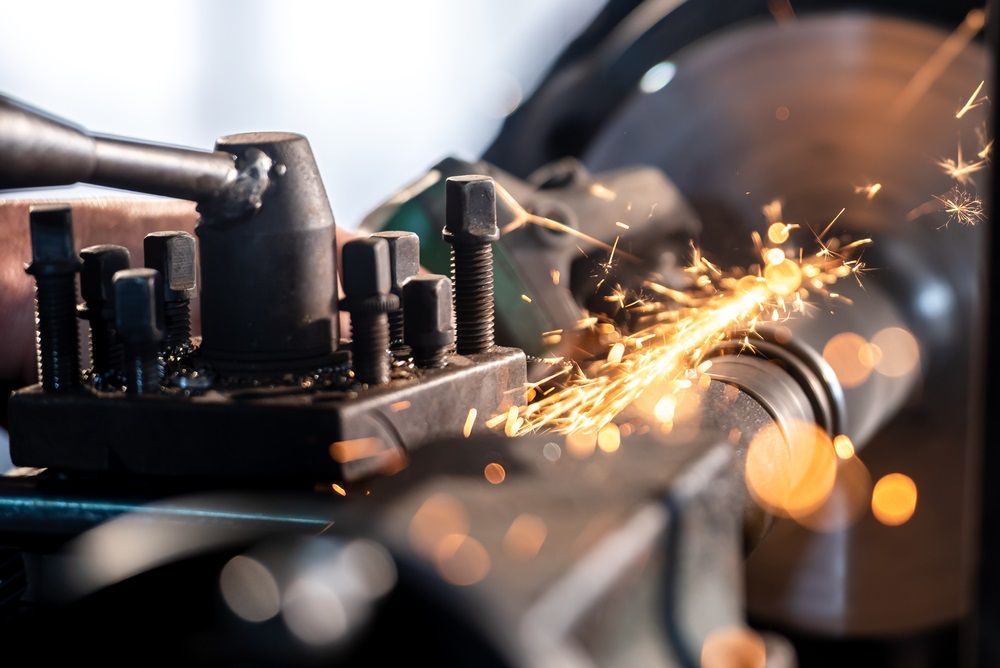

Delay in Forecasted Commercial Sales: Titomic Limited (ASX: TTT) provides technology solutions for industrial scale metal additive manufacturing by using its unique patented Titomic Kinetic Fusion® technology. The market capitalisation of the company stood at ~$85.05 Mn as on 2nd December 2020. Recently, the company has appointed Norbert Schulze on the role of interim Chief Executive Officer. During the quarter ended 30th September 2020, the company has witnessed considerable delays in its forecasted commercial sales of TKF systems, owing to the COVID-19 pandemic. However, the company has executed cost reductions to alleviate the effect of delayed orders. In addition, the company would continue to undertake numerous initiatives in the second quarter for aligning the cost base with the business environment. TTT recorded net cash outflow from operating activities of ~$2.5 million and $2k from investing activities. For the year ended 30th June 2020, the company reported revenue and other income of $2,006,375 as compared to $1,474,937 in FY19. Loss after tax for the year amounted to $10,826,806 against $7,489,077 in FY19.

Cash Flow (Source: Company Reports)

Outlook: Going forward, the company is expecting strong industrial interest in its TKF Systems technology. In addition, the company would continue to manage its cost base and cement its management team in the upcoming few quarters.

Stock Recommendation: The company ended September 2020 quarter with cash and cash equivalents of ~$14.89 million. The 52-week low-high range for the stock stands at $0.465 - $1.140, respectively. In addition, the stock is trading at a price to book value multiple of 3.3x as compared to the industry median (Industrials) of 2.2x on TTM basis. On a technical analysis front, the stock has a support level of ~$0.51 and a resistance level of ~$0.749. Thus, considering the rising business losses, negative cash flows, weak business activities, we advise investors to avoid the stock at the current market price of $0.550 per share, down by 0.901% on 2nd December 2020.

Strategic Elements Limited

Achievement of Milestone: Strategic Elements Limited (ASX: SOR) is a registered Pooled Development Fund (PDF), which is focused on investments in Australian SME across the resources and technology sectors. The market capitalisation of the company stood at $68.10 Mn as on 2nd December 2020. Recently, the company notified the market that it has manufactured a 1 litre batch size of Battery Ink with the capacity to produce 2000 battery cells, which proved as a critical milestone with its self-charging battery technology. The company added that the technology is exhibiting the strong potential to scale up with the production capacity rapidly rising tenfold from 200 to 2000 battery cells.

On 12th November 2020, the company’s subsidiary Stealth Technologies has provided a license to CSIRO technology which enables robots to work together in teams. Both the parties would initially focus on security applications and work under an Early Adopter Program (EAP), which is likely to support Stealth to integrate and commercialise the technology.

Financial Highlights: During the September 2020 quarter, the company reported an expenditure of $403k, which includes project development, product manufacturing costs and administration costs. During FY20, the company reported contract revenue of $244,500 as compared to $51,250 in FY19. The revenue was comprised of $150,000 from the sale of tenements, and the remaining $94,500 was earned from the provisioning of services. SOR posted a loss of $2,547,826 against $1,980,372 in FY19, which mainly indicates the research and development activities of the Group and administration costs.

Financial Summary (Source: Company Reports)

Outlook: Looking forward, the company is planning to scale up the fabrication of a printable Battery Ink to 1 litre. In addition, it is also intending to expand the collaboration with Fortune 100 US company, Honeywell, and the WA Department of Justice for Autonomous Security Vehicles.

Stock Recommendation: As on 30th September 2020, the cash and cash equivalents of the company stood at ~$1.8 million. Current ratio of the company stood at 9.78x in FY20 as compared to the industry median of 1.38x. This reflects that the company is in a decent position to settle its short-term obligations. The 52-week low-high range for the stock stands at $0.033 - $0.215, respectively. In the past one month, the stock of SOR has provided a return of 54.54%. On a technical analysis front, the stock has a support level of ~$0.12 and a resistance level of ~$0.205. Therefore, considering the returns in the past months, expansion plans for collaboration with Fortune 100 US company and achievement of the milestone with its self-charging battery technology, we give a “Hold” recommendation on the stock at the current market price of $0.165 per share, down by 8.334% on 2nd December 2020.

Auris Minerals Limited

Update on Diamond Drilling: Auris Minerals Limited (ASX: AUR) is engaged in the exploration of mineral and base metal. The market capitalisation of the company stood at ~$38.77 Mn as on 2nd December 2020. Recently, the company notified the market with an update on the infill diamond drilling currently underway at the Sams Creek Gold Project by Sandfire Resources Limited. The company added that first hole was drilled to a total depth of 171.3m and has intersected the Sams Creek Porphyritic Dyke between 75.3m and 143.95m. In addition, Sandfire Resources Limited has planned up to seven holes for around 900m.

Financial Highlights: During September 2020 quarter, the company reached a binding agreement to acquire interest of Sandfire Resources Limited in the 1Moz Sams Creek Gold Project. The quarter was very positive for the company, which was supported by the announcement of a maiden copper resource for the Forrest and Wodger deposits. For the year ended 30th June 2020, the company recorded loss amounting to $422,531 as compared to $1,845,664 in FY19.

Key Financials (Source: Company Reports)

Outlook: Going forward, AUR is likely to strengthen the existing resource to advance the Sams Creek Gold Project towards a preliminary scoping study. The company has scheduled to conduct the 2020 Annual General Meeting on 7th December 2020.

Stock Recommendation: As on 30th September 2020, the cash and cash equivalents of the company stood at $543k. In the past six months, the stock has surged 226.92%, and the 52-week low-high range for the stock stands at $0.011 - $0.140. On a technical analysis front, the stock has a support level of ~$0.055 and a resistance level of ~$0.100. Hence, considering the absence of revenue, rising losses and low market capitalisation, we advise investors to avoid the stock at the current market price of $0.081 per share, down by 5.814% on 2nd December 2020.

Comparative Price Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.