Kalkine has a fully transformed New Avatar.

Hyliion Holdings Corp.

HYLN Details

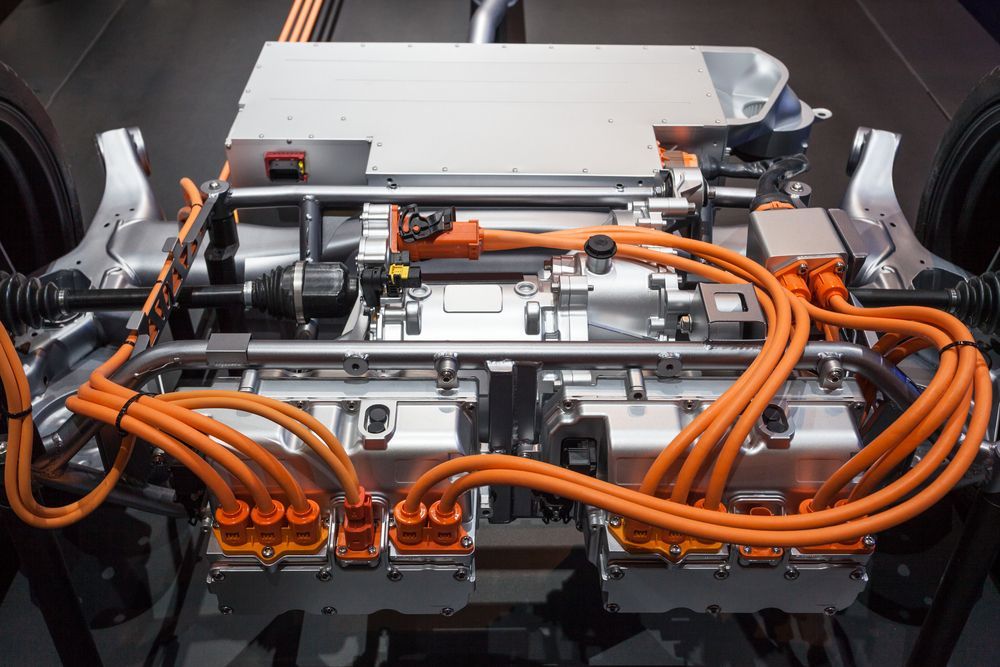

Hyliion Holdings Corp. (NYSE: HYLN) designs, develops, and sells electrified powertrain solutions with a motive to reduce carbon intensity and greenhouse gas (GHG) emissions of Class 8 commercial trucks. The company uses its advanced software algorithms and data analytics capabilities which enable fleets to decrease their fuel and operating expenses and integrate with their existing fleet operations seamlessly.

Delivering 300 Hypertruck ERX Systems: On August 02, 2021, HYLN executed a reservation agreement with Detmar Logistics LLC, frac sand solutions provider, covering HYLN’s 300 Hypertruck ERX systems. Hypertruck ERX is an electric powertrain that can be recharged by an onboard natural gas generator. This reservation furthers the collaboration between the two companies focused on fully electrifying Detmar’s fleet in the next five years.

Hypertrucks Targetting ZEV Credits: On July 28, 2021, the company launched a long-range variant of the Hypertruck ERX, the first ever version brought to market. The Hypertruck ERX equipped production trucks qualify for zero-emission vehicle (ZEV) credits under California’s Advanced Clean Truck (ACT) Rule. This new variant offers 75 miles of all-electric range and over 1,000 miles of total range, with freight hauling capabilities that are comparable to diesel.

Q1FY21 Results: During Q1FY21 (ended March 31, 2021), the company reported a 4.98x increase in loss from operations to USD 16.73 million vs. USD 3.36 million in Q1FY20, owing to a 249.38% and 970.77% increase in R&D and selling, general and administrative expenses, respectively, coupled with absence of revenue. Net loss for the quarter was USD 16.56 million, compared to USD 5.56 million in Q1FY20, aided by an interest income of USD 0.17 million. HYLN exited the quarter with a cash balance (including short-term investments) of USD 479.55 million and no outstanding debt.

Key Risks: The company is yet to generate revenue from its primary segment and has reported net losses in every quarter, which has resulted in a higher accumulated deficit, which remains a key concern for the company. In addition, its electrified powertrain solutions are dependent on highly technical and complex software and hardware which are developed and maintained internally or by third parties. These software and hardware may contain errors, bugs or vulnerabilities, which, if not detected timely, could damage HYLN’s reputation, cause loss of customers, and adversely affect its business.

Outlook: In its Q1FY21 earnings release, the company stated that it expects to recognize revenue on its Hybrid product deliveries in H2FY21. It had installed ten Hybrid electric powertrains during Q1FY21, and is currently focused on the deployment of technology for future volume growth.

HYLN Daily Technical Chart (Source: REFINITIV)

Stock Recommendation: HYLN stock declined 38.22% in the past six months and is currently at the lower-band of the 52-week range of USD 7.69 to USD 58.66. The stock is currently trading below its 50 and 200 DMA levels, and its RSI Index is 49.73. Considering the correction in the stock price, new collaborations and product launches, expected first-time revenue generation, strong balance sheet, and current valuation, we recommend a "Hold" rating on the stock at the current price of USD 9.99, up 2.67% as of August 09, 2021, 1:50 PM ET.

* The reference data in this report has been partly sourced from REFINITIV.

* All forecasted figures and industry information have been taken from REFINITIV.

NewAge, Inc.

NBEV Details

NewAge, Inc. (NASDAQ: NBEV) commercializes and distributes a portfolio of organic and healthy products majorly through its direct-to-consumer (D2C) channel to the market distribution system in more than 75 countries. Its products are categorized into 1) Health and Wellness, 2) Inner and Outer Beauty, and 3) Nutritional Performance and Weight Management. It has a network of more than 400,000 exclusive independent brand partners around the world. As of August 09, 2021, the company's market capitalization stood at USD 269.59 million.

Management Changes: On July 21, 2021, NBEV announced the appointment of Kevin Manion as its CFO, with immediate effect. Before joining NBEV, Mr. Manion held the position of CFO at Calavo Growers, a fresh food company.

Strategic Collaborations: On July 12, 2021, NBEV announced a manufacturing partnership and an agreement to sell its US manufacturing operations to Taiwan-based TCI Co., Ltd., for a cash consideration of USD 3.5 million and a share in revenues for the next five years. This move augments NBEV's focus on its core competencies and reduction in cost and employee-related expenses. This news follows the acquisition of Aliven, Inc., a Japan-based direct selling company, on June 03, 2021, in exchange for the issuance of approximately 1.1 million NBEV shares valued at USD2.6 million. NBEV anticipates additional revenue of USD 20 million and EBITDA of USD 3 million through this acquisition.

Q2FY21 Results: The company reported a surge of 98.03% in net revenues to USD 124.04 million in Q2FY21 (ended June 30, 2021) compared to USD 62.64 million in Q2FY20, primarily due to acquisitions of ARIIX and Aliven. Gross profit for Q2FY21 grew 2.20x YoY and stood at USD 83.80 million compared to USD 38.08 million in Q2FY20. NBEV reported a net income of USD 17.37 million for Q2FY21, in contrast to a net loss of USD 9.55 million in Q2FY20. As of June 30, 2021, the company had cash and cash equivalents of USD 80.92 million and total debt (excluding operating lease liabilities) of USD 31.50 million.

Key Risks: In FY20, Tahitian Noni Juice, TruAge MAX, Nutrifii, and Slenderiiz contributed ~70% of NBEV's total revenue. Therefore, any fall in demand for these products or aggressive competition in the market in which NBEV operates could hurt its financial performance. In addition, NBEV depends on a single manufacturing facility in Tahiti for noni puree used in all noni-based products. Therefore, any disruption in the production process could adversely impact its operations.

NBEV Daily Technical Chart (Source: REFINITIV)

Stock Recommendation: NBEV stock price fell 7.44% in the past month and is currently leaning towards the lower band of its 52-week range of USD 1.53 to USD 4.55. The stock is currently trading below its 50 and 200 DMA levels, and its RSI Index is 45.87. Considering the slight correction in the stock price, significant improvement in both top and bottom-line, strategic collaborations, and positive outlook, we recommend a "Hold" rating on the stock at the closing price of USD 1.99 as of August 09, 2021.

* All forecasted figures and Industry Information have been taken from REFINITIV.

* The reference data in this report has been partly sourced from REFINITIV.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.