Kalkine has a fully transformed New Avatar.

South32 Limited

S32 Details

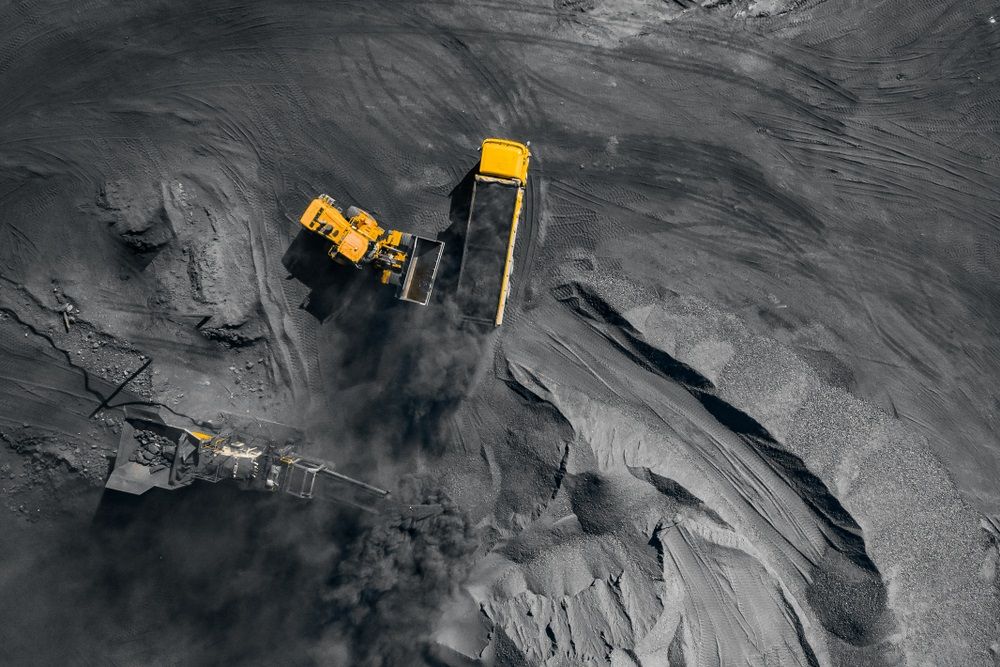

Record Hydrate Production at Worsley Alumina: South32 Limited (ASX: S32) is a globally diversified mining and metals company, which produces bauxite, alumina, aluminium, energy, and metallurgical coal, manganese, nickel, silver, lead and zinc in Australia, Southern Africa, and South America. As on 19 October 2020, the market capitalization of the company stood at ~$10.22 billion. The company has recently released its quarterly reports for the quarter ended September 2020, wherein it reported an increase in metallurgical coal production by 22% to 1,863kt and a growth of 19% in manganese ore production to 1,461kwmt. The company simplified its functional support structures and reported an increase in net cash by US$70 million to US$368 million. During the quarter, the company achieved record hydrate production at Worsley Alumina, reflecting a growth of 4% to 1,010kt.

Quarterly Production Summary (Source: Company Reports)

Outlook and Guidance: The company has maintained its guidance for FY21 and expects to produce 3,965kt of Alumina in Worsley Alumina and 1,370 kt in Brazil Alumina. The company is reshaping and improving its portfolio by embedding growth options with a bias to base metals and is expecting to see growth as the world transitions to a lower carbon economy.

Valuation Methodology: Price to Cash Flow Multiple Based Relative Valuation (Illustrative)

Price to Cash Flow Multiple Based Relative Valuation (Source: Refinitiv, Thomson Reuters)

Note: All the forecasted figures are taken from Thomson Reuters, NTM: Next Twelve Months

Stock Recommendation: The company is on track to exit its lower returning businesses, including energy coal and manganese alloys, which is expected to improve margins and lift return on invested capital. The stock of S32 is trading on average 52-weeks level and retains potential for further growth. The stock of S32 gave a return of 10.55% in the past six months and a return of 1.32% in the last three months. The stock of S32 has a support level of ~$1.959 and a resistance level of ~$2.352. We have valued the stock using the price to cash flow multiple based illustrative relative valuation and have arrived at a target price, offering an upside of lower double-digit (in percentage terms). For the said purposes, we have considered Mineral Resources Ltd (ASX: MIN), Nickel Mines Ltd (ASX: NIC), and Base Resources Ltd (ASX: BSE) as peers. Considering the current trading levels, decent returns in the past three months, positive guidance and decent operational performance, we recommend a ‘Buy’ rating on the stock at the current market price of ~$2.20, up by 4.265% on 19 October 2020.

.png)

S32 Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Evolution Mining Limited

EVN Details

Quarterly Operational Highlights: Evolution Mining Limited (ASX: EVN) is engaged in the exploration, mine development, mine operations, and the sale of gold and gold/copper concentrate in Australia and Canada. As on 19 October 2020, the market capitalization of the company stood at ~$10.33 billion. The company started the new financial year with positive momentum and reported gold production of 170,021 ounces at an AISC costs of $1,198 per ounce. During the quarter, the company reported operating mine cash flow of $272.3 million and net mine cash flow of $183.4 million. In the same time span, net debt of the company stood at $180.3 million after distributing the final dividend of $153.8 million.

FY20 Financial Highlights: During FY20, the company produced 746,463 oz of gold at an AISC of $1,043/oz and reported an increase of 29% in revenue to a record $1,941.9 million. In the same time span, the company reported record statutory net profit after tax of $301.6 million, reflecting an increase of 38.2% on the prior year.

FY20 Financial Highlights (Source: Company Reports)

Valuation Methodology: Price to Cash Flow Multiple Based Relative Valuation (Illustrative)

Price to Cash Flow Multiple Based Relative Valuation (Source: Refinitiv, Thomson Reuters)

Note: All the forecasted figures are taken from Thomson Reuters, NTM: Next Twelve Months

Stock Recommendation: The business continues to generate sector leading cash flow per ounce and reported a healthy balance sheet. However, the stock of EVN seems to have reached its market potential and is trading close to its 52-weeks’ high level of $6.585. The stock of EVN gave a negative return of 0.986% in the past three months and a negative return of 3.21% in the last one month. On a technical front, the stock of EVN has a support level of ~$5.63 and a resistance level of ~$6.388. We have valued the stock using the price to cash flow multiple based illustrative relative valuation and have arrived at a downside of high single-digit (in percentage terms). For the said purposes, we have considered Newcrest Mining Ltd (ASX: NCM), Northern Star Resources Ltd (ASX: NST) and Regis Resources Ltd (ASX: RRL) as peers. Considering the current trading levels, volatile returns, softer market conditions and key risks of investment, we suggest our investors to wait for a better entry levels and recommend an ‘Expensive’ rating on the stock at the current market price of $6.020, down by 0.496% on 19 October 2020.

.png)

EVN Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.