Macquarie Atlas Roads Group

.png)

MQA Details

Base Fee Reduction: Macquarie Atlas Roads Group’s (ASX: MQA) weighted average toll revenue and traffic in the June quarter of 2016 increased by 5.2% and 2.1%, respectively, on the prior corresponding period (pcp) reflecting the better traffic levels and revised toll schedules implemented over a year. In the first half ending 30 June 2016, the weighted average toll revenue grew 6.2% while traffic over the same period was 4.2% above prior corresponding period (pcp). Additionally, the first instalment of the 2016 performance fee of A$44.7 million is payable for the year ended 30

th June 2016 and the payment of the second and third performance fee instalments is subject to satisfaction of further performance hurdles, namely that the aggregate MQA return from 1

st July 2015 is equal to or exceeds the aggregate benchmark return over the relevant future periods. Moreover, the third instalment of the 2014 performance fee of A$19.4 million has also met the requisite performance criteria for the year ended 30

th June 2016. However, MQA has reduced the base fee effective from 1

st July 2016 by 100bps per annum on market capitalization up to A$1.0 billion and 25bps per annum on market capitalization between A$1.0 billion and A$3.0 billion.

.png)

Toll Revenue & Traffic Data for June Quarter (Source: Company Reports)

This would lead to savings of over A$14.3 million per annum for MQA security-holders as compared to the management and advisory agreements and over A$7.5 million as compared to the amounts charged following the February 2014 fee waiver. Meanwhile, MQA stock delivered 34.8% in the last six months (as of August 05, 2016). We believe there is more potential for MQA and give a “Hold” recommendation on the stock at the current price of $5.86

.PNG)

MQA Daily Chart (Source: Thomson Reuters)

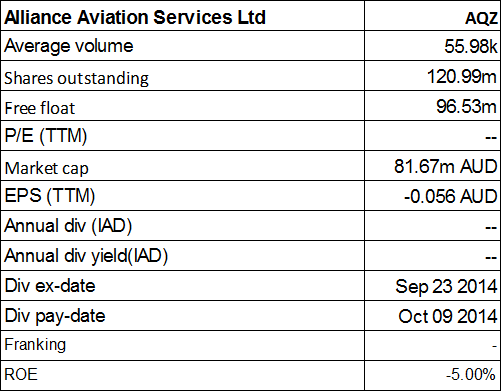

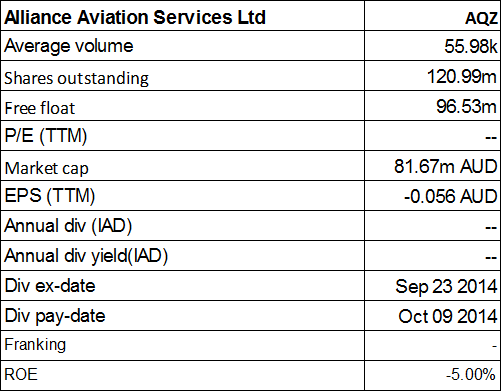

Alliance Aviation Services Ltd

AQZ Details

Solid contract base:Alliance Aviation Services Ltd (ASX: AQZ) has announced the sale of the first aircraft from the European fleet purchase. This delivery is the first of three aircrafts that Alliance is contracted to provide to Qantas Airways Limited subsidiary, QantasLink, announced earlier. AQZ had entered into a contract with Austrian Airlines AG for buying 21 Fokker aircraft in which five aircrafts have been delivered to Alliance. Out of these five, two have been contracted for sale (a third sale aircraft has not yet been delivered). The results from this sale and future aircraft and spare parts sales would be recognized in FY17. Moreover, AQZ has extended contracts for air charter services for South32’s Cannington and Gemco mines for further three years. Additionally, AQZ has renewed 8 contracts in a year and won the Santos contract for the Cooper Basin and a weekly service for Toll Services to Christmas Island.

Consequently, the stock has risen 50.00% in the last three months (as of August 05, 2016) placing them at higher levels. Hence, we give an “Expensive” recommendation on the stock at the current price of $0.685, and would review the stock at a later date.

.PNG)

AQZ Daily Chart (Source: Thomson Reuters)

Austal Ltd

.png)

ASB Details

Successful completion of the Full Shock Trials by USS Jackson (LCS 6): Austal Ltd (ASX: ASB) has finished Full Shock Trials by USS Jackson (LCS 6) and got the positive reaction from US Navy. Accordingly, ASB was awarded a US$11,239,032 cost-plus-fixed-fee contract modification from the U.S. Navy to provide emergent availability planning and full ship shock trials (FSST) support for tests to be conducted on Littoral Combat Ship USS JACKSON (LCS 6). The tests are being done to access the ship’s ability to withstand the effects of nearby underwater explosions and retain required capability.

Moreover, a comprehensive review of Austal over US$4 billion LCS block buy contract is completed after the delivery of LCS 6 & 8 and preliminary results of the first two physical shock trials of LCS 6. The review would offer better confidence in future US shipbuilding EBIT margins which are expected to be 5-7% in FY2017. ASB has given EBIT guidance for FY2017, which will be in the range $45-55 million. We give a “Hold” recommendation on the stock at the current price of $1.175

.PNG)

ASB Daily Chart (Source: Thomson Reuters)

Sydney Airport Holdings Ltd

.png)

SYD Details

Impact on Domestic demand: Sydney Airport Holdings Ltd (ASX: SYD) June’s International passenger grew 7.5%, driven by strong inbound demand of 11.7% comprising demand rise from Chinese (+16.3%), USA (+15.8%), Korean (+34.3%), Indian (+20.9%) and Japanese (+23.6%) nationalities compared to corresponding period last year. The Domestic passenger grew 3.7%, driven primarily by load factor improvements compared to the prior corresponding period. In addition, Xiamen Airlines has planned to increase the frequency on the Xiamen-Sydney route, from two to four on a weekly basis, over Northern Winter effective from 31

st October 2016. Meanwhile, the group is boosting its capital position to leverage the booming tourism market opportunity and diversified the debt sources and long term maturity profile as well as fixed or hedged the 90% debt portfolio.

.png)

Sydney Airport Traffic Performance (Source: Company Reports)

The group has raised US$900 million ($1.2 billion) on debt capital markets to repay bank debt, unlock liquidity and fund investment. Moreover, the company even enhanced its distribution guidance of 30 cents per stapled security for 2016 which is a rise of 17.6%. SYD is paying interim dividends on August 12, 2016. However, SYD may plan to cutting back on having new or larger planes in the skies and if the domestic demand remains weak the airlines could cut their capacity plans as well leading to a reduction in overall capacity growth, as compared to the guidance of 6-8%.

The oil prices have started rising which could affect the fuel prices of the airlines. Trading at an unreasonable P/E, we give an “Expensive” recommendation on the stock at the current price of $7.32, ahead of their half year results onAugust 18, 2016.

.PNG)

SYD Daily Chart (Source: Thomson Reuters)

Transurban Group

.png)

TCL Details

Raising Funds to Repay Debt: Transurban Group’s (ASX: TCL) revenue data has reported 17.4% increase in toll revenue to $500 million in the June quarter 2016 traffic when compared to the pcp. The proportional toll revenue, which gives the most accurate reflection of the portfolio’s performance, increased by 17.5% from the pcp, to $513 million. The revenue growth for the period is favorably impacted by the Easter holiday period which shifted from the June quarter in 2015 to the March quarter in 2016. The group also finished the pricing of the private placement of NOK 750 million (A$117 million) of senior secured 11 year notes under its Euro Medium Term Note Programme and settlement was expected to occur on 26

th July 2016 to repay the bank debt. Meanwhile, Transurban Queensland would partner with Brisbane City Council for the upgradation project of Inner City Bypass (ICB) for $80 million. The shortlisted bid teams, which included CPB Contractors, Seymour Whyte Constructions and BMD Constructions, had to submit detailed and fully costed bids in September before Council expects to award the contract later this year and the construction is expected to be completed in 2018.

TCL is paying final dividends on August 12, 2016. On the other hand, the stock is trading at unreasonable P/E. We give an “Expensive” recommendation on the stock at the current price of $12.07

TCL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.PNG)

.PNG)

.png)

.PNG)

.png)

.png)

.PNG)

.png)

Please wait processing your request...

Please wait processing your request...