Nine Entertainment Co Holdings Ltd

.png)

NEC Dividend Details

Boost from revised NRL Deal: With the latest update on National Rugby League variation announcement that Nine Entertainment Co Holdings Ltd (ASX: NEC) is going to receive an additional $20 million per annum from Foxtel across the 2016-17 seasons given NEC’s agreement to allow Fox Sports to simulcast all regular games, NEC stock has surged about 15.86% in the last one month (as at December 09, 2015). Boost to advertising revenue would also come from NEC getting a live Saturday night match for the last five rounds in 2017. In 2016, Fox Sports will show every game live; and in 2017, it will launch a dedicated new NRL channel which will feature every game of every round. This entire deal will help NEC enter into a strong media partnership for next seven years at least. Thus, the news that News Corporation Australia, in conjunction with subsidiary Fox Sports Australia secured a five year deal with the NRL for seasons 2018 to 2022 brings News Corporation, Nine Entertainment and Telstra together to deliver $ 1.8 billion to the NRL and secure the game’s long-term future.

.png)

Result Overview (Source: Company Reports)

Though the Metro FTA sector seems to face a blow at the back of drop in the audience in FTA, however, the improvement in NEC’s TV revenue share in FY15 with strong balance sheet position and the above deal seem to work as growth catalysts for NEC. We also note that new CEO, Hugh Marks, brings a credentialed experience to NEC. Given the above, we recommend a BUY for the stock at the current price of $1.80

NEC Daily Chart (Source: Thomson Reuters)

Seven West Media Ltd

.png)

SWM Dividend Details

Launch of new services and businesses to steer growth: Seven West Media Ltd (ASX: SWM) fell 40.47% this year to date but surged about 13.67% in the last one month (as at December 09, 2015). The company lately provided its trading update at the AGM while stating that its FY16 EBIT is expected to be at the bottom end of the minus 5-10% guidance range. SWM’s publishing advertising revenues are encountering challenges and the TV market growth is flat. On the other hand, the company has extended the windowing of its content into video on demand; and with the launch of a new service, all the channels are streamed live.

.png)

Net Debt (Source: Company Reports)

The company is now creating more content than at any time in its history both in domestic and international content production and has formed two new production companies 7Wonder and 7Beyond.

These new businesses are part of the strategy to originate owned and controlled growing library of content that can be distributed anyway, and already they have both secured major contracts. This year, Seven Productions will create and produce nearly 700 hours of television. In a major breakthrough, Seven Productions is producing A Place to Call Home for Foxtel and will produce two series of one of Australia’s most watched drama series. We do note that the company reported a net loss after tax of $ 1.9 billion for FY 2015 after taking large write-downs in good will and television licences, newspapers and magazines of a huge $ 2.12 billion but high dividend yield coupled with probable licence fee cuts, content cost renegotiations, and digitization appear to weigh towards better performance. We therefore give a BUY recommendation for the stock at the current price of $0.76

SWM Daily Chart (Source: Thomson Reuters)

oOh!Media Ltd

.png)

OML Dividend Details

Guidance upgrade and momentum from acquisition update: oOh!media Ltd (ASX: OML), the out of home media company, signed a definitive transaction documentation to acquire Inlink Group Pty Ltd (having a national network of over 2,800 digital screens across Australia). The business is highly complementary to the company’s offering because it aligns with the market leading digital advertising strategy to deliver premium audiences to advertisers, in particular rare access to premium CBD and business audiences, in particular the affluent 25 to 54 age group. The acquisition price of $ 45 million will be fully funded by debt using the company's existing facilities which will increase the pro forma FY 2015 net debt/EBITDA from 1x to 1.7x leaving a considerable headroom in the existing facilities. The proposed acquisition is expected to be EPS accretive immediately with respect to FY 2016 adjusted EPS basis. The acquisition is subject to the satisfaction of conditions precedent and completion is expected in December 2015.

Further, out-of-home category seems to benefit from the adoption of digital technologies. The company has also upgraded its CY15 EBITDA expectations to $57–58 million versus the prospectus forecast of $48.6 million given the continued strong sector growth. However, the stock is trading close to its 52 week high price with a P/E ratio of about 154x. Therefore, we believe that the stock is Expensive at the current price.

OML Daily Chart (Source: Thomson Reuters)

Ten Network Holdings Ltd

.png)

TEN Details

Outlook expectations given the challenging conditions in the television advertising market: Ten Network Holdings Ltd (ASX: TEN) has corrected 23% this year to date and surged about 6.67% in last five days (as at December 09, 2015). TEN recently completed its Retail Shortfall Bookbuild with respect to its fully underwritten 7-for-37 accelerated renounceable entitlement offer of new TEN shares. For the 12 months ended 31 August 2015, the company reported $ 654.1 million in revenues indicating a 4.5% rise and a 4.6% increase in TV revenue along with a 6.5% decrease in TV costs. The network audience share of people between the ages of 25 and 54 was 29.2% and 24.8% in share of total people, and audience growth was 9% in prime time in total people and also 9% in the age group of 25 to 54. Network Ten was up 4% in prime time in total people and 3% in people between the ages of 25 and 54 (excluding the Commonwealth Games from 2014). Tenplay reported page views up 8%, unique visitors up 7% and video views up 7%. Despite the increase in revenue, the group reported a loss of $ 312 million attributable to the members of TEN, which was much worse than the loss of $ 168 million in the previous year.

However, in spite of the depressed conditions in the television advertising market as of now, the company expects an increase of at least 10% in the first quarter of FY 2016. Given the dismal results and with no great prospect of any improvement in FY 2016, we think that the stock is overvalued and Expensive at the current price.

TEN Daily Chart (Source: Thomson Reuters)

STW Communications Group Ltd

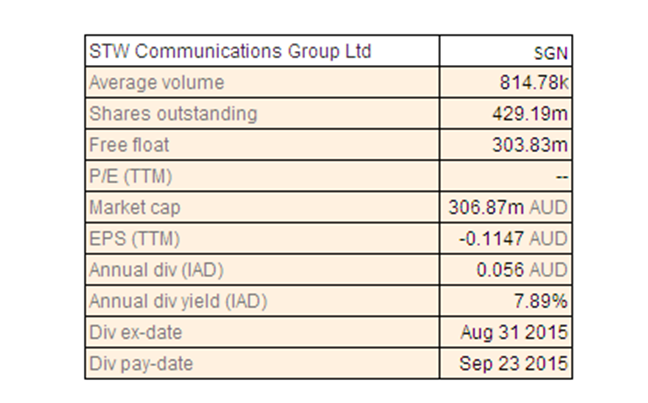

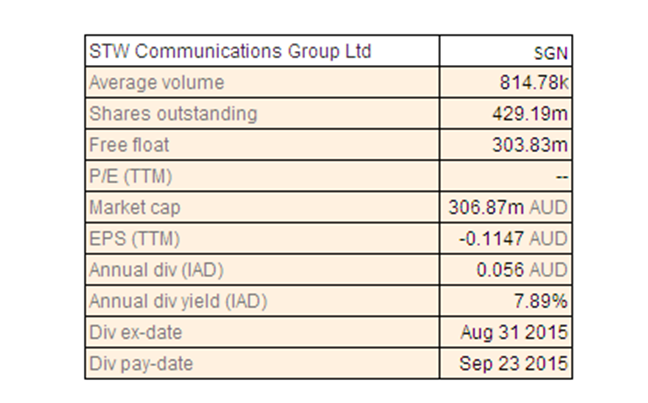

SGN Dividend Details

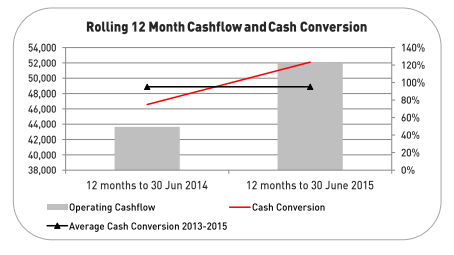

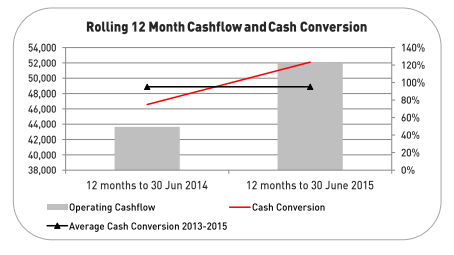

Strong operating cashflow for 2015 half year: STW Communications Group Ltd (ASX: SGN) announced its financial results for the half year ended 30 June 2015 and the key features included revenue of 194.4 million, up 3.3%; underlying NPAT of $ 15.1 million, down to 22.5%; strong operating cash flow of $ 34.4 million, up $ 19 million over the previous year; underlying EPS of 3.7 cents per share, down 24.9%; and reported loss of $ 73.4 million after incurring non-cash impairment charges of $ 78.9 million and strategic review and other one-off costs of $ 9.6 million. The strategic review has been completed and is being implemented to drive performance improvements in the future. The one-off costs relating to the strategic and structural review have largely been incurred in the first half of the year and benefits will start to grow in the second half of the year. The interim dividend fully franked was 2.1 cents per share and a dividend reinvestment plan will operate in respect of the final dividend. The company attributed the performance for FY 2015 to the loss of some big client mandates in 2014 such that the first half of FY 2015 was always going to be difficult. The company is trying to make some efforts to bridge the gap.

Operating Cashflow (Source: Company Reports)

The full-year outlook for FY 2015 is a net profit after tax of around $ 40 million. We think that the company is beginning to show signs of a turnaround and believe that future performance improvements can be expected. The stock fell 26.67% this year to date (as at December 09, 2015). Given the above, we would rate the stock as a Buy at the current price of $0.725

SGN Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...