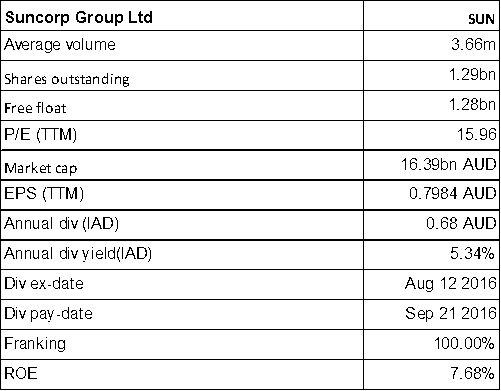

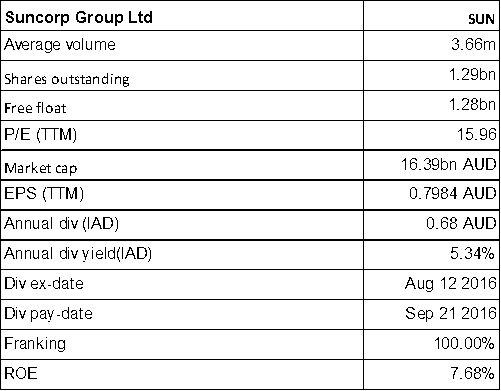

Suncorp Group Ltd

SUN Details

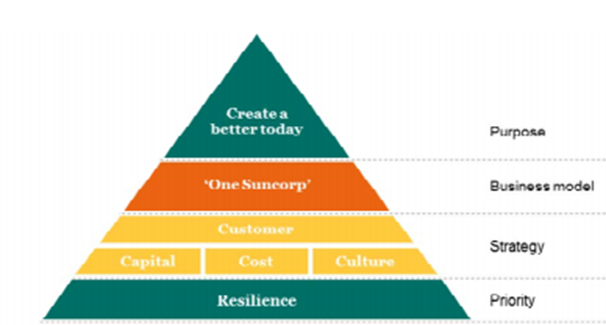

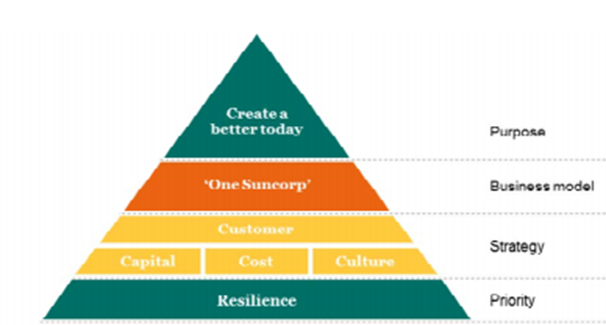

Aligned the operating model to the new strategy: Suncorp Group Ltd (ASX: SUN) has aligned the operating model to the new strategy and is focusing on the customer, and aligned the cost base to deliver a more resilient business. SUN’s marketplace approach would connect more customers to the company by providing access to all products, all services and all brands through any channel. Moreover, SUN would shortly be announcing a new health offer, to provide the 9 Spokes solution for small business, a third party annuity offering for the mature customers, and AAMI Smartplates for Learner drivers. However, SUN has reported NPAT of $1,038 million in FY 16 against $1,133 million in prior corresponding period. This is due to the lower returns from investment markets and a reduction in reserve releases. The General Insurance underlying ITR is of 10.6% due to the increased cost of settling claims and lower investment returns and the total GWP increased by 1.8% to over $9 billion. On the other hand, Suncorp Bank net profit after tax grew 11.0% due to continued home lending growth, improved net interest margins and enhancing credit quality.

SUN’s new strategy (Source: Company Reports)

Suncorp Bank is executing the major transformation programs including the updating of the core banking system. Suncorp Life net profit after tax grew 13.6% and the underlying profit increased by 9.7% to $124 million. The underlying profit included the positive lapse and claims experience of $21 million. In addition, after accounting the dividend payment, the group is well capitalized with about $347 million in CET1 capital held above its operating targets. Additionally, SUN expects to get a sustainable return on equity of at least 10% which means an underlying ITR of at least 12% and maintaining the dividend payout ratio of 60% to 80% of the cash earnings. Meanwhile, SUN stock has risen 14.2% in the last six months (as of August 29, 2016).

We give a “Buy” recommendation on the stock at the current price of $12.78

SUN Daily Chart (Source: Thomson Reuters)

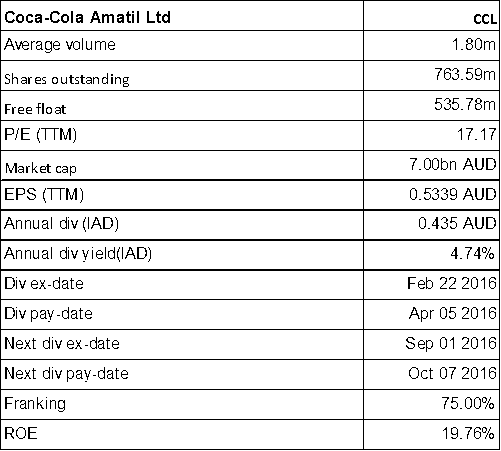

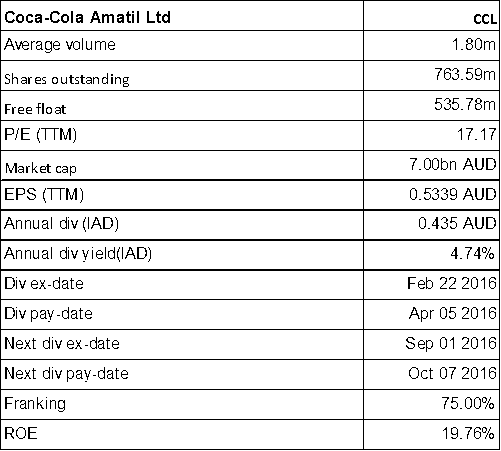

Coca-Cola Amatil Ltd

CCL Details

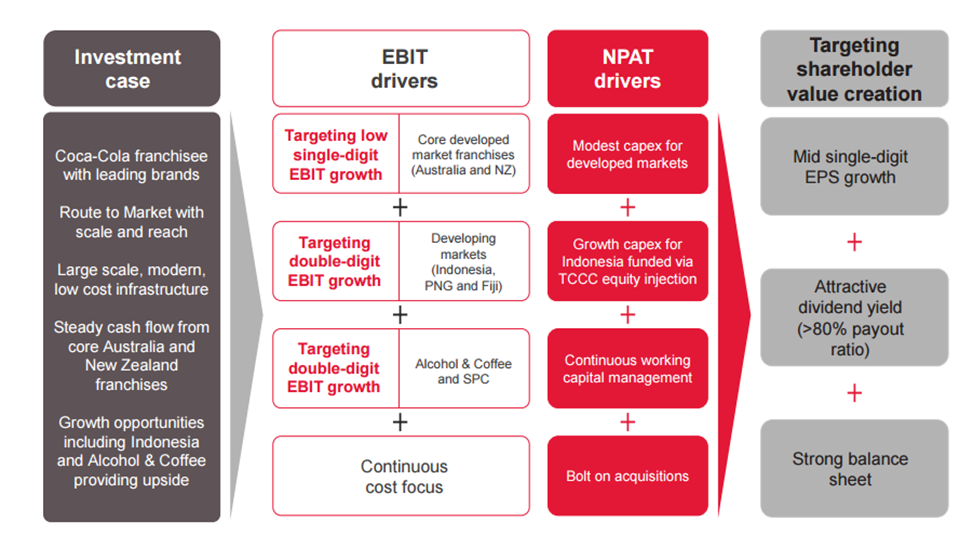

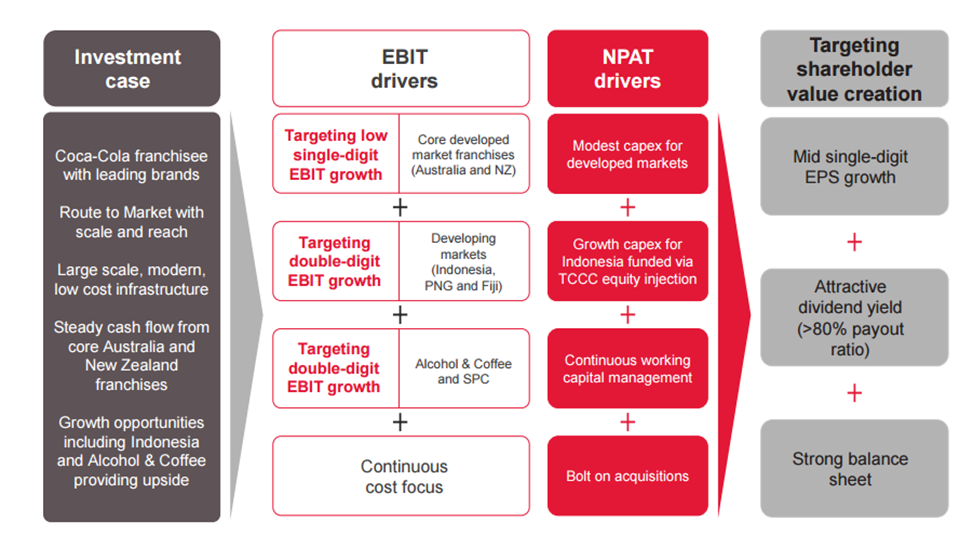

Strong result and moving to healthier portfolio: Coca-Cola Amatil Ltd (ASX: CCL) reported a strong half year result with 3.2% rise in EBIT to $326.9m and 5% rise in interim dividend. New Zealand and Fiji experienced 5.4% EBIT rise while 65.2% and 33.6% of EBIT growth were witnessed by Indonesia & PNG and Alcohol & Coffee, respectively. The cash realisation rose to 98.1%. On the other side, CCL is expecting a capex of $300m for FY16 which is lower than February’s forecast owing to potential slower spend rate on approved projects.

Shareholder value proposition (Source: Company Reports)

The company has been expanding its healthier portfolio and had even started selling products that are owned by The Coca-Cola Company and both the players have been jointly growing their water portfolio. However, the core Australian Beverage market has underperformed due to structural shift as the younger Australians shunned Coca-Cola in favor of healthier alternatives. Moreover, UK government has introduced a “sugar tax” on products like Coca-Cola that contain high amounts of sugar and to combat this situation the company has diversified into more retailing of bottled water, coffee, and alcoholic drinks. But, the group has been on track to achieve its $100M cost savings plan in Australian Beverages. In addition, CCL is aiming to return to mid-single digit growth in EPS over the next few years and expects to have increased contributions from growth segments, especially Alcohol & Coffee.

CCL has risen 5.6% on August 29, 2016. Based on the foregoing, we give a “Hold” recommendation on the stock at the current price of $9.69

CCL Daily Chart (Source: Thomson Reuters)

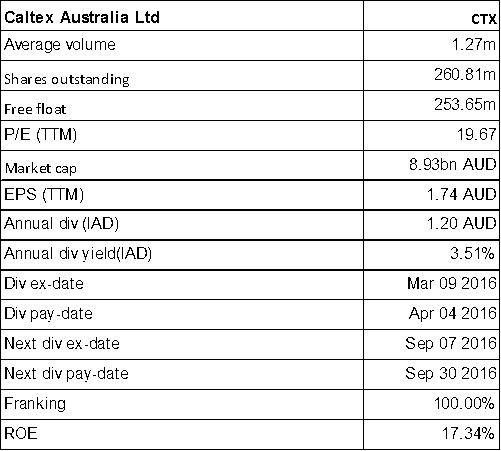

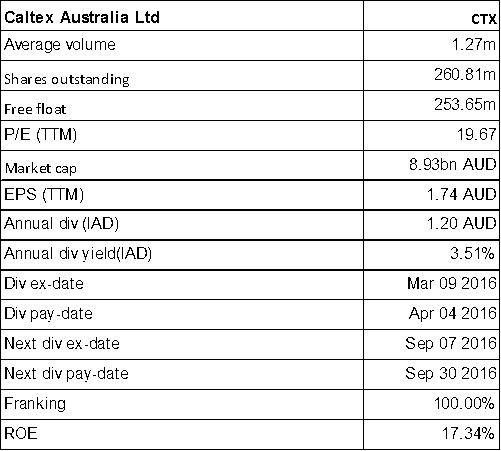

Caltex Australia Limited

CTX Details

Reported a better profit despite top line pressure: Caltex Australia Limited (ASX: CTX) reported an after tax profit fall of 15% to $318 million as compared to corresponding period 2015. But, on a replacement cost of sales operating profit (RCOP) basis, CTX’s after tax profit is up 1% to $254 million for the first half of 2016 on year on year basis. The group was also able to control their net debt to $693 million as at 30

th June 2016, as compared to $715 million as at 30

th June 2015. Even though, Lytton refinery’s EBIT fell $62 million, the volumes were up 21% to 2.9 billion liters (prior year impacted by major maintenance).

Meanwhile, CTX has declared an interim fully franked dividend of 50 cps for the first half of 2016, in line with the target dividend pay-put ratio of 40% to 60% payable on 30th September 2016. We give a “Hold” recommendation on this dividend yield stock at the current price of $34.09

CTX Daily Chart (Source: Thomson Reuters)

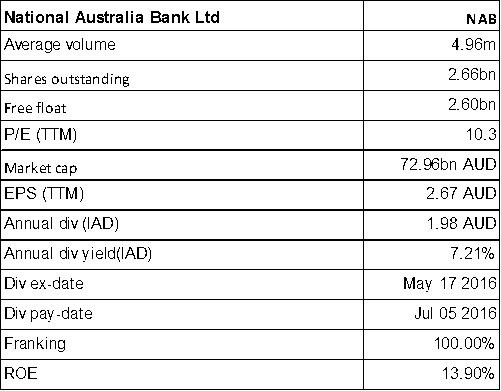

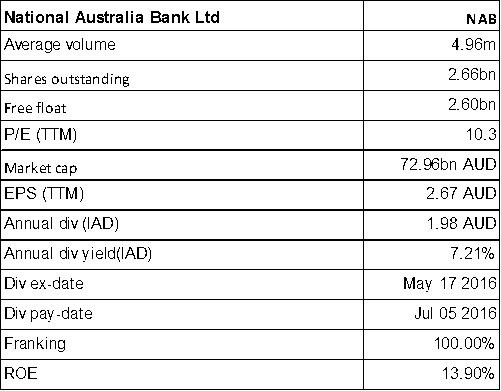

National Australia Bank Ltd

NAB Details

NIM subdued but Australia’s largest retail super fund is created: National Australia Bank Ltd (ASX: NAB) reported a 3% fall in unaudited cash earnings for continuing operations to about $1.6 billion for the third quarter 2016 against corresponding period 2015. The revenue is flat for the quarter as the growth in lending is offset by a lower net interest margin. The group NIM, excluding the impact of Markets and Treasury, was slightly lower due to higher funding costs. The Group’s Common Equity Tier 1 (CET1) ratio was 9.5% at 30 June 2016, against 9.7% at 31 March 2016 mainly reflecting the impact of the interim 2016 dividend declaration. Moreover, NAB had a higher funding costs during the quarter as the bank did not pass on all of the most recent RBA interest rate cut to home loan borrowers. However, the bank’s asset quality remains strong and cost control was effective. Additionally, the branch rollout from the Personal Banking Origination Platform has now been completed in every state except New South Wales, which recently started. NAB’s initiative NAB Labs are supporting the small business sector including NAB QuickBiz loans, NAB Business Start-up and new digital marketplace Proquo in partnership with Telstra. In addition, the sale of 80% of the life insurance business to Nippon Life will be completed during the second half of calendar year 2016. This comes post the merger of five super funds to create Australia’s largest retail super fund with approximately $70 billion in funds under management. Moody’s Investors rating has reaffirmed NAB’s rating with NAB’s senior unsecured debt unchanged at Aa2.

Meanwhile, NAB stock has risen 12.5% in the last six months (as of August 26, 2016) and the stock has an outstanding dividend yield. Based on the foregoing, we give a “Buy” recommendation on the stock at the current price of $27.19

NAB Daily Chart (Source: Thomson Reuters)

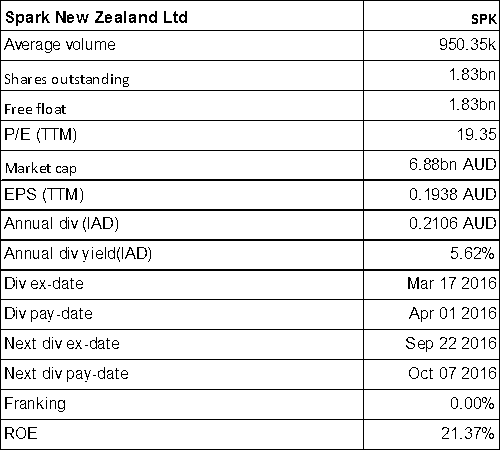

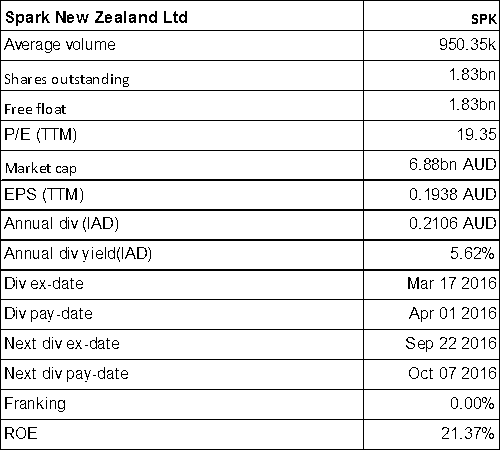

Spark New Zealand Ltd

SPK Details

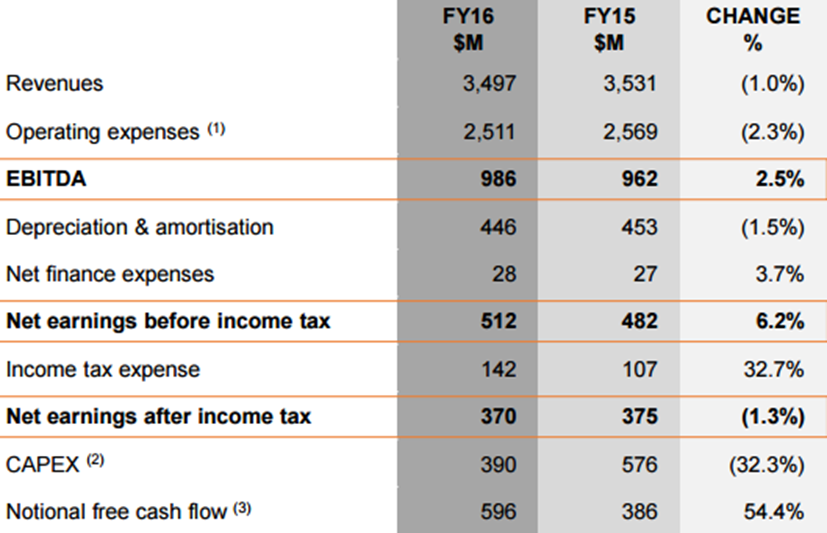

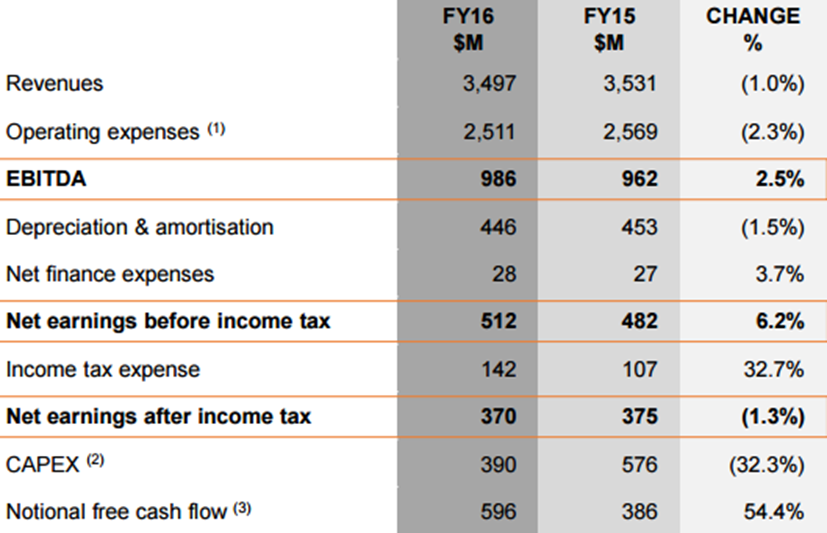

Decent growth estimates for FY 17:Spark New Zealand Ltd (ASX: SPK) reported that its FY16 EBITDA grew 2.5% due to the tight ongoing management of cash flow and capital, FY 16 Mobile and IT Services revenue contribution coupled with margin uplift. SPK has completed the four year, $238m re-engineering program to upgrade the key customer service IT systems. Meanwhile, the launch of Wireless Broadband is expected to provide further growth and cost reduction in the future.

FY 16 Financial Performance (Source: Company Reports)

Moreover, for FY 17, SPK expects ordinary dividend of 22 cps and special dividend of 3 cps. In FY 17, the revenue is expected to grow 0%-3% while EBITDA excluding potential net gains on sale for Mayoral Drive Carpark is estimated at $17m-$19m. The earnings per share for FY 17 is expected to be 21 cents compared to 20 cents in FY 16.

SPK has also launched a retail bond offer for up to NZ $100m unsecured unsubordinated fixed rate bonds to institutional investors and NZ retail investors. We give a “Hold” recommendation on this dividend yield stock at the current price of $3.71

SPK Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

SPK Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

Please wait processing your request...

Please wait processing your request...