Kalkine has a fully transformed New Avatar.

.png)

Stocks’ Details

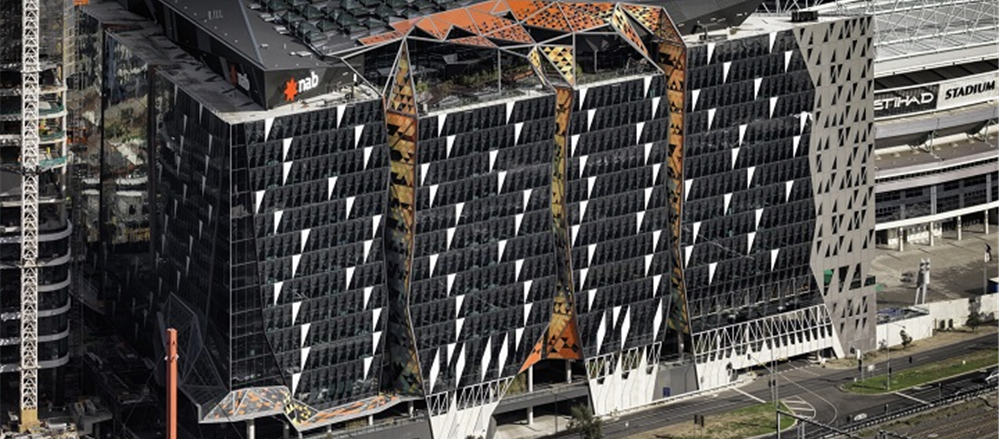

National Australia Bank Limited

Reservations around FY18 Dividend: National Australia Bank Limited (ASX: NAB) is one of the fourth largest banks in Australia in term of market capitalization and customer base. It offers a full range of banking and financial services to the consumer, small business and corporate sectors, with significant operations in New Zealand. On the financial front, the group recorded cash earnings (ex-restructuring) of A$3,289 Mn in 1HFY18 which is broadly in line with the prior corresponding period (pcp). The Common Equity Tier 1 (CET1) ratio increased by 10 bps to 10.21 per cent in 1HFY18 against pcp. However, Cash RoE (ex-restructuring) contracted to 40 bps and recorded 13.6 per cent in 1HFY18. The group is on track to achieve APRA’s ‘Unquestionably Strong’ CET1 ratio benchmark of 10.5% by January 2020 in an orderly manner, with accommodation of APRA’s proposed revisions to RWAs (risk-weighted assets). During the first half, the Board of Director declared an interim dividend of 99 cent per share which is flat compared with pcp. The bank may maintain its FY18 dividend at the FY17 level while there has been pressure in the banking sector overall. Meanwhile, the share price has fallen 3.84 per cent in the past three months as at August 08, 2018 and it is trading above its 52-week low level. The stock was up by 1.01 per cent as on August 09, 2018. Looking at the current trading level and a moderate outlook for full year, we maintain our “Hold” recommendation on the stock at the current market price of $ 28.010, ahead of third quarter performance due on August 14, 2018.

.png)

1HFY18 Financial Highlights (Source: Company Reports)

Tabcorp Holdings Limited

Splendid FY18 Performance: Tabcorp Holdings Limited (ASX: TAH) has recently reported robust FY18 performance in which revenue grew by 71.7 per cent to $3,828.7 Mn as against $2,229.6 in last year. The sales spiked up due to solid second-half performance which was driven by Wagering & Media and Lotteries & Keno business and other factors i.e., renewed licenses, new product launches, etc., during the same period. EBITDA before significant items grew substantially by 46.1% to $57,016 in FY18 as compared to last year. Resultantly, NPAT before significant items increased by 37.6 per cent and amounted to $ 246.2 Mn in FY18 as compared to the previous year. As a result, the Board of Directors declared fully franked final dividend of 10 cents per share for its shareholders and it will be payable on September 14, 2018 with the record date of August 16, 2018. This summarized a total dividend payment of 21 cents per share for the full year.

.png)

Robust FY18 Performance (Source: Company Reports)

On the other hand, the company has completed the combination with Tatts Group and the integration is on track.Although, the company is on track to deliver $50 Mn of EBITDA synergies and business improvements in FY19. Of which, the company has already delivered EBITDA synergies of $8 Mn in FY18 and has set a target to achieve at least $130 Mn in FY21. The revenue synergy estimates include the cost of rolling out TAB venue arrangements to UBET states, including the payment of digital commissions. Meanwhile, the share price has risen 5.63 per cent in the past three months as at August 08, 2018 and is trading at a higher P/E level. However, by looking at its robust performance in FY18 and ongoing developments, we give a “Buy” recommendation on the stock at the current market price of $ 4.960.

Commonwealth Bank of Australia

Trading at Lower level: Commonwealth Bank of Australia (ASX: CBA) has recently disclosed its FY18 full-year results wherein statutory net profit after tax (NPAT) from continuing operations recorded degrowth of 4 per cent and amounted to $9,375 Mn in FY18 against FY17. Cash NPAT from continuing operations contracted to 4.8 per cent to $9,233 Mn in FY18 on Y-o-Y basis. As a result, its Common Equity Tier 1 (CET1) capital ratio came at 10.1% on an APRA basis in FY18, showing 20 bps degrowth on Y-o-Y basis. The Net Stable Funding Ratio stood at 112%, up from 107% in June 2017, driven by a more NSFR efficient customer deposit mix. Insurance income increased by 31.4% because of lower weather event claims and growth in premiums driven by risk-based pricing initiatives. In 2018, the group has posted 2.6% growth in operating income and 5 basis point expansion for net interest margin to 2.15%. However, the Board has increased the dividend for the full year and declared a final dividend of A$2.31 per share, up 1 cent on 2H17, which brings the full year dividend to A$4.31, fully franked, up 2 cents on FY17. The final dividend will be paid on September 28, 2018 with the record date of August 16, 2018. Further, the operating expenses grew 9.2% to $11.599 Bn due to the $700 million penalty paid to settle the anti-money laundering action by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

.png)

FY18 Financial Highlights (Source: Company Reports)

Additionally, during the year, the bank has done transformational changes in the top management as the group was caught in 53,750 breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF). Meanwhile, the stock has fallen 4.22 per cent in the past one month as on August 08, 2018 and is trading at a reasonable PE level (12.81x) among its peer group. Hence, we maintain our “Buy” recommendation on the stock at the current market price of $75.370, considering potentiality to generate higher profit, maintaining healthy balance sheet position and capability to deliver returns for shareholders throughout the economic cycle.

Pendal Group Limited

FUM Update as on June 2018: Pendal Group Limited (ASX: PDL) reported an increase of 1.0 per cent as on 30 June 2018 from 31 March 2018 in FUM and recorded the same at $100 Bn. This was mainly supported by the decent investment performance, market movements and distribution incurred during the same period. During the quarter, Pendal Australia experienced net inflows of $0.4 Bn led by strong inflows in Australian equities offset by lower margin cash outflows of $0.2 Bn. The positive flows continued into the wholesale channel in most asset classes, while there were outflows in Westpac FUM relating to the ongoing reconfiguration of its MySuper portfolio comprising of (-$0.4 Bn) and the run-off in the legacy book. Besides this, JOHCM experienced net outflows of $1.1 Bn during the quarter led by segregated mandate redemptions in the Global Select strategy (-$0.5 Bn), and net outflows in European (-$0.7 Bn) and Asian (-$0.3 Bn) OEIC funds. The US pooled funds took in $0.5 Bn continuing the momentum from prior quarters. The effect of the net flows during the June quarter on Pendal Group revenue is a decrease to annualised fee income of $5.8 Mn. Pendal Australia performance fees for the year ended 30 June 2018 have now been realised totalling approximately $6.9 Mn in revenue which compares to $9.4 Mn for the FY17. The stock has fallen 14.62 per cent in the past one month (as at August 08, 2018) and is trading at 52-week lower level. Considering the foregoing update, we maintain our “Expensive” recommendation on the stock at the current market price of $ 8.860.

.png)

FUM Highlights as at June 30, 2018 (Source: Company Reports)

WAM Research Limited

Strong Business Strategy to Invest into Undervalued Growth Companies: WAM Research Limited (ASX: WAX) was formed on May 10, 2002 with the objective of achieving a high real rate of return, comprising both income and capital growth within risk parameters and acceptable to the management. The group invests in value and growth stocks of small to medium-cap companies. Recently, the group disclosed June month investment performance wherein the group delivered investment portfolio returns for one month as at June 2018 that edged up to 1.1 per cent but did not outperform the S&P/ASX all ordinaries accumulation index that rose by 2.9%. However, WAX has paid 89.9 cps in fully franked dividends to shareholders since inception. The Company has a dividend yield of 5.71 per cent as of August 09, 2018. The NTA after tax as on 30 June 2018 was recorded at 124.55 cents and while on 31 May 2018, the same was recorded at 123.45 cents. Meanwhile, the stock climbed up 7.28 per cent in the past three months as at August 08, 2018. We maintain our “Speculative Buy” recommendation on the stock at the current price of $ 1.625, considering robust fundamentals along with the well-versed strategy to invest into the market resulting into the high return from undervalued growth companies.

.png)

Investment Performance (Source: Company Reports)

Australian Finance Group Ltd

Update on Mortgage Index: Australian Finance Group Ltd (ASX: AFG) was formerly known as Australian Finance Group Pty Ltd and was founded in 1994 in West Perth, Australia. It offers commercial finance, insurance products, and AFG-branded and mortgage brokerage services through Australia. The group has recently disclosed its Mortgage Index for the fourth quarter of the financial year 2018. As per the release, the total mortgage lodgement numbers recorded at 28,896 for the full year while lodgement volume came at $14,589,632,848 in Q4FY18. Further, the management stated that the fixed rates stood at 15.5% in Q4FY18 which was down from 26.4% in the first quarter of FY18. On the financial front, the group recorded NPAT growth of 11 per cent to $14.4 Mn in 1HFY18 as compared to the prior corresponding period (pcp). As a result, the Board of Directors declared fully franked interim dividend and special dividend of 4.7 cents per share and 12.0 cents per share, respectively. Hence, we expect that the company will continue to pay the dividend to its shareholders in the range of 70%-80% of underlying (cash) profits. Besides this, National Nominees Ltd ACF Australian Ethical Investment Limited, a substantial holder of the group changed its holding from 5.21% of interest to 6.27% of the voting power. Meanwhile, the share price climbed up 3.53 per cent in the past three months and traded relatively at a lower PE level (7.4x) as compared to the peer group. Hence, we maintain our “Buy” recommendation on the stock at the current market price of $ 1.460, considering financial performance and capability to maintain capital for further growth initiatives.

.png)

Comparative Price Movement Chart for top four stocks by Market Capitalization (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.