Kalkine has a fully transformed New Avatar.

Opthea Limited

OPT Details

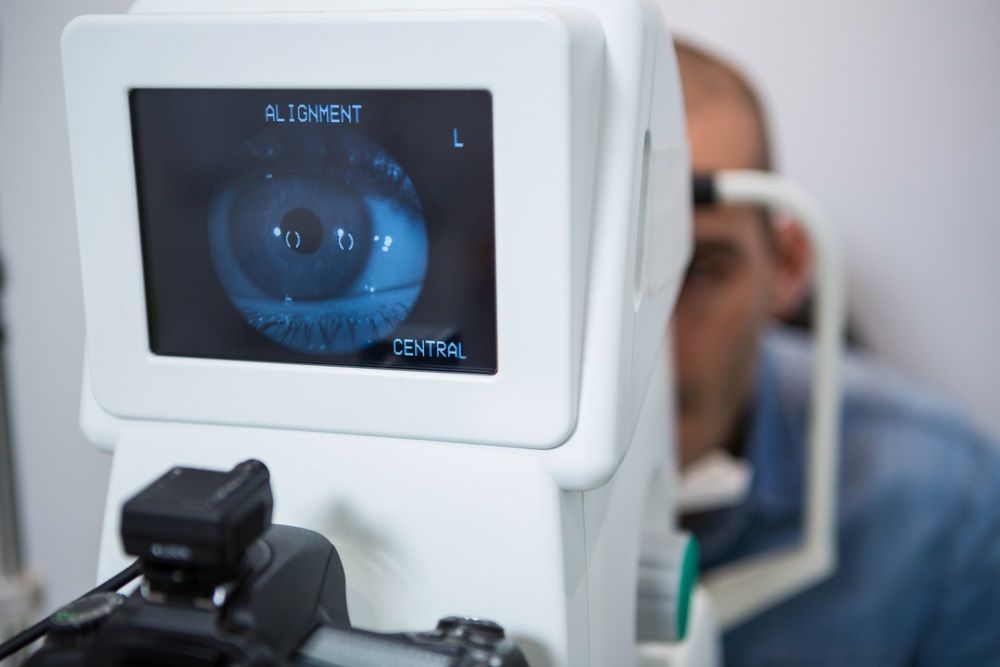

Fast Track Grant for OPT-302: Opthea Limited (ASX: OPT) is a biotechnology company that develops drugs, innovative, biology-based therapies for the treatment of eye disease. As per a recent announcement, US FDA has granted Fast Track designation for the company’s VEGF-C/-D ‘trap’ inhibitor, OPT-302 in combination with anti-VEGF from the U.S. Food and Drug Administration (FDA). It is a therapy to treat patient with neovascular (wet) age-related macular degeneration (AMD).

H1FY21 Financial Performance:

Revenue Trend (Source: Analysis by Kalkine Group)

Outlook: The publishing of the Phase 1b and Phase 2a DME trials in peer reviewed journals could have a positive impact on company’s goodwill and competitive in the market. The company is expanding its reach by establishing US-based operations. OPT is investing in R&D which could provide upgraded and innovative offerings to the clients.

Key Risks:

Stock Recommendation: The stock of OPT is trading lower than the average 52-weeks' price level of $1.240-$3.280. The stock of OPT gave a positive return of ~6.80% in the past one week and a negative return of ~50.91% in the past one year. On a TTM basis, the stock of OPT is trading at a Price/Book multiple of 4.2x, lower than the industry median (Biotechnology & Medical Research) of 5.5x. Considering the current trading levels, R&D investment, healthy cash position, increase in revenue and the key risks associated with the business, we recommend a ‘Speculative Buy’ rating on the stock at the current market price of $1.290, as on 26 July 2021, 3:14 PM (GMT+10), Sydney, Eastern Australia.

OPT Daily Technical Chart, Data Source: REFINITIV

Integral Diagnostics Limited

IDX Details

Business Update: Integral Diagnostics Limited (ASX: IDX) is a diagnostics & research company that provides medical imaging services to general practitioners, medical specialists, and allied health professionals and their patients through 64 radiology clinics in Australia and New Zealand. In a recent announcement, the company has advised that 336,145 fully paid ordinary shares are currently held under voluntary escrow which will release on 31 July 2021.

H1FY21 Financial Performance:

Revenue Trend (Source: Analysis by Kalkine Group)

Key Risks:

Outlook: Looking ahead, the company is focused on accelerating the use of digital and AI technologies to improve the patient and referrer experience. Further, the company is focused on evaluating further strategic acquisitions.

Valuation Methodology: EV/Sales Multiple Based Relative Valuation (Illustrative)

Source: Analysis by Kalkine Group

*% Premium/(Discount) is based on our assessment of the company’s NTM trading multiple after considering its key growth drivers, economic moat, stock's historical trading multiples versus peer average/median, and investment risks.

Stock Recommendation: The stock of IDX is inclined towards its 52-weeks’ high level price of $5.550. The stock of IDX gave a positive return of ~40.57% in the past one year and a positive return of ~19.33% in the past six months. On a technical analysis front, the stock of IDX has a support level of ~$4.99 and a resistance level of ~$5.55. We have valued the stock using an EV/Sales multiple-based illustrative relative valuation and have arrived at a target price with a correction of high single-digit (in % terms). We believe the company can trade at a slight premium to its peer average EV/Sales (NTM trading multiple), considering the improvement in the EBITDA and increase in cash position. For this purpose, we have taken peers such as Capitol Health Ltd (ASX: CAJ), Virtus Health Ltd (ASX: VRT), Sonic Healthcare Ltd (ASX: SHL), to name a few. Considering the current trading levels, recent rally in the stock price, government restrictions, increase in net debt and the key risks associated with the business, we suggest investors to book profits and give a 'Sell' rating on the stock at the current market price of $5.380, as on 26 June 2021, 11:05 AM (GMT+10), Sydney, Eastern Australia.

IDX Daily Technical Chart, Data Source: REFINITIV

Note 1: The reference data in this report has been partly sourced from REFINITIV

Note 2: Investment decisions should be made depending on the investors' appetite for upside potential, risks, holding duration, and any previous holdings. Investors can consider exiting from the stock if the Target Price mentioned as per the analysis has been achieved and subject to the factors discussed above alongside support levels provided.

Technical Indicators Defined: -

Support: A level where-in the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level where-in the stock prices tend to find resistance when they are rising, and the uptrend may take a pause due to profit booking or selling interest.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.