Kalkine has a fully transformed New Avatar.

Stocks’ Details

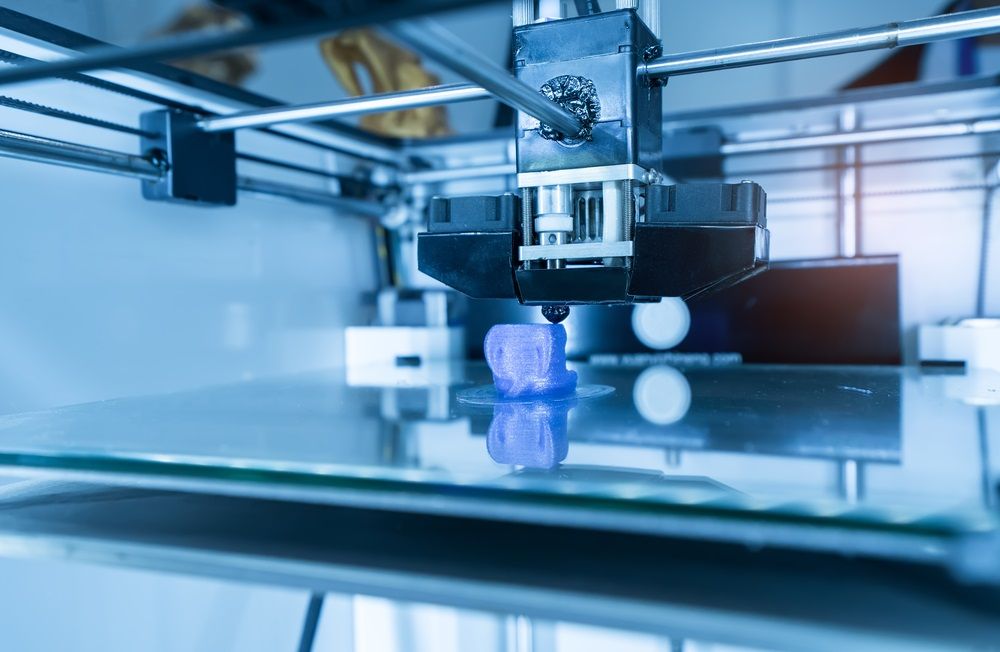

Desktop Metal, Inc.

DM to Acquire EnvisionTEC: Desktop Metal, Inc. (NYSE: DM) is a leader in mass production and turnkey additive manufacturing solutions, with a market capitalization of ~5.68 billion as on 22 January 2021. Recently, DM inked a definitive agreement to buy EnvisionTEC, for a total purchase consideration of $300 million, in both cash and stock deal. The agreement is likely to close in the 1QFY21, subject to customary closing conditions. Post the completion of the acquisition, EnvisionTEC will function as a wholly-owned subsidiary of Desktop Metal. The partnership with Al and the EnvisionTEC team will aid DM with significant growth opportunities in the additive market.

Business Combination of DM and Trine Acquisition: In September 2020, Trine Acquisition Corp announced a proposed business combination with Desktop Metal, Inc. for an estimated pro forma equity value of ~$2.5 billion. The combined company is now trading on NYSE under the ticker symbol of “DM”. Desktop Metal is well-positioned to strengthen its foothold in the rapidly growing additive manufacturing industry, given its substantial technology channel, and entrenched customer relationships across varied end markets.

What to expect: From FY21 to FY25, DM’s revenue is expected to grow at a CAGR of 87%. Looking ahead, Desktop Metal intends to maintain its focus on technology & product development.

Revenue and Adjusted EBITDA Forecasts (Source: Company Reports)

Stock Recommendation: The stock of DM went up by ~30.46% in the past one month, and it has provided a return of ~137.44% in the last six months period. The stock is currently inclined towards its 52-week high price of $26.3. With its proprietary and defensible technology platform, DM is primed to be the industry leader. On the technical analysis front, the stock has a support level of ~$22.3 and a resistance of ~27.5. Considering the synergies from the business combination with Trine Acquisition, buyout of EnvisionTEC, expected revenue growth of Desktop Metal in the coming five years, and decent industry outlook, we recommend a “Hold” rating on the stock at the closing price of $25.05, up by 4.29% on 22 January 2021.

Canoo Inc.

Managerial Changes: Canoo Inc. (NASDAQ: GOEV) is involved in developing electric vehicles with a patented and highly versatile EV platform for personal and business use. On 19 January 2021, GOEV appointed Kamal Hamid as a Vice President of Investor Relations, effective immediately. In another update, post becoming publicly traded company, GOEV announced members of its Board of Directors which include Executive Chairman Tony Aquila, Debra L. von Storch, Josette Sheeran, Thomas Dattilo, Rainer Schmueckle, Foster Chiang, and Greg Ethridge.

Closing of Business Combination: On December 21, 2020, Canoo Inc. and Hennessy Capital Acquisition Corp. IV ("HCAC"), a special purpose acquisition company, updated the market regarding the completion of their business combination. The Business Combination was approved by HCAC stockholders, post which (that is on December 22, 2020), Canoo's common stock started trading on Nasdaq Global Select Market under the ticker symbols "GOEV". On 18 August 2020, both the company had entered into a deal to create a new single entity.

What to Expect: GOEV remains on track to complete advanced testing of its pioneering electric mobility platform and expects to bring its recently disclosed multi-purpose delivery vehicle to limited production in 2022. Further, it expects to commercial production and rollout of the vehicle in 2023. Post the completion of the business combination, GOEV thrives to be a leader in the EV market. In FY21, GOEV expects to produce revenues from subscription segment and engineering & B2B segment of ~$120 million, depicting a growth of 258% on pcp.

Expected Segmental Revenues (Source: Company Reports)

Stock Recommendation: The stock of GOEV corrected by ~4.55% in the past one month but provided a return of ~49.38% in the last six months period. The stock is currently trading close to its 52 weeks’ average high and low price of $24.9 and $9.21, respectively. GOEV has achieved numerous key milestones including competition of Beta Development, maintaining robust relationships with global strategics, and developing own proprietary technology. On the technical analysis front, the stock has a support level of ~$16.00 and a resistance of ~18.5. Considering the aforesaid facts, synergies from the business combination and decent long-term outlook, we recommend a “Hold” rating on the stock at the closing price of $17.00, down by 0.7% on 22 January 2021.

Globalstar, Inc.

GSAT Partners with Battlbox: Globalstar, Inc. (AMEX: GSAT) is engaged in providing worldwide satellite voice and data services to commercial and recreational users. On January 20, 2021, GSAT’s wholly owned subsidiary, SPOT LLC, entered into a partnership with Battlbox, a monthly subscription box service. Under the terms of the agreement, Battlbox Pro Box subscribers will obtain a SPOT Gen4, the next generation of the SPOT Satellite GPS Messenger™, with up to six months of service.

GSAT Inks Deal with Ceres Tag: On January 13, 2021, GSAT inked a commercial deal with Ceres Tag, to provide satellite services to the livestock industry via the world’s earliest and only smart ear tag for biosecurity, traceability origin, health, animal welfare, production expansion and theft decline.

Key Financials for 3QFY20: Recently, CCL provided a business update for third quarter for the period ended 30 September 2020. During the quarter, the company reported loss per share of $0.01, flat on a year over year basis. During the quarter, revenues declined from the year-ago period figure of $38.6 million and stood at $32.8 million, due to the decline in service revenue as revenue produced from subscriber equipment sales was mostly flat. Adjusted EBITDA went down by 3% on pcp and came in at $11.5 million in 3QFY20: The company exited the quarter with a cash balance of $19.5 million.

Key Results Highlight (Source: Company Reports)

Stock Recommendation: The stock of GSAT gave a positive return of 247.56% during the span of three months and 178.44% in the past one-month period. The stock of the company is currently trading above the average of its 52-week trading range of $0.23 - $1.48. Debt to equity ratio of the company stood at 0.84x in 3QFY20 as compared to the industry median of 0.78x. On the valuation front, the stock is trading at an EV/Sales multiple of 16.4x as compared to the industry median of 4.9x on TTM (Trailing Twelve Months) basis. On the technical analysis front, the stock has a support level of ~$0.92 and resistance of ~1.9. Considering the spike in the stock price over the last few months, current trading levels, high debt to equity ratio and valuation on TTM basis, we are of the view that most of the positive factors of the company have been discounted at current trading levels. Hence, we suggest investors to wait for better entry level and give an “Expensive” rating on the stock at the closing price of $1.04, down by 16.13% on 22 January 2021. Any positive change in Industry dynamics should be waited for in the long run.

Comparative Price Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.