This report is an updated version of the report published on 25 October 2022 at 11:16 AM (PDT)

Halliburton Company

HAL Details

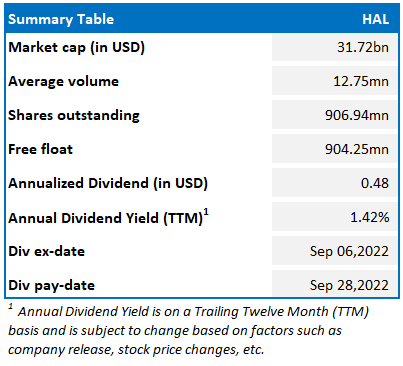

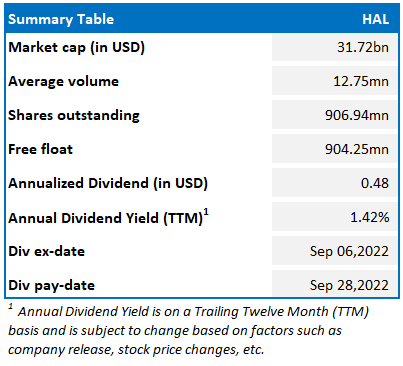

Halliburton Company (NYSE: HAL) provides products and services to the energy industry. The Company operates through two segments: the Completion and Production segment and the Drilling and Evaluation segment.

Financial Results for 3Q’FY22

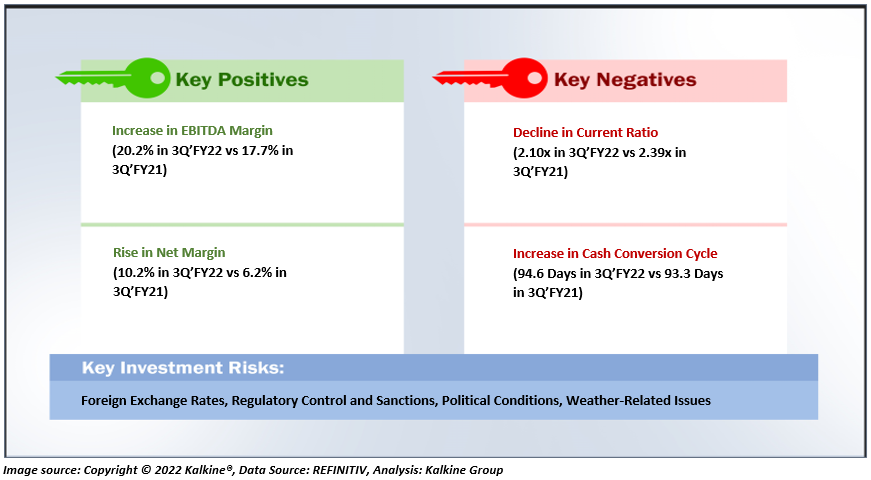

- The company reported growth in revenue by 6% QoQ to USD5,357 million (up 395 YoY), primarily driven by the rise in activity and pricing simultaneously in North American and International markets.

- International revenue stood at USD2.7 billion, up 3% QoQ. Latin America revenue was reported at $841 million, up 11% QoQ, due to a rise in construction and project management activity in Mexico and elevated fluids and project management activity in Suriname.

- Operating income increased by 18% QoQ with effective margin performance in Completion and Production as well as Drilling and Evaluation.

Outlook

The company is well-positioned to benefit from growth momentum in the industry. The company has an advanced technology portfolio, a wide geographic presence, and new service line opportunities to deliver profitable international growth. However, seasonally lower software sales in a few regions, the wind-down of business in Russia, a fall in drilling services in Norway, and decreased wireline services in the Gulf of Mexico could impact the growth momentum.

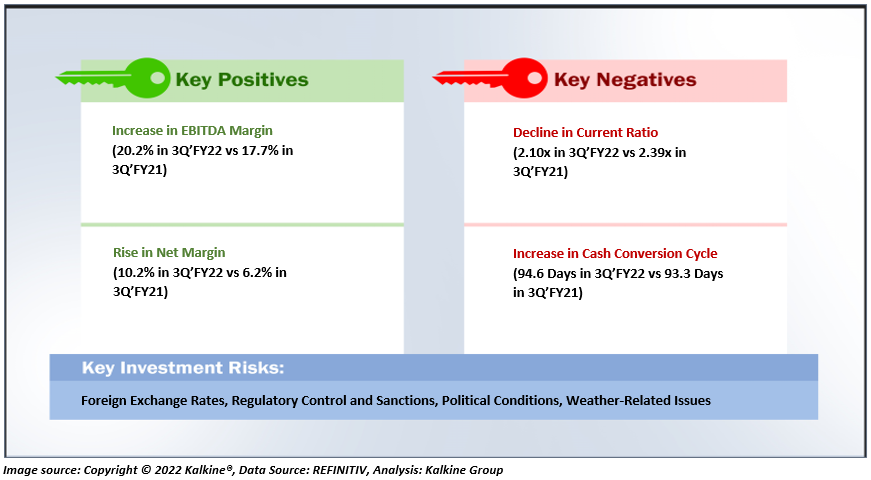

Key Risks

Most of the companies in the energy segment are exposed to international operations. Hence foreign exchange, unsettled political conditions, regulatory control and sanctions are the prime risk. Weather-related issues also affect the company’s operation. Delays or failures by customers to make payments could impact the company's liquidity position.

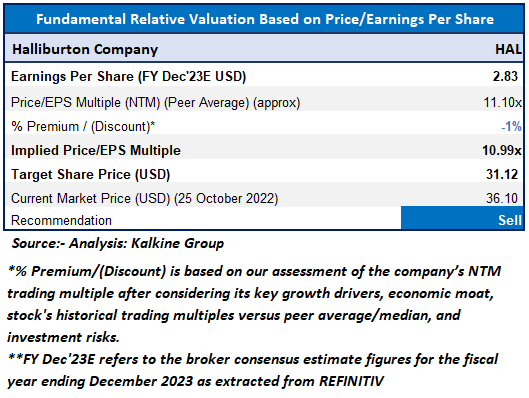

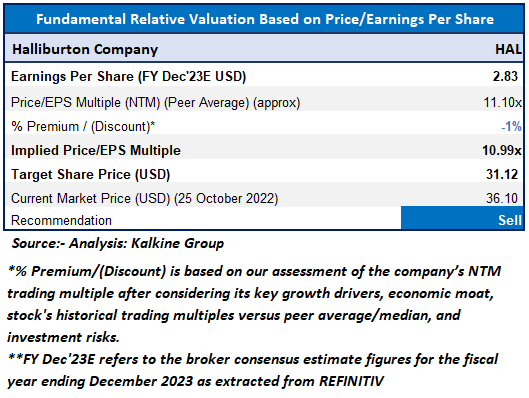

Valuation Methodology: Price /Earnings Per Share Based Relative Valuation (Illustrative)

Stock Recommendation

Over the last three months, the stock has given a return of ~24.75%.

The stock has been valued using P/E multiple-based illustrative relative valuation, and the target price so arrived reflects a fall of low double-digit (in % terms). A slight discount has been applied to P/E Multiple (NTM) (Peer Average), considering the marginal impact on business due to the wind-down of business in Russia and the fall in drilling services in Norway.

Considering the resistance, target level attainment, current trading levels, risks associated, and volatile market condition on the back of rising interest rates, a ‘Sell’ rating is assigned to the “HAL” at the current market price of USD 36.10 (as of 25 October 2022, at 07:25 AM PDT).

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Halliburton Company (HAL) is a part of Kalkine’s Global Green Energy Product

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for share price chart is based on October 25, 2022, and all other data such as stock price performance as of October 26, 2022. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine and its related entities do not hold interests in any of the securities or other financial products covered on the Kalkine website unless those persons comply with certain safeguards, procedures, and disclosures.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.

AU

Please wait processing your request...

Please wait processing your request...