This report is the updated version of the report uploaded on 2 February 2023 at 2:19 PM PST.

NXP Semiconductors N.V.

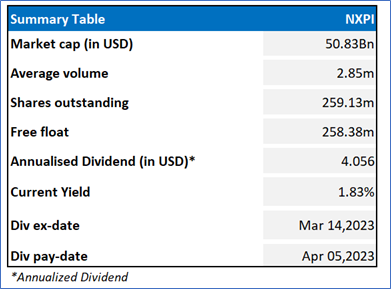

NXPI Details

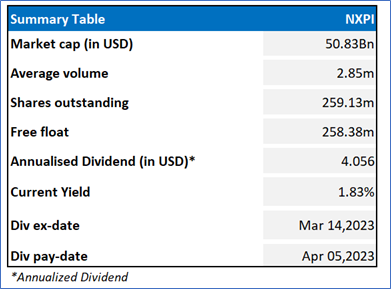

NXP Semiconductors N.V. (NASDAQ: NXPI) operates as a semiconductor company that provides mixed signal analog-digital and standard product solutions.

Financial Results

- The company posted full-year 2022 revenue of $13.21 Bn, reflecting an increase of 19% YoY, with revenue increasing throughout all of the focus end-markets. In Q4, revenue amounted to $3.31 Bn, reflecting a rise of 9% YoY, in line with the mid-point of the guidance range.

- In review, 2022 was a good year for the company, with robust execution resulting in record revenue, solid profit growth as well as healthy free cash flow generation.

- From the end-market perspective, the company’s automotive business performed very well.

Outlook

With respect to the guidance for the Q1 FY 2023, on the GAAP basis, total revenue is expected between $2,900 Mn- $3,100 Mn and gross profit is expected to be between $1,634 Mn- $1,780 Mn.

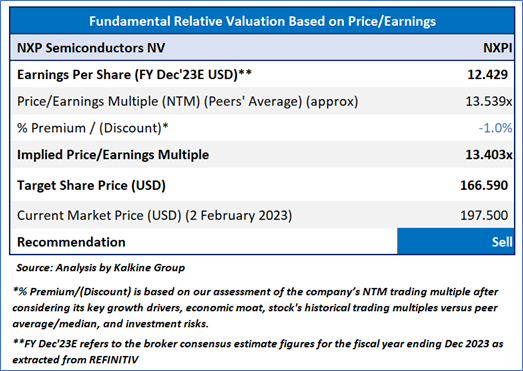

Fundamental Valuation

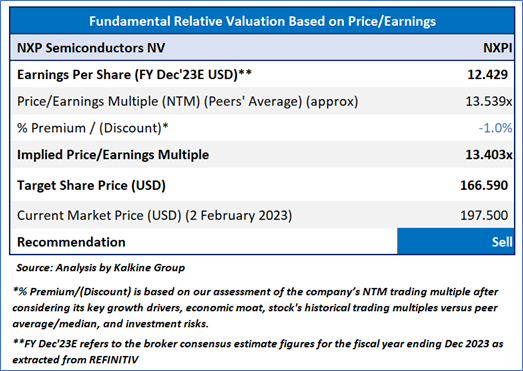

P/E Multiple Based Relative Valuation

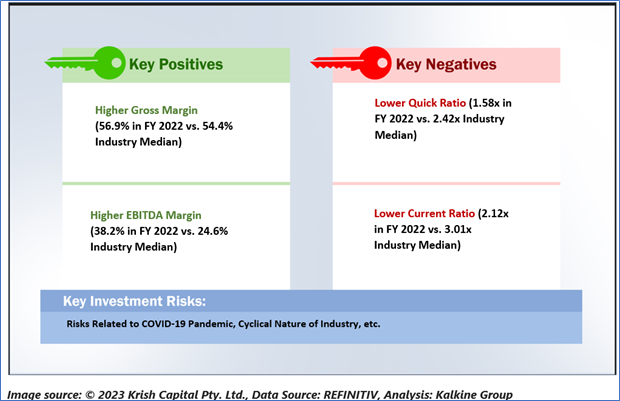

Key Risks

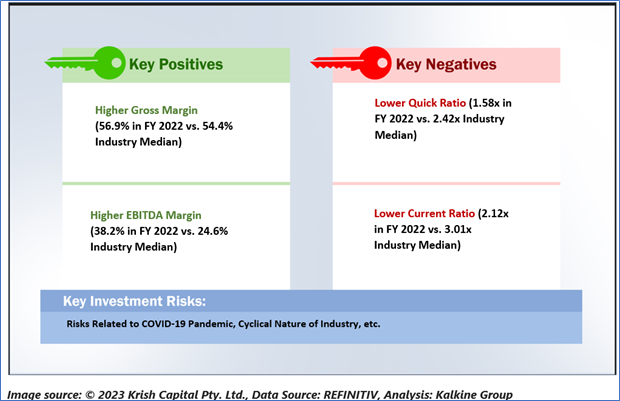

The company is exposed to the risks related to the COVID-19 pandemic. Also, the semiconductor industry is highly cyclical.

Stock Recommendation

The stock has been valued using Price/EPS multiple based relative valuation (on an illustrative basis) and the target price so arrived reflects a decline of low double-digit (in % terms). A slight discount has been applied to Price/EPS Multiple (NTM) (Peer Average) (approx) considering risks associated as well as the cyclical nature of the company. Also, significantly increased volatility as well as instability and unfavorable economic conditions could affect the business.

Resultantly, it is prudent to liquidate the stock at the current levels.

Hence, a ‘Sell’ rating has been provided on the stock at the current price of USD 197.50 (as of February 02, 2023, at 10:40 AM PST).

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on February 2, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.

AU

Please wait processing your request...

Please wait processing your request...