Bank of Queensland (Expensive)

Bank of Queensland (ASX: BOQ) is undergoing a turmoil given the heightened uncertainties with respect to its wobbling growth strategies owing to leadership changes and the awaiting judgment from the Brisbane Federal Court over ASIC’s unregistered managed investment scheme proceedings in respect of Storm Financial. A critical judgment could bring upon claims against the bank over a period of time.

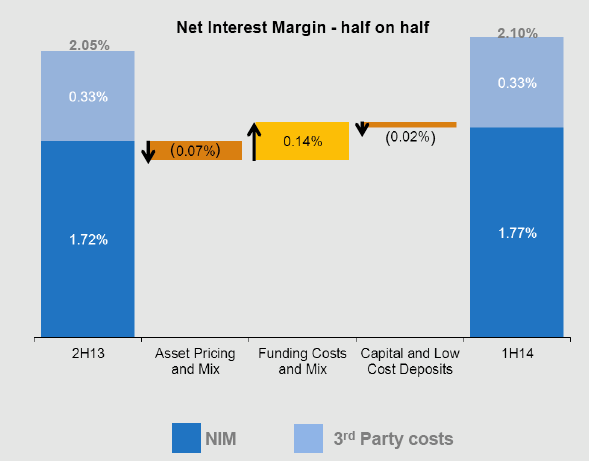

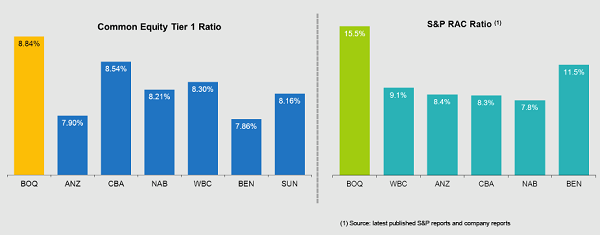

Looking at the net interest margin, we see a strong 5bps improvement on 2H13 alongside the tailwinds of rating upgrades reducing the wholesale costs; and deposit pricing adjustments with lower lending growth. However, this is accompanied by high margin asset run-off, lending front-book pricing competition and low interest rate environment.

Net Interest Margin (Source – Company Reports)

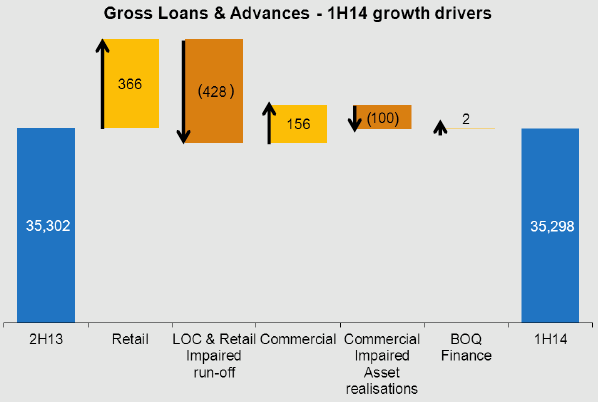

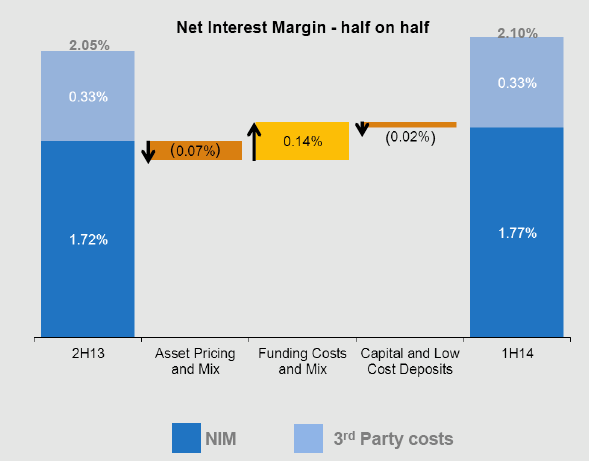

BOQ has also reported that it is now focusing on improving the book quality. Line of Credit (LOC) run-off is still high as portfolio re-weighting continues. There are other strings attached to this as well, including but not limited to Queensland’s (QLD’s) continued underperformance on national system growth.

Gross Loans & Advances (Source – Company Reports)

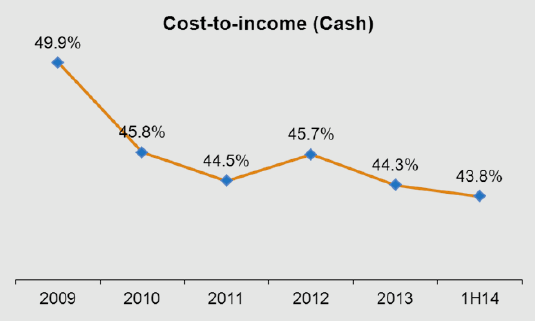

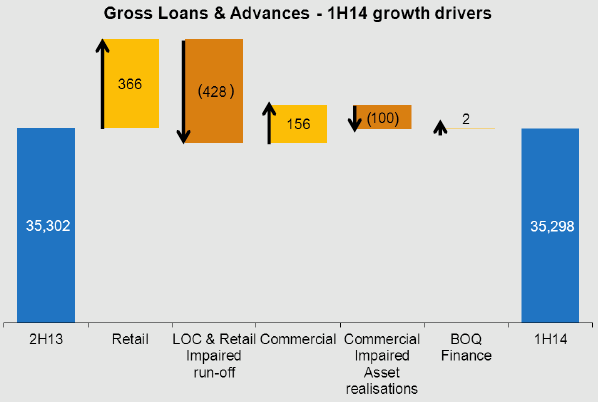

On the other hand, the cost-to-income profile for BOQ appears to underscore the reinvestment stratum for its growth plan. Savings have been harvested in Procurement ($3.6m), Property & service rationalization ($0.8m), and Corporate network restructuring ($1.1m).

Cost to Income (Source – Company Reports)

For 1H14, BOQ reported statutory net profit after tax of $134.7m, 34% increase from $100.5m of 1H13; cash earnings after tax of $140.2m, 17% increase from $119.9m of 1H13; return on average tangible equity (cash) of 13.2% from 11.6% of 1H13; and ordinary dividend of 32¢ from 28¢ of 1H13 [

Source: Results presentation for the half year ended 28th Feb 2014].

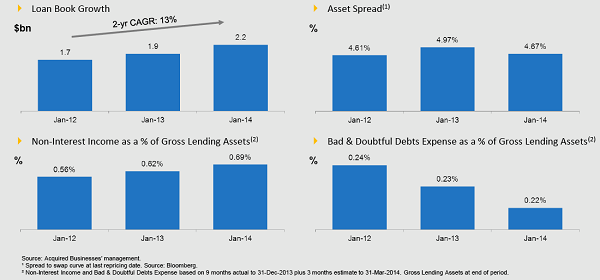

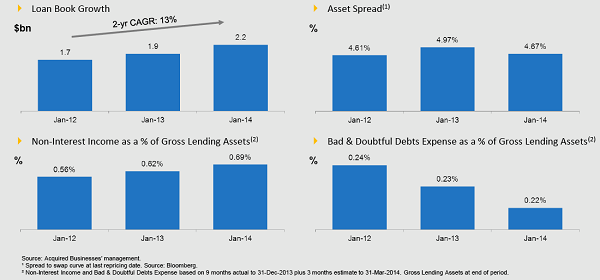

Loan Book Growth (Source - Company Reports)

Moving back a little, we see that the bank recorded revenues of ~A$860.6 million in the fiscal year ending Aug 2013, an increase of 6.4% over 2012. Its operating profit was A$275.8 million in comparison to an operating loss of A$19.3 million in 2012. The net profit was A$185.8 million in comparison to the net loss of A$17.1 million in 2012. However, BOQ reported sales of A$2.46 billion for the fiscal year ending Aug 2013, indicating a 10.6% decrease in comparison to 2012. As of Aug 2013, its long-term debt was A$1.31 billion and total liabilities were A$39.61 billion. BOQ has also lately stated that it is taking a closely controlled approach by not buying market share in view of the low credit growth environment.

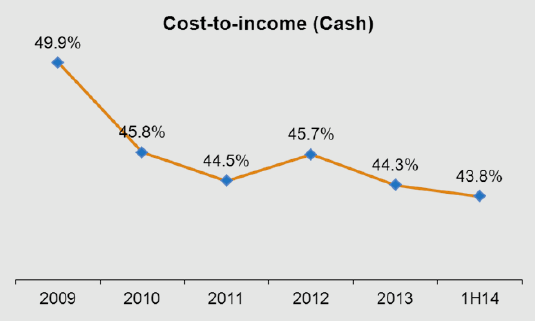

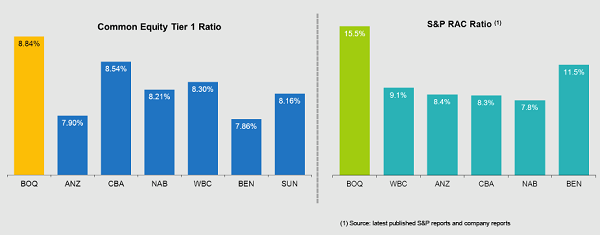

Investigations reveal that BOQ is well-capitalized vis-à-vis its peers.

Common Equity (Source - Company Reports)

Its stock has increased in its value during the last 3 fiscal years. The stock was up 28.8% to A$12.73 for the 52 weeks ending 5

th Sep 2014. The bank is trading at 1.69 times its sales; and 1.45 times book value with a market capitalization of A$4.16 billion.

A recent announcement by the bank highlighted its determination of dividend for Convertible Preference Shares of $2.7469 per share or a total dividend of $8.2407m to be paid for the period from and including 15

th Apr 2014 to but excluding 15

th Oct 2014 (

Dividend Rate of 5.4787 per cent per annum). BOQ has paid a dividend for 6 straight years. During the 12-month period ending 28

th Feb 2014, the bank reported earnings of A$0.66 per share; indicating 93.9% of its profits being paid as dividends.

BOQ Daily Chart (Source - Company Reports)

In spite of the fact that BOQ appears to be on track to report FY14 cash profit of $298m above earlier forecast of $292m, BOQ faces few challenges from the external market, economic volatility, and risk-oriented factors such as natural disasters and tourism. Moreover, there exists an upheaval for finance approvals in QLD, which in a way affects bank’s activities. Although we expect BOQ to keep on delivering decent operating results in the long run, the returns may still be sub-par in consideration of the estimated cost of capital.

Additionally, the latest announcement on resignation of its CEO (

Stuart Grimshaw) leaves a question mark on BOQ’s growth strategy, which was under his purview. This brings a cause of concern for the pending integration of recent acquisitions in the overall growth strategy. For instance, BOQ has entered into an agreement to acquire Investec Bank (Australia) Limited's Professional Finance and Asset Finance, and Leasing Businesses, in Apr 2014. Another such example is the acquisition of Virgin Money (Australia), the Australian retail financial services arm of the Virgin Group, in Apr 2013.

Further, BOQ’s home-loan growth plan is under a mild storm; its housing-loan book increased 0.4% compared with system growth of 6.7% (

Publication by the Australian Prudential Regulation Authority for the 12 months to 31st May 2014), the growth still appears to be stumpy. We thus believe that the stock is expensive at the current price in view of BOQ’s struggle in maintaining a competitive edge, asset quality and bad debt provisioning. We would review the stock at a later date.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.

Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).

The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.

Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.

The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide.

AU

Please wait processing your request...

Please wait processing your request...