Kalkine has a fully transformed New Avatar.

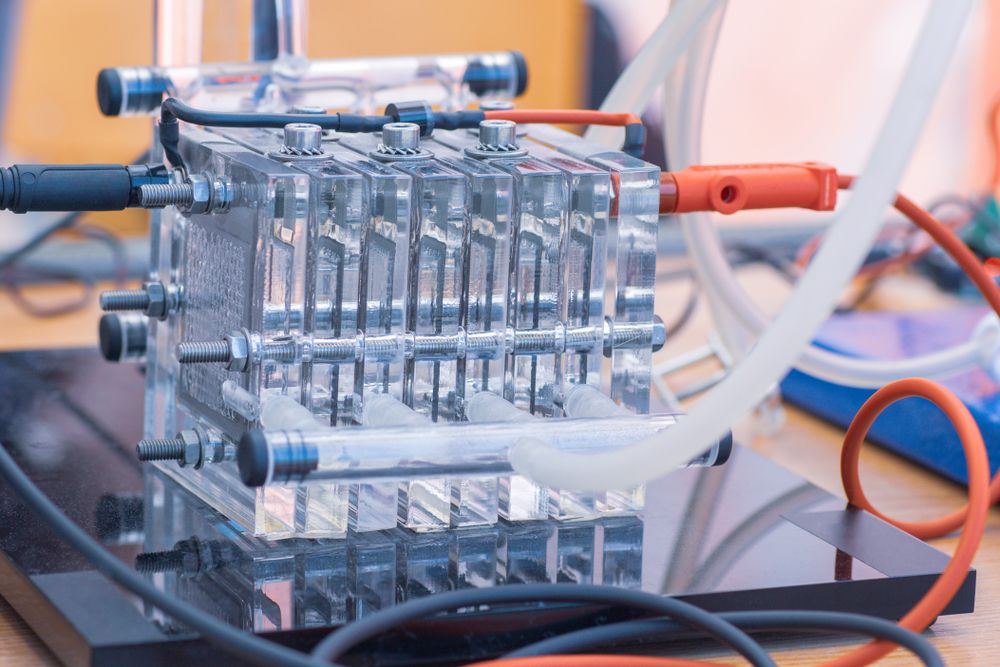

FuelCell Energy Inc

FuelCell Energy Inc (NASDAQ: FCEL) is engaged in the manufacturing and selling of fuel cell products that convert chemical energy into electricity.

Investment Rationale – WATCH at USD 6.23

One Year Share Price Chart

(Data Source: Refinitiv, Analysis by Kalkine Group)

Conclusion

Based on the weak fundamentals and unfavourable technical indicators, we have given a “WATCH” recommendation on FuelCell Energy Inc at the closing market price of USD 6.23 (as on 25 August 2021). However, if the clients already have this stock in their portfolio, they can look for booking profit (if bought at lower level) or hold it as per their own analysis and risk/return trade-off strategy.

eGain Corporation

eGain Corporation (NASDAQ: EGAN) deals with innovative Software as a service (SaaS) platform powered by deep digital, Artificial intelligence (AI), and knowledge capabilities.

On 01 September 2021, EGAN will release full-year FY21 results

Investment Rationale – HOLD at USD 11.27

One Year Share Price Chart

(Data Source: Refinitiv, Analysis by Kalkine Group)

Conclusion

Based on the robust revenue guidance and consistent profit-making nature of the Company, we have given a “HOLD” recommendation on eGain Corporation at the closing market price of USD 11.27 (as on 25 August 2021).

Beam Global

Beam Global (NASDAQ: BEEM) produces sustainable technology for the electric vehicles.

Investment Rationale – HOLD at USD 27.94

One Year Share Price Chart

(Data Source: Refinitiv, Analysis by Kalkine Group)

Conclusion

Based on the increase in the sales pipeline and favourable technical indicators, we have given a “HOLD” recommendation on Beam Global at the closing market price of USD 27.94 (as on 25 August 2021).

ADMA Biologics, Inc

ADMA Biologics Inc (NASDAQ: ADMA) is the end-to-end commercial biopharmaceutical company engaged in the development of plasma-derived biologics for the treatment of immunodeficient patients.

Investment Rationale – WATCH at USD 1.39

One Year Share Price Chart

(Data Source: Refinitiv, Analysis by Kalkine Group)

Conclusion

Based on the loss-making nature of the Company and unfavourable technical indicators, we have given a “WATCH” recommendation on ADMA Biologics, Inc at the closing market price of USD 1.39 (as on 25 August 2021). However, if the clients already have this stock in their portfolio, they can look for booking profit (if bought at lower level) or hold it as per their own analysis and risk/return trade-off strategy.

Diffusion Pharmaceuticals Inc

Diffusion Pharmaceuticals Inc (NASDAQ: DFFN) is an innovative biopharmaceutical company focused on the treatment of acute shortage of oxygen. Moreover, the lead product candidate is not commercialized yet.

Investment Rationale – AVOID at USD 0.52

One Year Share Price Chart

(Data Source: Refinitiv, Analysis by Kalkine Group)

Conclusion

Based on the weak fundamentals and negligible revenue, we have given an “AVOID” recommendation on Diffusion Pharmaceuticals Inc at the closing market price of USD 0.52 (as on 25 August 2021). However, if the clients already have this stock in their portfolio, they can look for booking profit (if bought at lower level) or hold it as per their own analysis and risk/return trade-off strategy.

*The reference data in this report has been partly sourced from REFINITIV.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine and its related entities do not hold interests in any of the securities or other financial products covered on the Kalkine website.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.