Computershare Ltd

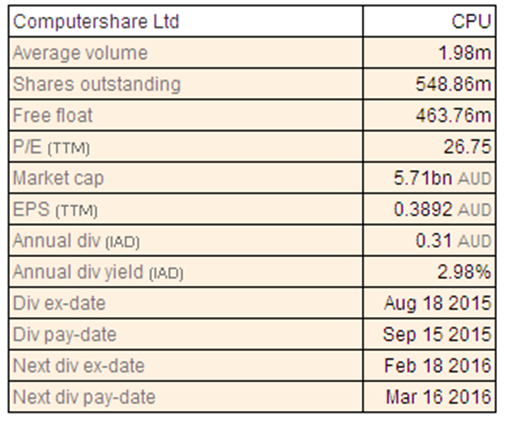

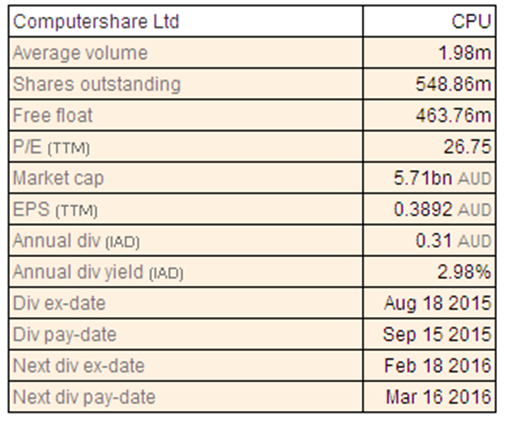

CPU Dividend Details

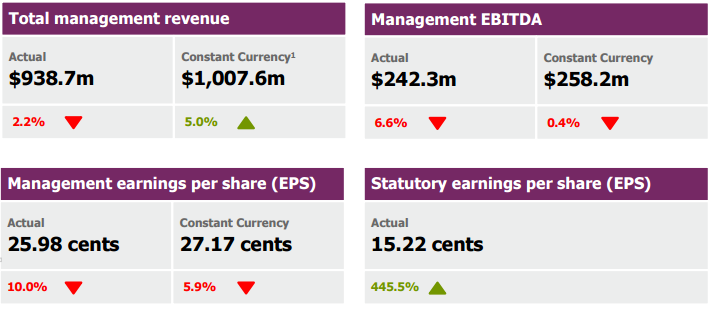

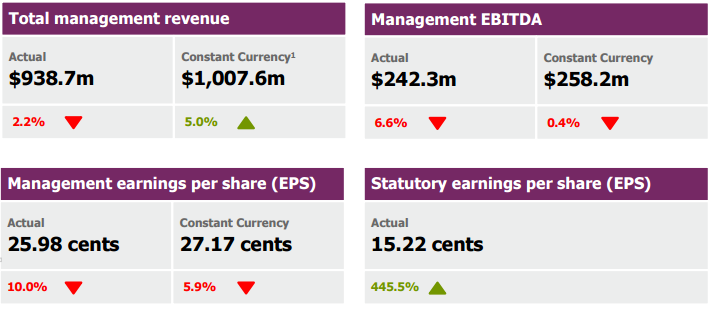

Profit drop but strengthening core operations via acquisitions: Computershare Ltd (ASX: CPU) reported a 10.5% drop in its 1H16 underlying NPAT of US$143.8m over the prior corresponding period (pcp) while EBITDA declined 6.6% (US$242.3m) over pcp. Further, revenue decline was about 2.2%. The statutory earnings per share jumped 445.5% on pcp. The company did warn about softening in operating environment with regards to FY16 outlook and mentioned that management EPS would be 7.5% lower than that of FY15. On the other hand, CPU is set to acquire Capital Markets Cooperative which has >200 originator clients and a collective annual loan origination of greater than $100 billion. The group is considering an acquisition price of USD 71.2 million and with this acquisition, CPU intends to further strengthen its US mortgage servicing presence.

HY16 Performance (Source: Company Reports)

The group also was chosen as the preferred supplier to carry out the mortgage servicing activities of UK Asset Resolution Limited (UKAR). This is a seven-year contract which involves around £30bn of assets under management. On the other hand, we believe that CPU shares are trading at expensive levels with a relatively higher P/E. The group also has a lower dividend yield. The stock has already corrected over 19.19% (as of February 10, 2016) in the last six months and we believe the negative momentum in the stock would continue in the coming months. A

ccordingly, we give an “Expensive” recommendation on the stock at the current price, and would review the stock at a later date.

CPU Daily Chart (Source: Thomson Reuters)

Qube Holdings Ltd

.png)

QUB Dividend Details

Revised proposal for Asciano: Qube Holdings Ltd (ASX: QUB) along with GIP, CPPIB and CIC Capital (Consortium) recently offered a proposal to acquire the entire stake at Asciano, as a part of Qube’s strategy to become a major provider of integrated logistics solutions in Australia by concentrating on import and export supply chains.

.png)

Qube’s estimated synergies via Asciano’s acquisition (Source: Company Reports)

Based on the revised proposal, Asciano shareholders would get A$7.04 cash and 1 Qube share for every Asciano share held. In fact, Asciano has determined that QUB’s revised proposal is superior to that offered by Brookfield. The shares of Qube delivered an outstanding performance and rallied over 57.25% (as of February 10, 2016) in the last five years driven by its strong performance and core business growth. However, Qube shares have been correcting by 13.45% since the last one year (as of February 10, 2016) as the stock is trading at higher valuations with a high P/E and low dividend yield. We thus believe that the stock is “Expensive” at the current price.

QUB Daily Chart (Source: Thomson Reuters)

Bank of Queensland Ltd

.png)

BOQ Dividend Details

Focusing on niche business and customer satisfaction: Bank of Queensland Ltd (ASX: BOQ) stock corrected over 19.41% in the last six months and by 21.19% during this year to date (as of February 10, 2016) impacted by the rising competitive pricing coupled with decreasing interest rates impact on margins. However, despite the tough market conditions, BOQ managed to deliver a cash net interest margin improvement by 15 basis points to 1.97% during 2015 fiscal year, driven by better BOQ Specialist business. Accordingly, the group continues to focus on its high margin businesses like BOQ Finance and BOQ Specialist. Bank of Queensland also enhanced its Net Promoter Score to 30.5 in 2015 as compared to less than zero in early 2013, and way ahead of the major banks average of 0.5. BOQ also intends to spend $15.0 million in FY16 towards reshaping its organizational structure to better affect the group’s strategy and to be at par with competitors. This is believed to help move towards cost to income ratio in the low 40% range. The bank is launching Virgin Money mortgage product via its broker channel during the first quarter of 2016. BOQ also continues to focus on expanding distribution channels of Retail Bank, by increasing accredited brokers to 4,000 from 2,500.

.png)

Capital adequacy as of November 2015 (Source: Company Reports)

Management reported that the outlook for margins is also improving as compared to over a year ago. Variable mortgage repricing led to a better net interest margins which would contribute to the bank’s earnings during 2016. Meanwhile, BOQ is also trading at a reasonable P/E and has a solid dividend yield. Accordingly, we give a “BUY” recommendation on the stock at the current price of $10.81

.PNG)

BOQ Daily Chart (Source: Thomson Reuters)

Telstra Corporation Ltd

.png)

TLS Dividend Details

Entered into an MOU with NBN network: Telstra Corporation Ltd (ASX: TLS) entered into a Memorandum of Understanding (MoU) with NBN network to offer design, engineering, procurement and construction management for NBN via the group’s HFC footprint. The group already got two new contracts from NBN which are estimated to generate a first year revenue of over $80m based on the volume of work. This deal with NBN boosted the shares of TLS by over 3.63% in the last three months (as of February 10, 2016). However, the increasing consolidation of the smaller players might hurt the group’s potential growth prospects going forward. Moreover, management estimates only a low single digit EBITDA growth in FY16. We thus put an “Expensive” recommendation on this dividend stock at the current price.

.PNG)

TLS Daily Chart (Source: Thomson Reuters)

Aurizon Holdings Ltd

.png)

AZJ Dividend Details

Strong dividend yield: Aurizon Holdings Ltd (ASX: AZJ) shares plunged over 25.15% (as of February 10, 2016) in the last three months impacted by the ongoing fall in commodity prices. AZJ also estimates a range of $215-240 million (before tax) of total non-cash impairment charge during the first half of 2016.

.png)

December quarter performance (Source: Company Reports)

On the other hand, AZJ is focusing on operation savings to offset its top line pressure and forecasts a further overall savings of around $310-$380 million during FY16 to FY18. Moreover, the heavy correction in the stock placed AZJ at a cheaper P/E. Aurizon Holdings also has a very strong dividend yield. The upcoming half year report ending December 2015 is also due and would reveal more insights. Overall, we believe that the stock has a potential to rise in long term and issue a “BUY” recommendation at the current price of $3.89

.PNG)

AZJ Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.PNG)

.png)

.PNG)

.png)

.png)

.PNG)

Please wait processing your request...

Please wait processing your request...