Boral Ltd

.png)

BLD Dividend Details

Housing market and cost reduction enables an upgraded rating: Moody's Investors Service has upgraded Boral Limited’s (ASX: BLD) issuer rating and senior unsecured rating to Baa2 from Baa3 and the outlook on this rating has been changed from positive to stable. Simultaneously, it has upgraded the commercial paper of Boral Limited, Boral Industries, Inc., Boral International Holdings, Inc. to P-2 from P-3 and upgraded the other short term rating of Boral Ltd to P-2 from P-3. It has also upgraded the senior unsecured MTN rating of Boral Limited to (P)Baa2 from (P)Baa3. Maurice O'Connell, a Moody’s Vice President and Senior Credit Officer says that the rationale for the rating upgrade is the sustained improvement in the credit profile of the company over the last two fiscal years. In particular, it has seen as a strengthening of the operating profile supported by the entrenched turnaround in the performance of the two financially weakest divisions Boral USA and Boral Building Products. Support from the improved levels of housing demand in Australia and the USA as well as meaningful cost reduction measures undertaken by the company have resulted in the improvement of underlying earnings.

.png)

FY15 Financial Results (Source: Company Reports)

At the same time it notes that the improved debt position because of the $ 500 million inflow from sale of its 50% stake in Boral Gypsum has been maintained despite a share buyback programme. An important part of the rating upgrade is the improvement in Boral USA which, after being a drag on earnings for four years, has delivered a positive EBIT of $ 6 million in FY 2015.

.png)

1Q FY16 Trading Update (Source: Company Reports)

The company has also recently announced that Karen Moses has been appointed as a non-executive Director of Boral Limited, effective 1 March 2016. We believe that recent efforts have paid off well and the metrics of the company have improved significantly but still consider the stock to be

overpriced in relation to its future prospects.

BLD Daily Chart (Source: Thomson Reuters)

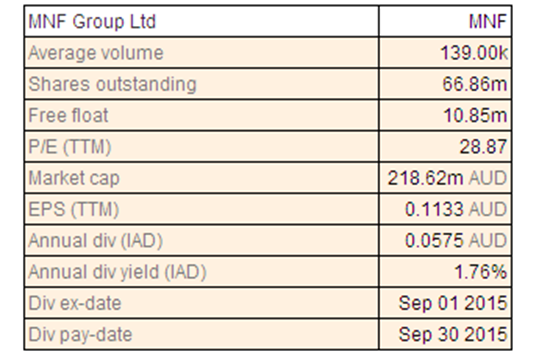

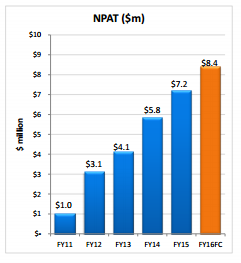

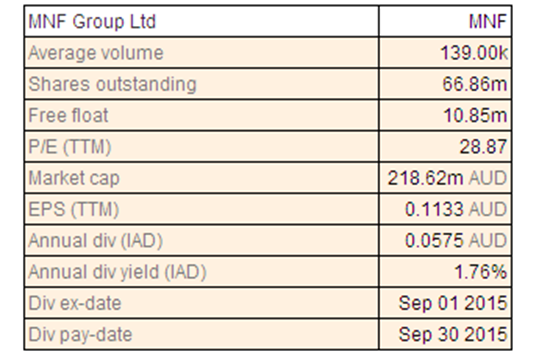

MNF Group Ltd

MNF Dividend Details

Strong result and positive forecast: In accordance with a special resolution passed at the Annual General Meeting, My Net Fone Limited, has changed its corporate name to MNF Group Ltd and the ASX code will remain MNF. The name change reflects the fact that the company is now a large and sophisticated group trading in global markets under multiple brand names. The Board of Directors believes that the new name, while recognising the heritage, also defines the diversity and the role of the parent company.

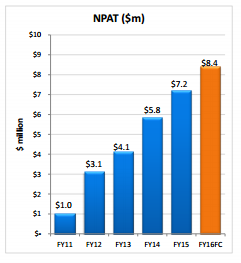

NPAT Growth (Source: Company Reports)

The highlights for FY 2015 reports of 44% growth in revenue to $ 85.7 million and a 31% growth in gross profit to $ 31.8 million. EBITDA grew by 35% to $ 12.2 million but EBITDA margin declined from 15.2% to 14.2%. Net profit after tax grew 24% to $ 7.2 million while EPS grew 24%. The dividend per share fully franked grew by 28% to 5.75 cents per share compared to 4.50 cents per share. The fully EBITDA was 9% ahead of the original guidance for FY 2015 and the results included three months contribution from TNZI. The underlying results also include acquisition costs of $ 0.3 million for the the TNZI transaction and the decline in EBITDA margin is a result of lower margin contributions from TNZI. Free cash flow was $ 5.8 million compared to $ 7.7 million in the previous year though operating cash flows were higher at $ 12.8 million compared to $ 10.1 million. Capital expenditure was higher because of the need to reengineer the domestic interconnect network and this would produce substantial operating synergies and increase the capacity.

Brands (Source: Company Reports)

The forecast for FY 2016 is a 42% increase in EBITDA to $ 17.3 million, net profit after tax up 17% to $ 8.4 million and EPS up 10% at 12.6 cents per share. Despite this forecast, we believe that the share is expensive considering the growth that is involved. The stock is trading at a high price to earnings ratio of 27.76x while the annual dividend yield is only 1.8%.

Accordingly, we put an Expensive recommendation for the stock at the current price.

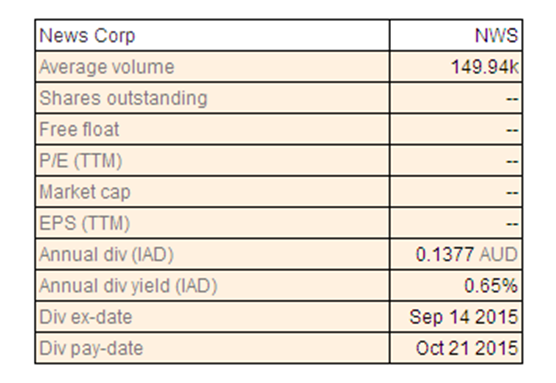

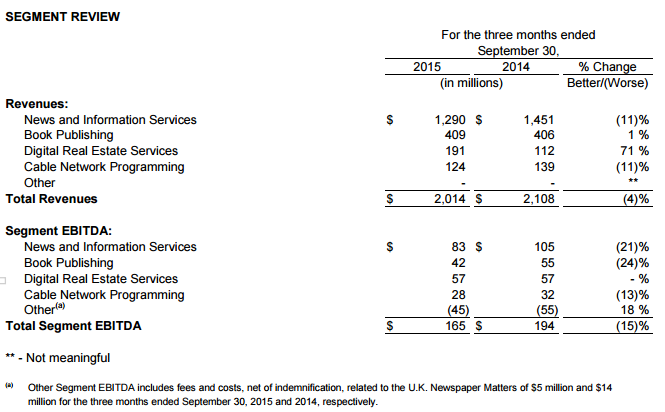

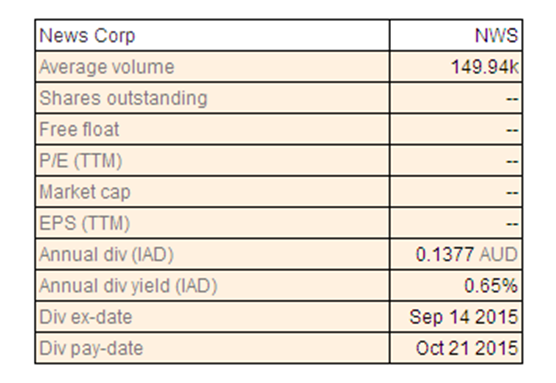

News Corp

NWS Dividend Details

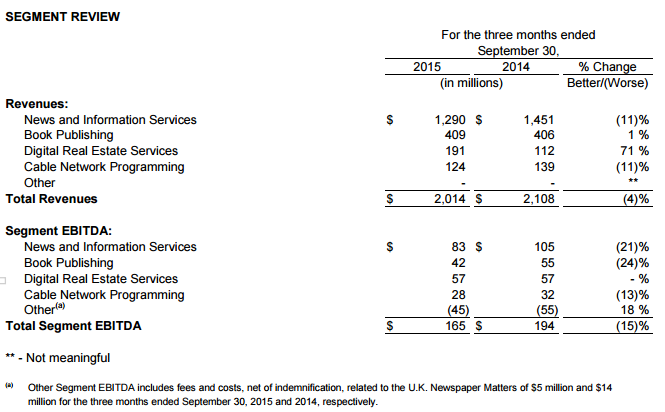

Industry headwinds pulling down: Results for the first quarter of FY 2016 highlighted softness in the key financial metrics for News Corp (ASX: NWS). Revenues were $ 2.01 billion compared to $ 2.11 billion in the previous year and total segment EBITDA was $ 165 million compared to $ 194 million in the previous year. Income from continuing operations was $ 143 million compared to $ 109 million and the reported EPS from continuing operations was 22 cents per share compared to 15 cents per share. Adjusted revenues declined by 1% because strong growth in the Digital Real Estate segment from REA Group Ltd was offset by lower advertising revenues in the News and Information Services segment. The figure for revenues included $ 85 million from the acquisition of Move Inc which was offset by unfavourable foreign currency fluctuations. This led to a total reported revenue reduction by $ 188 million compared to the previous year. The total segment EBITDA dropped by 15% to $ 165 million with respect to the previous year EBITDA. The adjusted total segment EBITDA declined by 7% as the continued strength in the Digital Real Estate Services and Cable Network Programming segments was affected by declines in the other segments including News America marketing and book publishing.

Result Overview (Source: Company Reports)

However, income from continuing operations was $ 143 million compared to $ 109 million in the previous year due to a tax benefit from the release of valuation allowances resulting from the planned disposal of the digital education business partly offset by other factors. To some extent, the decline in revenues reflect the challenges faced by the media industry as a whole. The company was spun off from the corporate parent so as not to be a drag on the parent and we do not see any potential improvement in the growth prospects. We believe that the decline will continue in the future and believe that the share is

expensive at the current price.

NWS Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...