With Amazon hype fading a bit, consumer discretionary stocks seem to be coming into limelight again. Below are six such stocks that have been into discussion these days from investment standpoint.

Woolworths Limited

.png)

WOW Details

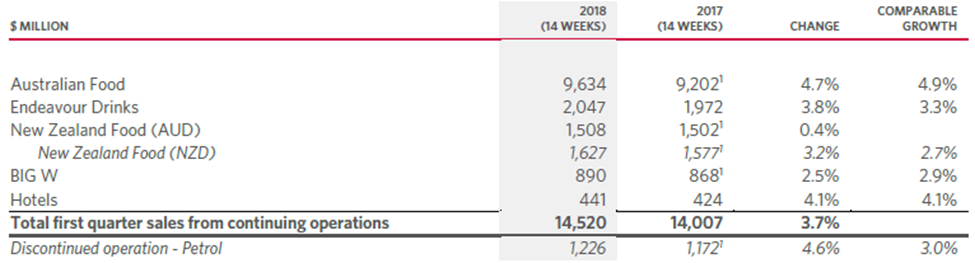

Turnaround to transformation:Woolworths Limited (ASX: WOW) has moved from turnaround to transformation and is tracking in line with the 3-5 years’ plan. In the first quarter of FY 18, the Australian Food business has posted 4.9% comparable sales growth, Endeavour Drinks posted 3.3% comparable sales growth and BIG W has posted 2.9% comparable sales growth. BIG W has reported positive comparable sales growth for the first time in a number of quarters. Moreover, in the first quarter, the overall customer satisfaction VOC score includes a weighting of 25% for Online, which shows the company’s focus on improving the online offer. With Amazon commencing its full-scale launch, WOW is taking a lot of initiatives so that they are able to retain their customers. Additionally, WOW recently combined the Digital and Rewards business to deliver on the customer need and called it WooliesX. The company, in FY18 till now, has rolled out Pick up for almost 1,000 Woolworths Supermarkets. Therefore, the customers can now choose to shop in-store, pick-up the product at the store or have it delivered to their homes.

First Quarter Sales Performance (source: Company Reports)

The company is also piloting Express Delivery. In FY17, the dividend had increased by 9.1% and the final dividend increased by 17 cents to 50 cents, which shows the strong cash flow generation during the year, improved trading performance in the second half and improved working capital across the group. On the other hand, ACCC has delayed consideration of BP’s acquisition of WOW’s service stations. Given the potential that WOW possesses, we put a “Buy” recommendation on the stock at the current price of $26.96

.png)

WOW Daily Chart (Source: Thomson Reuters)

JB Hi-Fi Limited

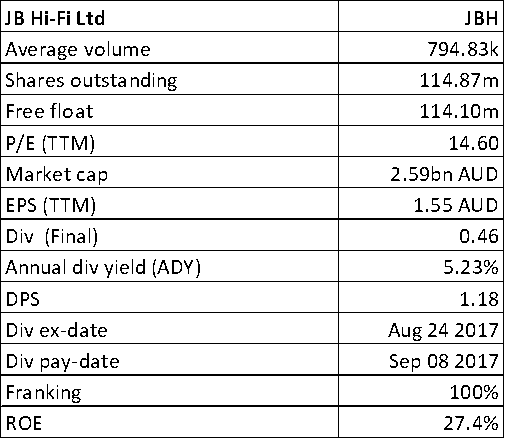

JBH Details

Sales growth moderated in September and October:JB Hi-Fi Limited (ASX: JBH) has posted 6.2% growth in the total sales year to date to October 22, 2017 compared to 14.3% growth in pcp, while the comparable sales grew 3.2% compared to 10% growth in pcp. For The Good Guys business, the total sales growth year to date was of 3.1%, with comparable sales growth of 2.4%. The sales growth had moderated in September and October due to the fact that JBH business cycled changes in the timing of key product releases and elevated comparable sales growth in the pcp. Moreover, JBH had reaffirmed the FY18 Group sales guidance of total sales of circa $6.8 billion (JB Hi-Fi $4.65 billion and The Good Guys $2.15 billion) and expects the market to remain competitive as the peers compete for market share in the lead up to the key Christmas trading period. As a result, JBH stock has fallen 6.58% in three months as on November 28, 2017; but with a growing sentiment on retail sector, the stock surged 3.8% on November 29, 2017. Considering some weakness, we give an “Expensive” recommendation at the current price of $23.43, while keeping a watch on catalysts for future.

.png)

JBH Daily Chart (Source: Thomson Reuters)

Harvey Norman Holdings Limited

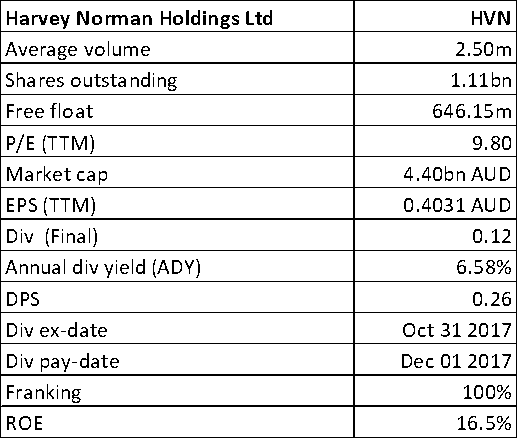

HVN Details

Growth in aggregated sales: Harvey Norman Holdings Limited (ASX: HVN) for the four-month ended October 31, 2017 reported for the aggregated amount of sales growth of 4.9% to $2.35 billion when compared to the growth of 3.4% in the corresponding period of 2016.

.png)

Aggregated Sales in Australian Dollars (Source: Company Reports)

Moreover, the aggregated sales were positively affected by a 1.9% appreciation in the Euro, and negatively affected by a 3.2% devaluation in the New Zealand dollar, a 2.2% devaluation in the UK Pound, a 3.5% devaluation in the Singaporean dollar and a 7.4% devaluation in the Malaysian Ringgit for the period, compared to the corresponding period of last year. On the other hand, the sales by franchisees in Australia are not made by HVN or controlled entities. Till we see some more positives with any capability of dominating in the prevailing challenging environment, we give an “Expensive” recommendation on the stock at the current price of $4.02

.png)

HVN Daily Chart (Source: Thomson Reuters)

Super Retail Group Ltd

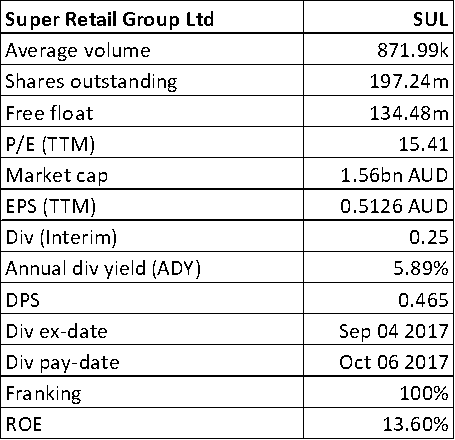

SUL Details

Sales up across all three retail segments:Super Retail Group Ltd (ASX: SUL) during the first 16 weeks of FY 2018 reported for better sales across all three of its retail segments despite the weak trading conditions. SUL expects the capital expenditure to be approximately $120 million for the year majorly for the store development, refurbishment program and Amart Sports store conversions to Rebel. Moreover, this financial year, SUL expect to open up to ten new stores in the Auto Division and refurbish up to 44 stores. In the Leisure Division, SUL expects to open three new BCF stores and one new Rays store; and in the Sports Division, the company expects to open three new Rebel stores. SUL had a positive start to the year with the businesses delivering profitable growth in line with the budget expectations. However, like for like sales growth has been slightly dampened due to the subdued consumer environment. Based on the scenario, we give a “Hold” recommendation on the stock at the current price of $8.04

.png)

SUL Daily Chart (Source: Thomson Reuters)

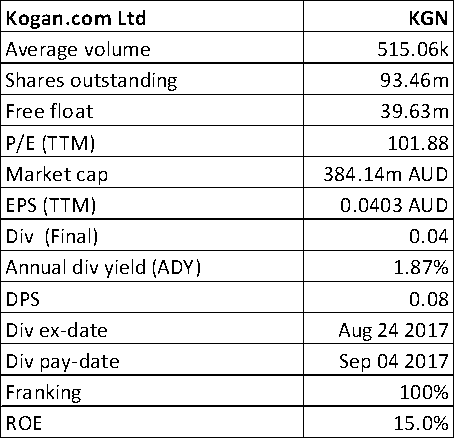

Kogan.com Ltd

KGN Details

Strong start in FY18: Kogan.com Ltd (ASX: KGN) gave a positive and strong outlook for FY 18 in the Annual General Meeting. KGN would extend the partnership with Vodafone in order to launch Kogan Internet in the second half of FY18 and scale-up into FY19. KGN also announced for an expanded partnership with Vodafone to offer fixed-line NBN plans from 2018. The NBN is a major opportunity for KGN as current NBN activations are of 2 million premises, which are not even a third of the projected 7.6 million activations by 2020. Moreover, KGN has partnered with leading global insurer Hollard to offer value for money insurance products through Kogan Insurance and is targeting the $30.8 billion Australian insurance market. Further, KGN has a strong start in FY 18, and is expecting the revenue growth of 35.9% and EBITDA growth of 37.7%, when compared to the corresponding period last year. KGN in FY 18 till the end of October from July has revenue growth of 36.2%, gross margin of 18.4% and EBITDA growth against prior year’s pro-forma EBITDA of 58.3%. The numbers show an increase in the year-to-date growth trend, after a strong trading performance in October. As a result, KGN stock has risen 32.58% in three months as on November 28, 2017. Based on the already high run-up and price to earnings scenario, we give a “Hold” recommendation on the stock at the current price of $4.24

.png)

KGN Daily Chart (Source: Thomson Reuters)

Myer Holdings Limited

.png)

MYR Details

Q2 18 does not look very different from Q1 18: Myer’s (ASX: MYR) stock rose over 4.2% on November 29, 2017 with some sector-driven positive sentiment that has been building up lately. On the other hand, the group at its AGM, updated that it has not seen any improvement in trading in Q2 till date compared to Q1 18. In Q1, Myer reported for a LFL sales drop of 2.1%. The group does not see any underlying change to the challenging conditions experienced in Q1. The group also revised its strategy targets but is still running below expectations. While support may come in from potential corporate activity, we maintain a “Hold” on the stock at the current price of $0.74

.png)

MYR Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.