Kalkine has a fully transformed New Avatar.

Origin Energy Ltd (ASX: ORG)

.png)

ORG Details

Efforts on long-term goal of net zero emissions: Origin seems to be positioned well with various levers (such as improved credit metrics, LNG scenario) in place for achieving its FY18 earnings guidance. Recently, AWE announced that ORG has entered into a new gas sales agreement with the Operator of the Casino Henry Joint Venture and Cooper Energy. Origin Energy will purchase 100% of the joint venture’s production which will be processed under a new agreement with Lochard Energy at the Iona Gas Plant for a matching period. Total Production from the field for the financial year to date has averaged approximately 36 terajoules per day. Output is expected to increase following the completion of the workover of the Casino-5 well which is scheduled for February 2018. It is also planning for the drilling of a well in 2019 to bring undeveloped gas in the Henry field to the market. The ten-month term of the new agreement was selected to align the supply agreements with the calendar year contract and to preserve optionality for optimal contracting at a higher gas volume for 2019. Lately, Cooper Energy also announced that the Casino Henry Joint Venture has signed a new gas sales agreement with the Origin Energy Retail Limited for supply from 1 March 2018 to 31 December 2018 and this new agreement at the current market gas prices replaces the existing supply agreement with Energy Australia which will expire on 28 February 2018 and has been in operation since the Casino gas field commenced supply in February 2006. BlackRock Group has become one of the substantial holder of Origin Energy Ltd since 19 December 2017 by holding 88,098,801 shares.

.png)

Target Capital Structure (Source: Company Reports)

ORG also announced that all the conditions which are subject to the sale of its conventional upstream oil and gas business, Lattice Energy, to Beach Energy have been satisfied. The sale is planned to be completed by 31 January 2018 and Origin will continue to recognise its earnings from Lattice Energy till 31 January 2018. Origin also committed a 50% reduction in the carbon emissions by 2032 and becomes Australian first company to have science-based targets which is recognised by global We Mean Business (WMB) initiative. It’s joint venture at Cooper Basin also commenced successfully which was followed by a successful gas exploration at Western Flank at Naiko-1. ORG’s return on capital employed increased to 6% from 2.9% from last year while capital expenditure decreased to a great extent following the completion of development projects across Otway Bass and Cooper basins. Origin has a lot of more work to be done to improve the returns to the shareholders after the collapse of the oil prices in 2014-2015 which had cut the profits and dividends and inflated debt. Origin is aiming for $500 million a year in capex and cost reductions within 18 months as it moves to operate the project more efficiently after ramping it up to full production and is aiming at a stable BBB credit rating so that the balance sheet is resilient to the fluctuating commodity prices. As far as the stock performance is concerned, the stock prices increased by 37.7% in the past six months and firmer oil prices enable ORG to poise for further momentum. Looking at the overall performance, we recommend to “Hold” the stock at the current price of $9.53

.png)

ORG Daily Chart (Source: Thomson Reuters)

Fastbrick Robotics Ltd (ASX: FBR)

.png)

FBR Details

Transition of Industrial Robotics from controlled factory environment to uncontrolled outdoor environment: Fastbrick is developing robotic solutions for industry sectors which are susceptible to disruption. Its initial focus is to disrupt the construction sector with digital construction products. Its first product is the revolutionary Hadrian X construction robot which is globally patented 3D robotic bricklaying system. Hadrian X is enabled by the Company’s Dynamic Stabilisation Technology which now allows the revolutionary transition of industrial robotics from controlled factory environments to uncontrolled outdoor working environments. Hadrian X will initially target USD$1.3 trillion “Brick & Block” sector. Caterpillar is the Fastbrick’s preferred global partner and also FBR is targeting to discover and harvest early adopters in the key markets. Post IPO, FBR achieved few milestones like it launched a proprietary CAD software and also Hadrian X became operational. It also strengthened its Leadership Team by appointing Mr Aidan Flynn as its CFO and he has 20 years of corporate experience. The group also received a tax rebate of $972,622 from the Australian Tax Office (ATO) through the R&D Tax Incentive program which is jointly run by the Department of Innovation and Science and the ATO.

.png)

2018 Milestones (Source: Company Reports)

As Fastbrick moves into 2018, the Hadrian X development programme will continue to accelerate, as they complete the machine assembly and undertake the associated testing. It is developing a robotic truck which aims to build brick walls and Hadrian X robot will apparently be able to build a wall in a few hours that otherwise would take a team of labours hours a day. In past six months, the share prices increased by 56% approximately but lost about 7% in last five days. We would recommend waiting for further positive catalysts regarding its Hadrian X development programme, and put an “Expensive” recommendation at the current price of $0.205

FBR Daily Chart (Source: Thomson Reuters)

Auckland International Airport Ltd (ASX: AIA)

.png)

AIA Details

Expecting rapid growth: Auckland International Airport announced completion of a strategic review of their 24.55% stake in North Queensland Airport which confirms that it will remain a highly attractive asset but not integral to the current business strategy. There were few possible outcomes from the holding of this stake entailing selling of the stake to shareholders in accordance with the security holders agreement and selling to a third party in accordance with the security holder agreement. Its recent regulatory disclosure reflected that it is focused on providing great outcomes for its customers and is consistent with the purpose of legislation. Its financial disclosure demonstrates that over the past five years the group has adopted to the changing market conditions and created the right balance between investing to support the sustainable tourism growth in a changing and dynamic market, and delivering a capital investment programme that responds to demand and meeting the customer expectations. It also confirms that the current airport regulatory regime is working to provide the transparency in relation to the real benefits Auckland Airport is delivering for its airline customers, passengers, investors.

AIA’s overall return for the past five financial years was 8.5% which is close to the target return which was set in 2012, despite of the material changes between the pricing forecasts and the actual outcomes for a number of pricing elements. The changes in the prices event which is called as PSE2 was leaded by the combination of new airlines, new routes and new capacity which generated rapid growth. It leads to an increase in the destination choice and price competition for passengers. It also increased the traffic on the domestic network and allowed to spread the future cost of providing aeronautical services over more demand when the prices are reset as they were recently for FY18-22. Overall during PSE2 the capital expenditure has been 80% higher than the expected at the time of pricing which is a clear step of delivering the Airport of the future. There were few achievements like international passengers increasing by 11% from the previous year. AIA also progressed to plan and to convert Taxiway Alpha into a flexible contingent runway. AIA recently announced the appointment of Andre Lovatt as its new general manager of airport development and delivery. However, compared to its peers, the stock seems to trade at higher levels and looks ‘Overvalued’ at the current price of $6.02

AIA Daily Chart (Source: Thomson Reuters)

DuluxGroup Ltd (ASX: DLX)

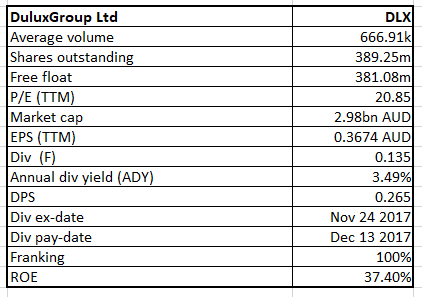

DLX Details

Positive Outlook for 2018: DGL Camel International which is a DuluxGroup’s 51% owned joint venture company has entered into an agreement to sell most of its coatings portfolio in Hong Kong and Mainland China to Yip’s Chemical Holdings Limited. The EBIT till the sale transaction for Hong Kong and China for FY18 is expected to be in line with FY17. The group reported for a 9.6% increase in FY17 net profit to $142.9m with a $3.1m write-back of a tax provision established in previous years. Sales revenue was up 4.0% to $1.78bn and final dividend of 13.5 cps, fully franked, led the full year dividend growth to be about 10.4% over FY16. Its other Australian and New Zealand segments including Selleys & Parchem, B&D Group and Lincoln Sentry delivered strongly and grew profit by $8.2m or 14.1%. During the year, DLX continued to focus on the profitable market share growth in these businesses which accounted for 70% of the group sales and more than 80% of the total EBIT of the group. Overall in 2018, conditions will be positive for DuluxGroup and the strong consumer demand for both retail and trade projects is expected to continue. It expects the overall net profit after tax in FY18 to be higher than FY17. With the group touching high levels with growth catalysts already factored in, we give an “Expensive” recommendation at the current price of $7.60

.png)

DLX Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.