Vista Gold Corp

Vista Gold Corp. (NYSE: VGZ) is a development stage company, which is engaged in the gold mining industry. The Company is focused on acquisition, exploration and advancement of gold exploration and potential development projects. The Company’s flagship asset is the Mt Todd gold project (the Project) in Northern Territory, Australia (the NT).

Recent Business and Financial Updates

- Vista Gold Corp. Hires Director, Projects and Technical Services: On June 18, 2024, Vista Gold Corp announced the appointment of Maria Vallejo Garcia as Director of Projects and Technical Services. Ms. Vallejo, an accomplished mining professional with extensive experience in mineral economics and mining engineering, will succeed John Rozelle, who retired on December 31, 2023. Frederick H. Earnest, President and CEO of Vista Gold, expressed confidence in Ms. Vallejo's ability to advance the company's strategic initiatives at the Mt Todd project. He also acknowledged Mr. Rozelle's significant contributions to the company's technical studies and wished him well in retirement.

- Strategic Focus and Operational Highlights: Frederick H. Earnest, President and CEO of Vista, highlighted the company's 2024 objectives: strengthening the balance sheet, advancing the Mt Todd project with an initially smaller scale and potential staged expansion, collaborating with CIBC Capital Markets to maximize shareholder value, and executing health, safety, and environmental initiatives.

- Project Updates and Initiatives: In the first quarter, Vista received a USD 7 million payment under a recent royalty agreement and anticipates a final payment of USD 10 million to further enhance the balance sheet. The Mt Todd feasibility study was updated to reflect current quotes for capital and operating costs, long-term gold price outlooks, and foreign exchange rates. The updated study demonstrated project economics similar to or slightly better than those reported two years ago. Additionally, Vista commenced a drilling program targeting shallow gold resources at the north end of the Batman deposit, expected to add low stripping ratio gold resources to benefit early production cash flows. The company also published its inaugural environmental, social, and governance report.

- Financial Performance: Vista reported a consolidated net loss of USD 1.1 million, or USD 0.01 per common share, for the quarter ending March 31, 2024, compared to a consolidated net loss of USD 2.0 million, or USD 0.02 per common share, for the same period in 2023. Cash and cash equivalents increased to USD 11.9 million at the end of the quarter, up from USD 6.1 million as of December 31, 2023, and the company continues to operate debt-free.

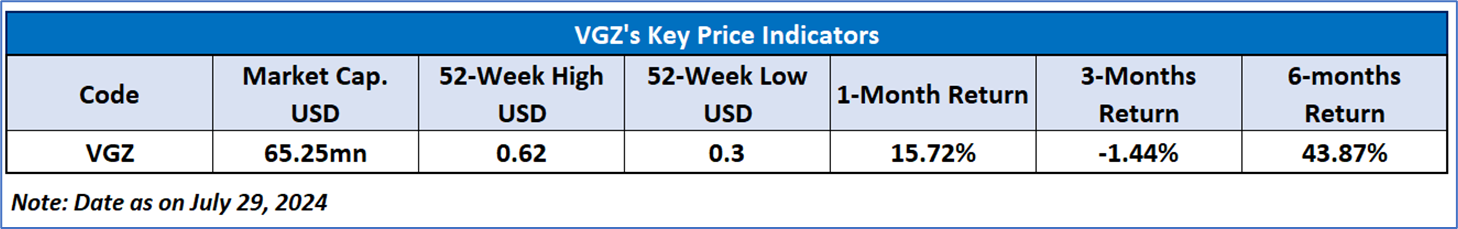

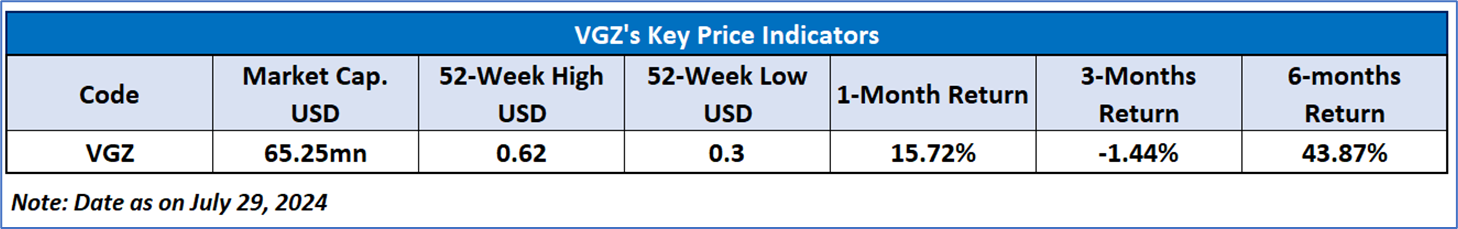

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 58.01, upward trending, with expectations of a consolidation or a short-term upward momentum with next resistance around 52-week high level. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is July 29, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

_07_29_2024_18_27_38_777161.jpg)

Please wait processing your request...

Please wait processing your request...