Nio Inc

NIO Inc (NYSE: NIO) is a China-based holding company principally engaged in the research, development and manufacturing of premium smart electric vehicles. The Company is mainly engaged in the design, development, manufacture and sales of high-end smart electric vehicles.

Recent Financial and Business Updates:

- Operating Highlights for the Third Quarter of 2023: In Q3 2023, NIO reported 55,432 vehicle deliveries, marking a 75.4% increase from Q3 2022 and a substantial 135.7% rise from Q2 2023. This comprised 37,585 premium smart electric SUVs and 17,847 premium smart electric sedans.

- Financial Highlights for the Third Quarter of 2023: Vehicle sales reached RMB 17,408.9 million (USD 2,386.1 million) in Q3 2023, a 45.9% YoY increase. Vehicle margin was 11.0%. Total revenues amounted to RMB 19,066.6 million (USD 2,613.3 million), a 46.6% YoY increase. Gross profit was RMB 1,523.3 million (USD 208.8 million). The gross margin was 8.0%. Loss from operations was RMB 4,843.9 million (USD 663.9 million), a 25.2% YoY increase.

- Recent Developments: NIO delivered 16,074 and 15,959 vehicles in October and November 2023, respectively. Cumulative deliveries reached 431,582 as of November 30, 2023. The company completed a Notes Offering, raising USD575 million. In December 2023, NIO entered agreements to acquire manufacturing equipment and assets from Anhui Jianghuai Automobile Group Corp., Ltd. Additionally, the All-New EC6 was launched in September 2023, and NIO released its 2022 Environmental, Social, and Governance (ESG) report on September 25, 2023. Professor Yonggang Wen was appointed as a new independent director on November 13, 2023.

- Announced Completion of the Repurchase Right Offer for Its 0.00% Convertible Senior Notes due 2026: NIO Inc., a prominent player in the premium smart electric vehicle market, has successfully concluded its repurchase right offer associated with its 0.00% Convertible Senior Notes due 2026. The offer expired on January 31, 2024, at 5:00 p.m., New York City time. A total of US$300,536,000.00 aggregate principal amount of the Notes, representing the Repurchase Price, were duly surrendered and not withdrawn before the expiration. The Company has facilitated the payment of the Repurchase Price in cash to the Paying Agent for subsequent distribution to the Holders who validly exercised their Repurchase Right. After the settlement, US$912,000.00 aggregate principal amount of the Notes will persist, adhering to the existing terms of the Indenture and the Notes.

- Provided January 2024 Delivery Update: In January 2024, NIO Inc., a leading player in the premium smart electric vehicle market, reported a year-over-year increase of 18.2% in deliveries, totaling 10,055 vehicles. This included 6,307 premium smart electric SUVs and 3,748 premium smart electric sedans. The cumulative deliveries of NIO vehicles reached 459,649 as of January 31, 2024. Furthermore, NIO expanded its influence in the electric vehicle industry by opening its power swap network to the entire sector. The company signed strategic partnership agreements with JAC Group and Chery Automobile for battery swapping, in addition to previous collaborations with Changan Automoile and Geely Group. NIO also participated in establishing Zhongan Energy, a company dedicated to developing an open and shared charging, swapping, and energy storage network, with plans to build 1,000 battery swap stations in China in the coming years. NIO anticipates further collaborations to contribute to the advancement of power networks and the widespread adoption of battery swapping.

- NIO Inc. Announced Closing of USD2.2 billion Strategic Equity Investment from CYVN: NIO Inc. has successfully concluded a strategic equity investment of USD2.2 billion from CYVN Investments RSC Ltd, an Abu Dhabi-based investment vehicle. This investment marks the closure of a series of transactions initiated in July 2023 when CYVN made a USD738.5 million strategic equity investment and acquired specific Class A ordinary shares from Tencent Holdings Ltd. for a total consideration of USD350 million. With the recent USD2.2 billion strategic equity investment closing, CYVN now holds approximately 20.1% of NIO's total issued and outstanding shares. Moving forward, NIO and CYVN, along with their affiliates, plan to collaborate closely in pursuing strategic and technological initiatives in international markets.

Technical Observation (on the daily chart)

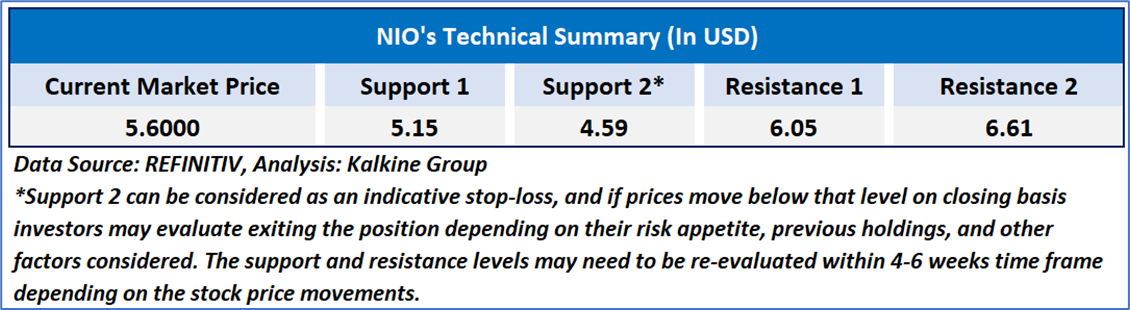

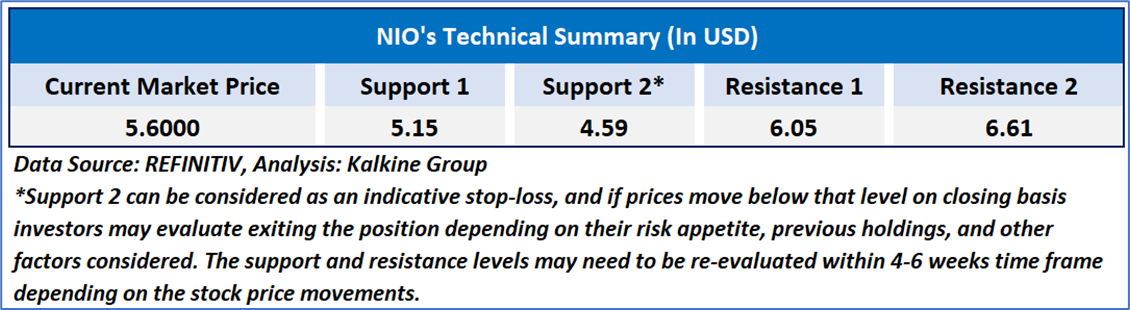

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 27.64, currently in the oversold zone, signifying the likelihood of either more consolidation or a brief surge soon. Adding to this, the stock presently finds itself positioned below both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term resistance levels. Now, the stock's price hovers around a crucial support range of USD 5.00 to USD 5.50, with an anticipation of an impending upward shift originating in case of a support from these support levels as the price is also showing expectations of a bullish divergence on the daily time frame.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 01, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...