NVIDIA Corporation

NVIDIA Corporation (NASDAQ: NVDA) accelerates computing to help solve the computational problems. The Company has two segments. The Compute & Networking segment includes its data center accelerated computing platform; networking; automotive artificial intelligence (AI) cockpit, autonomous driving development agreements and autonomous vehicle solutions; electric vehicle computing platforms; Jetson for robotics and other embedded platforms; NVIDIA AI Enterprise and other software; and cryptocurrency mining processors (CMP). The Graphics segment includes GeForce GPUs for gaming and personal computers (PCs), the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU (vGPU), software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and omniverse enterprise software for building and operating metaverse and three-dimensional Internet applications.

Recent Business Highlights

- Record-Breaking Performance: NVIDIA Achieves Staggering Q3 Revenue of 18.12 billion USD: In the third quarter of 2023, NVIDIA reported unprecedented financial success, with revenue surging by 206% from the previous year and an impressive 34% increase from the previous quarter. GAAP earnings per diluted share reached 3.71 USD, marking an exceptional 12x growth year-over-year, while non-GAAP earnings per diluted share stood at 4.02 USD, nearly 6x higher compared to a year ago.

- Dominance in Data Center: NVIDIA Sets New Records with 14.51 billion USD in Q3 Revenue: NVIDIA's Data Center segment continues to shine, achieving a record revenue of 14.51 billion USD in the third quarter, showcasing a remarkable 41% increase from the previous quarter and an outstanding 279% increase from a year ago. The company introduced cutting-edge technologies, including the HGX™ H200 and an AI foundry service, solidifying its position as a leader in accelerated computing and generative AI.

- Innovations in Gaming: NVIDIA Surpasses Expectations with Q3 Revenue of 2.86 billion USD: Gaming revenue for NVIDIA in the third quarter reached 2.86 billion USD, demonstrating a substantial 15% increase from the previous quarter and an impressive 81% increase from a year ago. The company introduced groundbreaking technologies such as DLSS 3.5 Ray Reconstruction and TensorRT-LLM™ for Windows, contributing to its extensive library of DLSS and Reflex games, which now exceeds 1,700 on GeForce NOW™.

- Strategic Growth in Professional Visualization and Automotive Sectors: Professional Visualization and Automotive segments also experienced significant revenue growth in Q3, with revenue reaching 416 million USD and 261 million USD, respectively. NVIDIA solidified its position in these sectors with strategic collaborations, such as the partnership with Mercedes-Benz in creating digital twins using NVIDIA Omniverse, and advancements in electric vehicles with Foxconn using the NVIDIA DRIVE Hyperion™ platform and DRIVE Thor™ system-on-a-chip.

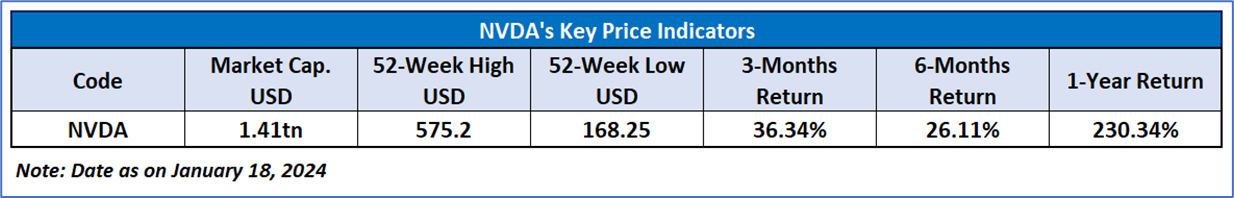

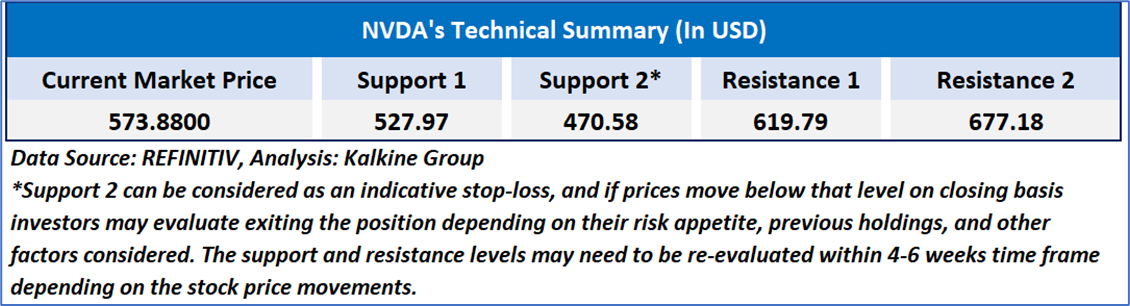

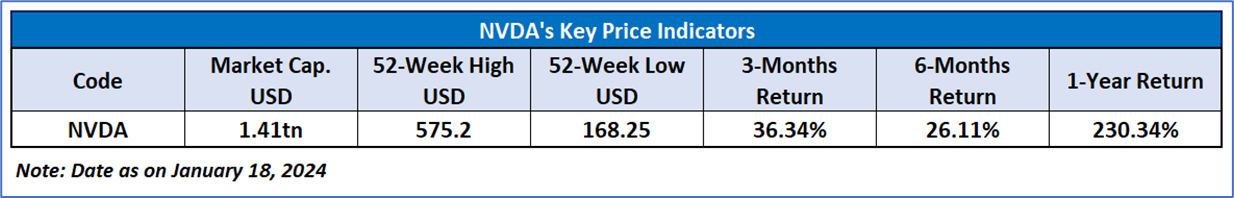

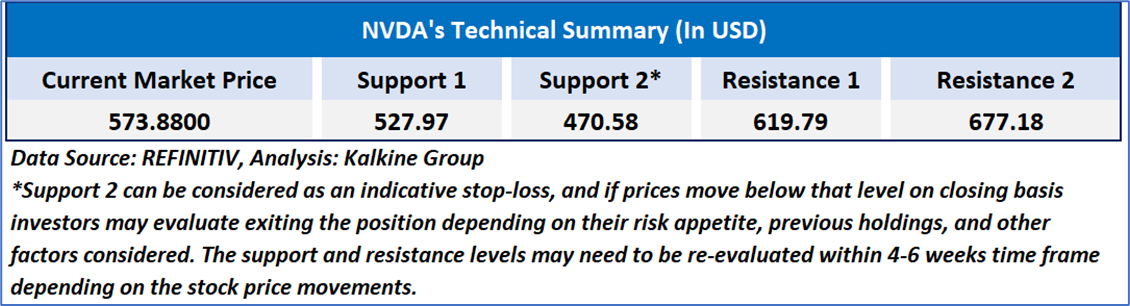

Technical Observation (on the daily chart)

The stock broke above an important resistance zone of USD 480-USD 500 in the first half of January 2024, with the expectations of price retesting those major levels. The Relative Strength Index (RSI) over a 14-day period stands at oversold level of 77.09, indicating a state of potential consolidation or a short-term correction. Additionally, the stock's current positioning is above both the 21-day Simple Moving Average (SMA) and the 50-day SMA, which may serve as dynamic short-term support level. NVDA is expected to release its FY24 results on 21st February 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

Please wait processing your request...

Please wait processing your request...