Airbnb Inc

Airbnb, Inc. (NASDAQ: ABNB) primarily operates a global platform for stays and experiences. The Company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences around the world. It partners with hosts throughout the process of setting up their listing and provide them with a range of tools to manage their listings, including scheduling, merchandising, integrated payments, community support, host protections, pricing guidance, and feedback from reviews.

Recent Financial and Business Updates:

Q3 2023 Financial Results

- Revenue and Income: In Q3 2023, Airbnb reported a revenue of USD 3.4 billion, marking an 18% YoY increase. This growth was attributed to increased Nights and Experiences Booked, a slight rise in Average Daily Rate (ADR), and a favorable foreign exchange impact. Net income for the quarter was USD 4.4 billion, including a one-time non-cash tax benefit of USD 2.8 billion. Adjusted Net Income, excluding this benefit, reached USD 1.6 billion, up from USD 1.2 billion in Q3 2022. Adjusted Net Income Margin increased significantly from 42% to 47% YoY.

- Adjusted EBITDA and Free Cash Flow: Adjusted EBITDA for Q3 2023 was USD 1.8 billion, a 26% YoY increase, demonstrating effective cost management. Adjusted EBITDA margin rose to 54% from 51% in Q3 2022. Free Cash Flow for the quarter reached USD 1.3 billion, up 37% YoY, driven by revenue and bookings growth, as well as an expansion in Adjusted Net Income Margin. The trailing twelve months (TTM) Free Cash Flow was USD 4.2 billion, with a TTM FCF margin improvement from 41% to 44%.

- Share Repurchases: In Q3 2023, Airbnb utilized its Free Cash Flow to repurchase USD 500 million of its Class A common stock. Since the initiation of share repurchases over a year ago, the company has bought back a total of USD 3.0 billion, reducing the fully diluted share count from 698 million in Q3 2022 to 681 million at the end of Q3 2023.

Business Highlights

- Record Summer Travel Season: Q3 2023 witnessed a record summer travel season for Airbnb, with Nights and Experiences Booked growing by 14% YoY. Noteworthy was the acceleration in the year-over-year growth rate of nights booked, attributed to an increase in active bookers globally. First-time bookers also showed substantial growth, reaching encouraging levels. The Airbnb app demonstrated strength, constituting 53% of gross nights booked compared to 48% in Q3 2022.

- International Expansion: Cross-border nights booked grew by 17% in Q3 2023, indicating momentum in international expansion. Airbnb's business in Asia Pacific fully recovered to pre-pandemic levels, with gross nights growing by 23% compared to Q3 2019. Notably, China outbound travel surged over 100% in Q3 2023 compared to the previous year. Smaller Asia Pacific markets also experienced robust growth in gross nights booked.

- Listing Growth: Airbnb added nearly 1 million active listings in 2023, reflecting a 19% growth in Q3 relative to Q3 2022. This growth was consistent across all regions, with Asia Pacific and Latin America exhibiting the highest supply growth. Urban and non-urban supply showed similar year-over-year growth rates. With over 7 million active listings, Airbnb believes the majority of new listings are exclusive to its platform.

Results from 2023 Summer Release

- Enhancements to Service: As part of the 2023 Summer Release, Airbnb implemented over 50 upgrades based on feedback from hosts and guests. Key updates include redesigned pricing tools, facilitating affordable longer stays, and addressing top suggestions from guests, such as lower prices, improved search features, and listing verification in select countries.

- Customer Service Improvements: Airbnb focused on providing timely and seamless customer support, achieving a 94% response rate within 2 minutes for calls in English during the summer. This 2-minute response time was extended to nine more languages. Starting November, guests calling customer service are matched with agents specialized in resolving their specific issues, ensuring faster resolution. Overall, Airbnb's Q3 2023 results reflect robust financial performance and positive operational developments, underscoring the company's resilience and adaptability in the travel and hospitality sector.

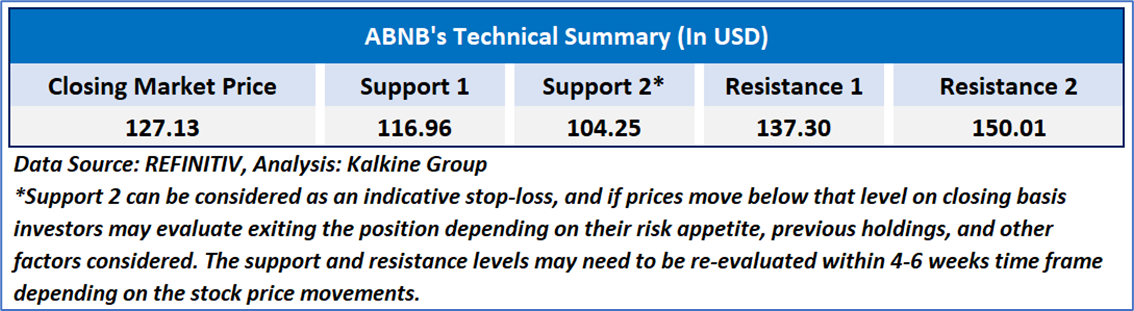

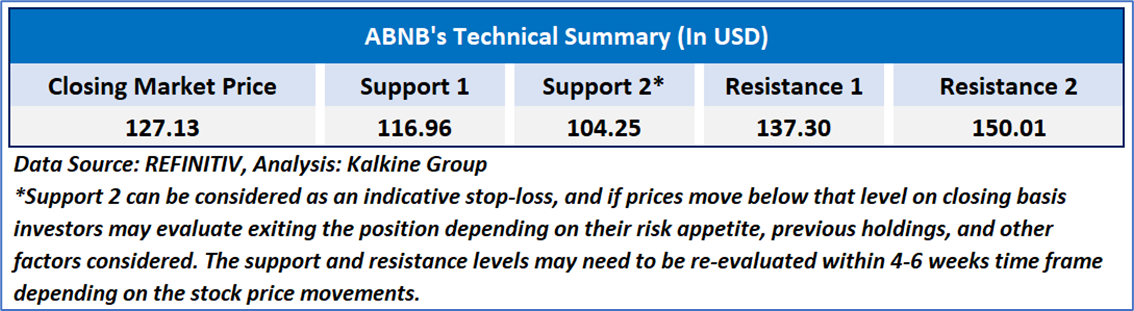

Technical Observation (on the daily chart)

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 53.63, currently in an uptrend, signifying the likelihood of either more consolidation or a brief surge soon. Adding to this, the stock presently finds itself positioned above both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term support levels. Now, the stock's price hovers inside a crucial range of USD 120 -USD 130, with an anticipation of an impending breakout in the either directions the price breaks the range.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Airbnb, Inc. (NASDAQ: ABNB) at the current market price of USD 127.13 as of November 28, 2023, at 08:50 am PST.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is November 28, 2023. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...