Aurora Cannabis Inc

Aurora Cannabis Inc. (NASDAQ: ACB) is a Canada-based medical cannabis company. The Company's principal business lines are focused on the production, distribution, and sale of cannabis related products in Canada and internationally. The Company’s segments include Canadian Cannabis, European Cannabis and Plant Propagation.

Key Business & Financial Updates

- Consolidated Revenue and Adjusted Gross Profit: In the first quarter of fiscal 2025, Aurora achieved a total net revenue of USD 83.4 million, reflecting a 12% increase compared to the USD 74.7 million recorded in the same period of the previous year. This growth was primarily driven by a 13% increase in the global medical cannabis business and a 16% rise in the plant propagation business. However, these gains were slightly offset by lower revenue in the consumer cannabis sector. The consolidated adjusted gross margin, excluding fair value adjustments, was 43% in Q1 2025, slightly down from 44% in the previous year. Adjusted gross profit before fair value adjustments increased by 10%, reaching USD 36.0 million, up from USD 32.6 million in the prior year.

- Medical Cannabis Segment Performance: The medical cannabis business generated net revenue of USD 47.2 million in the first quarter of 2025, representing a 13% increase compared to the previous year. This segment contributed 57% of Aurora's consolidated net revenue for the quarter and accounted for 91% of adjusted gross profit before fair value adjustments. The USD 5.6 million increase in net revenue was largely attributed to higher sales in Australia and a steady rise in sales to insurance-covered patients in Canada, coupled with larger average basket sizes. The adjusted gross margin before fair value adjustments on medical cannabis revenue reached 69%, a notable improvement from the 61% reported in the prior year, driven by sustainable cost reductions, higher selling prices in Australia, and enhanced production efficiencies.

- Consumer Cannabis Segment: Aurora's consumer cannabis segment saw a decline in net revenue to USD 11.5 million, representing a 10% decrease compared to the previous year’s figure of USD 12.8 million. This decrease was mainly due to the company's strategic decision to prioritize the supply of its GMP-manufactured products to higher-margin international markets, which resulted in reduced focus on the lower-margin consumer cannabis business. Adjusted gross margin before fair value adjustments for this segment decreased from 26% in the previous year to 24%, reflecting a shift in product sales toward higher-margin offerings.

- Plant Propagation Business: The plant propagation segment, primarily driven by the Bevo business, contributed USD 23.1 million in net revenue for the first quarter of 2025, a 16% increase compared to the USD 19.9 million recorded in the same period of the previous year. This growth was attributed to organic expansion and increased product offerings. Historically, 65-75% of plant propagation revenue is earned in the first half of the calendar year. The adjusted gross margin before fair value adjustments for the plant propagation business was 18%, down from 22% in the previous year, due to variations in product mix and an extended spring season.

- SG&A and R&D Costs: Selling, General, and Administrative (SG&A) expenses were USD 31.4 million for Q1 2025, excluding USD 4.9 million in business transformation costs. This figure is slightly higher than the company’s previous target of USD 30 million, primarily due to additional SG&A costs following the acquisition of MedReleaf Australia. Adjusted Research and Development (R&D) expenses remained relatively stable at USD 1.0 million, compared to USD 1.1 million in the prior year. Aurora's R&D investments are opportunistic and are expected to fluctuate based on the company’s innovation and development initiatives.

- Net Income, Adjusted EBITDA, and Fiscal Outlook: Net income from continuing operations for the first quarter of fiscal 2025 amounted to USD 4.8 million, a significant turnaround from the net loss of USD 20.2 million reported in the prior year. Adjusted EBITDA increased by 87% to USD 4.9 million, compared to USD 2.6 million in the previous year. Looking ahead to the second quarter of fiscal 2025, Aurora anticipates continued strong net revenue and adjusted gross margins in the cannabis business, with growth driven by the European and Australian markets. While positive adjusted EBITDA is expected to continue, free cash flow is likely to be negatively impacted by significant annual and one-time cash payments typically made in the second quarter. Additionally, revenues from the plant propagation segment are expected to decrease in line with historical seasonal trends, with 25-35% of annual revenues typically earned in the latter half of the calendar year.

Technical Observation (on the daily chart):

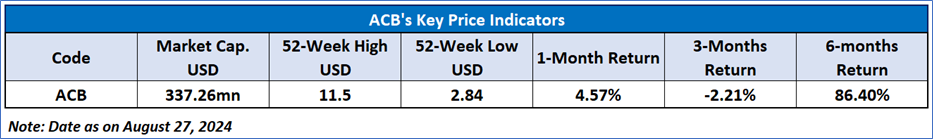

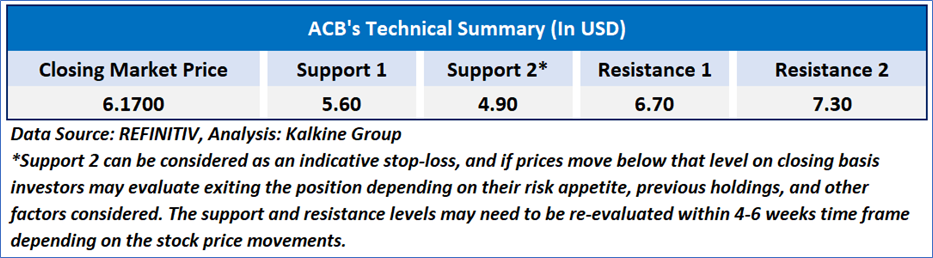

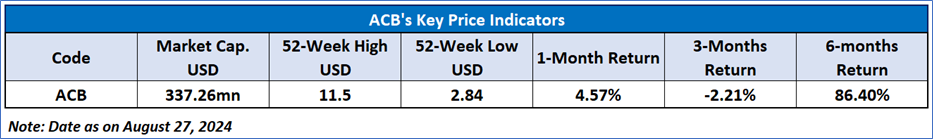

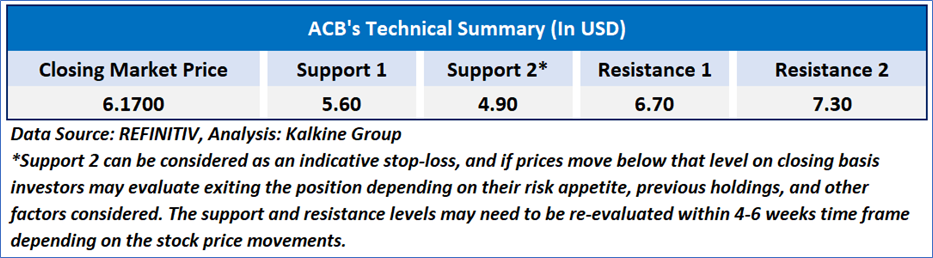

The Relative Strength Index (RSI) over a 14-day period stands at a value of 47.96, downward trending, with an expectation of upward momentum if the current support levels of USD 5.00 -USD 6.00 hold. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘WATCH’ rating has been given to Aurora Cannabis Inc. (NASDAQ: ACB) at the closing market price of USD 6.17 as of August 27, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 27, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...