Nikola Corporation

Nikola Corporation (NASDAQ: NKLA) is an integrated truck and energy company. The Company provides zero-emissions transportation and energy supply and infrastructure solutions. It operates in two business units: Truck and Energy. The Truck business unit is commercializing fuel cell electric vehicles (FCEV) and battery electric vehicles (BEV) Class 8 trucks that provide or are intended to provide environmentally friendly solutions to the trucking sector. The Energy business unit is developing hydrogen fuelling infrastructure to support its FCEV trucks.

Recent Business and Financial Updates

- Tom Schmitt Appointed Chief Commercial Officer at Nikola Corporation: Nikola Corporation has appointed veteran transportation executive, Tom Schmitt, as Chief Commercial Officer to lead the company's sales, operations, marketing, and customer success initiatives. Schmitt, with over 35 years of industry experience, is expected to drive Nikola’s focus on zero-emissions trucking and hydrogen infrastructure solutions.

- Record Revenue Growth in Q2 2024: Nikola Corporation reported its highest-ever quarterly revenue in Q2 2024, reaching USD 31.3 million, marking a 318% increase from the previous quarter. The company’s strong financial performance underscores its position as a leader in zero-emissions transportation solutions, particularly in the hydrogen fuel cell electric vehicle (FCEV) sector. The impressive revenue growth was further supported by the initial sale of regulatory credits, creating alternative revenue streams for the company.

- Hydrogen Fuel Cell Electric Vehicle Milestones: In the second quarter of 2024, Nikola exceeded its guidance by wholesaling 72 hydrogen fuel cell electric vehicles (FCEVs), an 80% increase from Q1. This brought the total number of wholesaled FCEVs to 147 within the first three quarters of serial production. The company’s FCEV fleet has now travelled over 550,000 miles, achieving an average fuel economy of 7.2 miles per kilogram, outperforming the typical Class 8 diesel trucks. In total, Nikola's FCEVs have helped avoid approximately 867 metric tons of CO2 emissions.

- Expansion of HYLA Energy Solutions: Nikola’s HYLA-branded energy division is scaling rapidly to support its growing FCEV fleet. The company launched a HYLA fuelling station in Toronto, Canada, and completed a modular station in Southern California. Additionally, Nikola doubled capacity at its Ontario, California station by adding another modular refueler. The stations, running 24/7, are designed to meet the high demand of end fleet users, with a record day of 28 FCEVs refuelled and over 850 kilograms of hydrogen dispensed.

- Positive Progress in BEV Recall Program: Nikola's battery-electric vehicle (BEV) "2.0" recall program remains on track to be completed by the end of 2024. The company has made significant progress in returning recalled units to its dealer network and fleet users, with positive feedback on the updates received. Over-the-air software updates continue to enhance the performance and reliability of the BEVs, further solidifying Nikola's commitment to customer satisfaction.

- Alternative Revenue Streams and Green Policies: Nikola has successfully created new revenue streams through the sale of regulatory credits, with the first sale of nitrogen oxide (NOx) and particulate matter (PM) credits completed in Q2 2024. The company holds 99% of FCEV and 23% of BEV vouchers under California’s HVIP program, maintaining its dominant position in the zero-emission vehicle market. As the production of FCEVs increases, Nikola expects the regulatory credit revenue stream to grow substantially in the coming years.

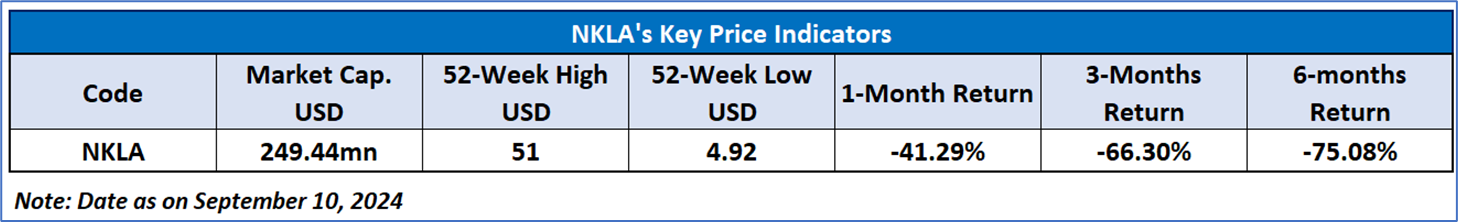

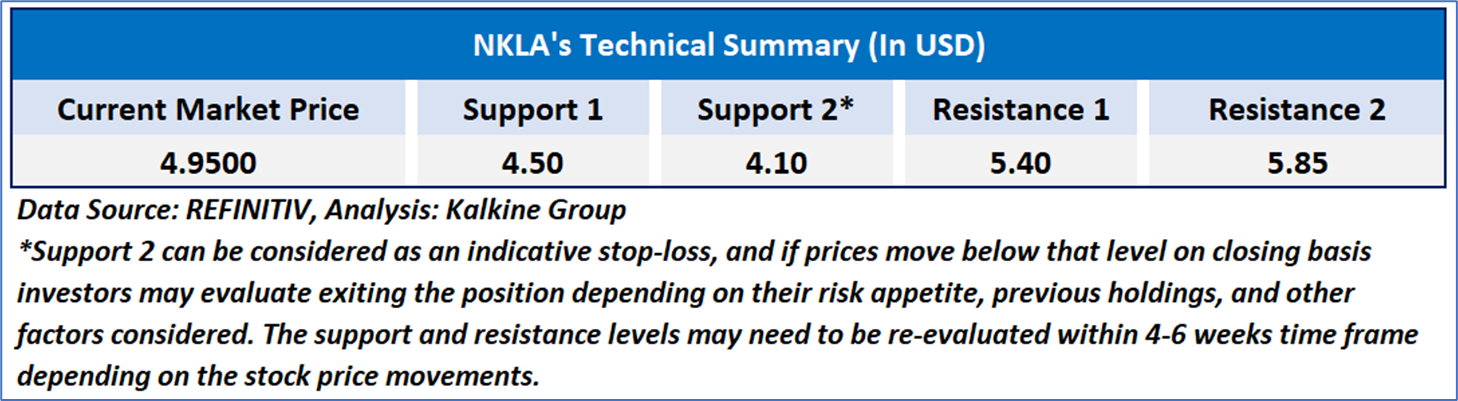

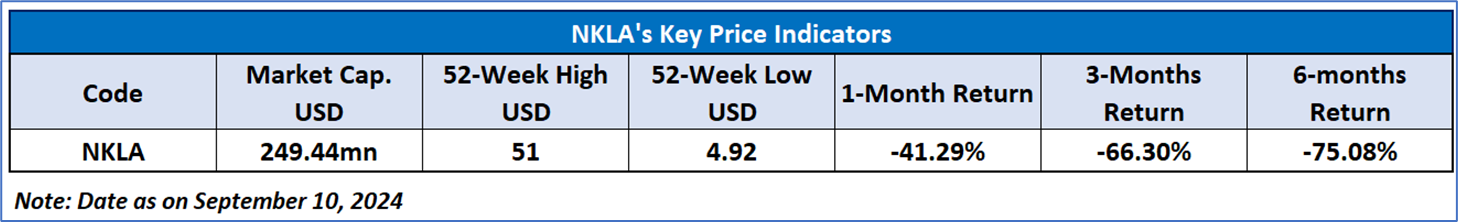

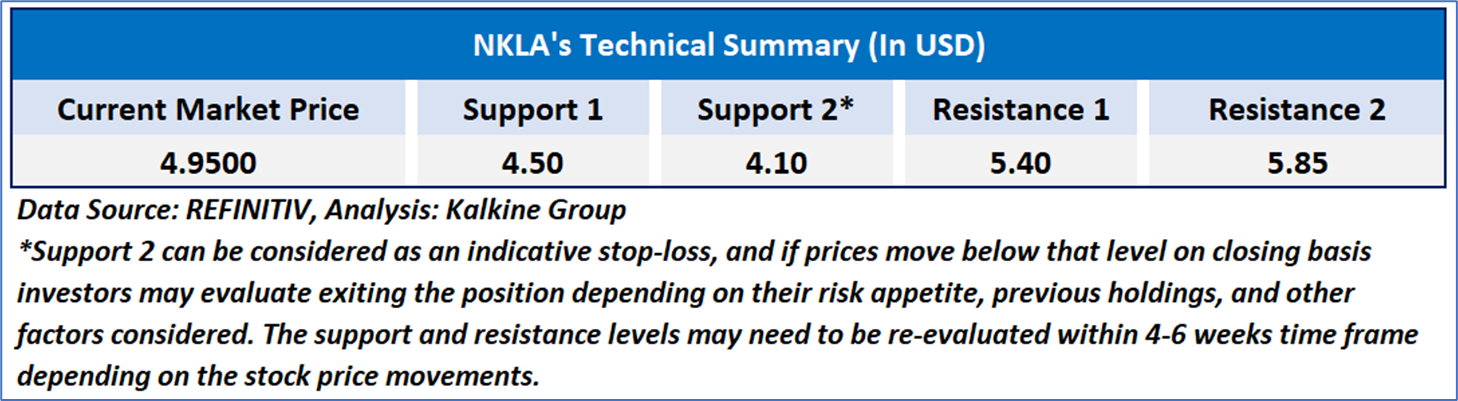

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 24.04, currently inside the oversold zone, with expectations of a consolidation. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 10, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...