Plug Power Inc

Plug Power Inc. (NASDAQ: PLUG) is a provider of hydrogen fuel cell turnkey solutions. The Company provides electrolyzers that allow customers, such as refineries, producers of chemicals, steel, fertilizer and commercial refueling stations, to generate hydrogen on-site. It focuses on industrial mobility applications, including electric forklifts and electric industrial vehicles, at multi-shift high volume manufacturing and high throughput distribution sites and environmental benefits; stationary power systems that supports critical operations, such as data centers, microgrids and generation facilities, in either a backup power or continuous power role and replace batteries, diesel generators or the grid for telecommunication logistics, transportation, and utility customers; and production of hydrogen.

Recent Financial and Business Updates:

- Plug Discloses Q3 2023 Financial Results, Reporting Revenue of USD 199 Million: The financial outlook for Plug in 2023 has been impacted by unprecedented challenges stemming from supply disruptions in North America's hydrogen network. Despite adverse effects on overall financial performance, the company aims to address these challenges through anticipated full-scale production at its facilities in Georgia and Tennessee by the end of the year.

- Hydrogen Network Challenges and Mitigation Efforts: Plug has faced significant constraints in the liquid hydrogen market due to force majeure events, affecting its deployment and service margin improvements. The company has proactively addressed these challenges by utilizing its logistics assets and implementing contingency plans to support customers throughout the United States.

- Revenue and Margin Performance: While challenges in hydrogen supply have negatively affected Plug's gross margin, there have been margin expansions in specific new products. The fuel business witnessed a 21% sequential gross margin improvement in Q3 2023 compared to Q2.

- Business Developments and Expansion: Key advancements at Plug's green hydrogen plant in Georgia and other locations like Louisiana, Texas, and New York are expected to drive significant margin expansions. The company's electrolyzer, liquefier, and cryogenics businesses have experienced notable growth, with increased sales pipelines and orders from large-scale projects.

- Manufacturing and Financial Strategies: Plug is actively working on scaling its manufacturing operations, focusing on high-power stationary applications and global material handling segments. The company is exploring various funding solutions to support its growth and operational requirements.

- Policy and Regulatory Engagement: Plug emphasizes its participation in regulatory initiatives such as the Inflation Reduction Act (IRA) Production Tax Credit (PTC) and engagement in DOE-sponsored hydrogen hubs, anticipating positive impacts on the industry.

- Green Hydrogen Generation Network Updates: Plug provides updates on ongoing projects in the US and Europe, detailing progress on various green hydrogen production facilities, including Georgia, Louisiana, Texas, Alabama, and New York.

- Financial Performance and Ongoing Challenges Summary: Despite reporting a revenue of USD 199 million for the quarter, challenges in hydrogen supply adversely affected Plug's gross margin. Service costs were impacted by supply disruptions and cost increases from inflation.

- Conclusion: Despite facing challenges, Plug is optimistic about overcoming short-term disruptions by focusing on operational scale, in-house hydrogen generation, and supportive policies. The company underscores its strategies for business expansion, margin enhancement, funding, and policy impacts to position itself as a global leader in the green hydrogen industry.

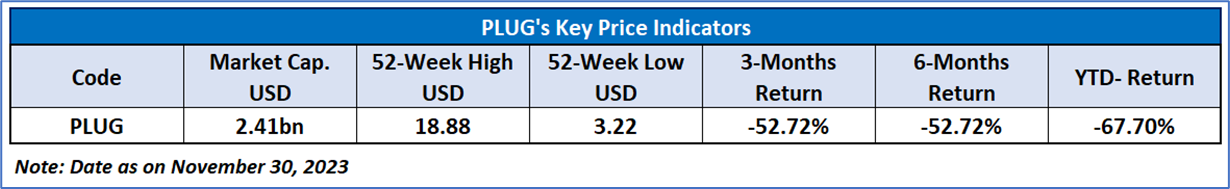

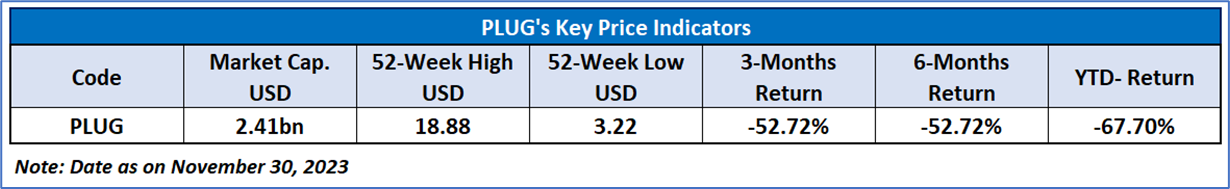

- Market Setback and Operational Funding Notice: Plug Power (PLUG) experienced a significant setback, witnessing a 40% stock decline to close at USD 3.53 per share. This followed the release of weaker-than-anticipated results and the issuance of a "going concern" notice regarding operational funding over the next year. Despite reporting a revenue slightly below expectations and a steeper-than-expected loss, challenges attributed to hydrogen availability issues led to concerns about the company's continuity. CEO Andy Marsh acknowledged the difficulties, while CFO Paul Middleton expressed confidence in securing financing, emphasizing the conservative nature of the concern raised. However, Plug Power's performance has been impacted by high-interest rates and substantial year-to-date stock decline of over 70%, influenced by both operational challenges and market conditions.

Technical Observation (on the daily chart)

The Relative Strength Index (RSI) over a 14-day period stands at 38.80, rising from the oversold zone. The stock price has given a healthy correction from levels of around USD 6.00, with the announcement of the recent quarterly results. Additionally, the stock's current positioning is below both 21-period SMA and 50-period SMA, which may serve as a dynamic short-term resistance level. Meanwhile, the stock price is currently taking resistance from the 21-day Simple Moving Average (SMA).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is November 30, 2023. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by the individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...