Plug Power Inc

Plug Power Inc. (NASDAQ: PLUG) is a provider of hydrogen fuel cell turnkey solutions. The Company provides electrolyzers that allow customers, such as refineries, producers of chemicals, steel, fertilizer and commercial refueling stations, to generate hydrogen on-site. It focuses on industrial mobility applications, including electric forklifts and electric industrial vehicles, at multi-shift high volume manufacturing and high throughput distribution sites and environmental benefits; stationary power systems that supports critical operations, such as data centers, microgrids and generation facilities, in either a backup power or continuous power role and replace batteries, diesel generators or the grid for telecommunication logistics, transportation, and utility customers; and production of hydrogen.

Recent Financial and Business Updates:

- Plug Reports Third Quarter 2023 Results with Revenue of USD 199mn The financial landscape of Plug for 2023 reflects challenges due to unprecedented supply issues in North America's hydrogen network. While these issues have negatively impacted the overall financial performance, the company anticipates resolving these challenges with the expected full-scale production at Georgia and Tennessee facilities by year-end.

- Challenges in the Hydrogen Network: Force majeure events have significantly constrained the liquid hydrogen market, affecting Plug's deployment and service margin improvements. The company has tackled these difficulties by leveraging its logistics assets and implementing contingency plans to support customers across the US.

- Revenue and Margin Performance: Despite the hydrogen supply challenges affecting the company's gross margin, there have been margin expansions in certain new products. Plug has seen a 21% sequential gross margin improvement in the fuel business in the third quarter of 2023 compared to the second quarter.

- Business Highlights and Expansion: Key developments at Georgia's green hydrogen plant and other locations, including Louisiana, Texas, and New York, are expected to drive significant margin expansions. The company's electrolyzer, liquefier, and cryogenics businesses have seen substantial growth, with expanded sales pipelines and orders from large-scale projects.

- Manufacturing and Financial Roadmaps: Plug is working on scaling its manufacturing operations, with significant developments in high-power stationary applications and global material handling segments. The company is actively pursuing various funding solutions to support its growth and operational needs.

- Policy and Regulatory Impacts: The company highlights its involvement in regulatory initiatives, such as the Inflation Reduction Act (IRA) Production Tax Credit (PTC) and engagement in DOE-sponsored hydrogen hubs. These initiatives are anticipated to impact the industry positively.

- Green Hydrogen Generation Network Updates: Plug emphasizes its ongoing projects in the US and Europe, reflecting updates on various green hydrogen production facilities. Key details about the status of ongoing projects, such as Georgia, Louisiana, Texas, Alabama, and New York, have been outlined, demonstrating progress in different locations.

- Summary of Financial Performance and Ongoing Challenges: Revenue for the quarter was reported at USD199M, but challenges in hydrogen supply affected the company's gross margin negatively. Service costs have been impacted by supply disruptions and cost increases from inflation.

- Conclusion: Despite challenges, Plug envisions overcoming short-term disruptions by focusing on operational scale, in-house hydrogen generation, and supportive policies. The company emphasizes its strategies for business expansion, margin enhancement, funding, and policy impacts to position itself as a global leader in the green hydrogen industry.

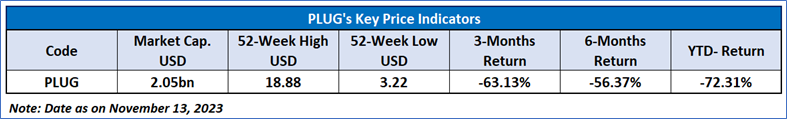

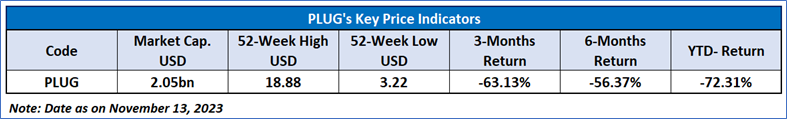

- Plug Power (PLUG) faced a significant setback as their stock plummeted by 40%, closing at USD3.53 per share following the release of weaker-than-anticipated results and the issuance of a "going concern" notice regarding their operational funding over the next year. The company reported in a filing late November 08, 2023, that their available cash and equities might not be adequate to sustain operations over the coming 12 months, which has raised concerns about the company's continuity. Despite posting a USD198.7 million revenue, slightly below the expected USD200.2 million, and a steeper than expected USD0.47 per share loss for the third quarter, the firm faced challenges attributed to hydrogen availability issues due to plant outages. While CEO Andy Marsh acknowledged the difficulties, CFO Paul Middleton expressed confidence in their ability to secure financing, noting the conservative nature of the concern highlighted. Nevertheless, renewable energy stocks have been under pressure due to high-interest rates, impacting Plug Power's performance, which, along with high short interest, has resulted in a substantial year-to-date decline of over 70% in their stock.

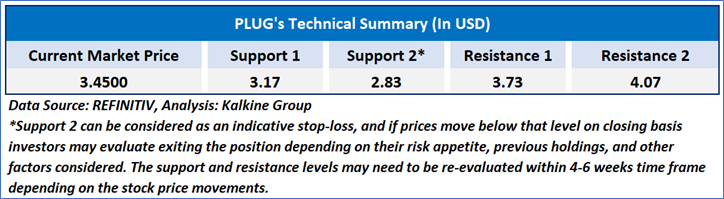

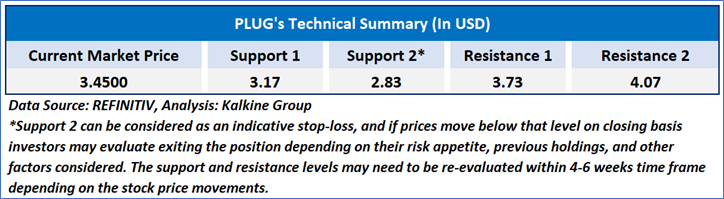

Technical Observation (on the daily chart)

The Relative Strength Index (RSI) over a 14-day period stands at 22.95, moving into the oversold zone. The stock price has given a healthy correction from levels of around USD 6.00, with the announcement of the recent quarterly results. Additionally, the stock's current positioning is below both 21-period SMA and 50-period SMA, which may serve as a dynamic short-term resistance level. Meanwhile, the stock price is currently taking resistance from the 21-day Simple Moving Average (SMA).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is November 13, 2023. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by the individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

_11_13_2023_18_50_54_970456.jpg)

Please wait processing your request...

Please wait processing your request...