Vale SA

Vale SA, (NYSE: VALE) formerly Companhia Vale do Rio Doce, is a Brazil-based metal and mining company which is primarily engaged in producing iron ore and nickel. The Company also produces iron ore pellets, copper, platinum group metals (PGMs), gold, silver and cobalt. Vale is engaged in greenfield mineral exploration in five countries and operates logistics systems in Brazil and other regions in the world, including railroads, maritime terminals and ports, which are integrated with mining operations.

Recent Financial and Business Updates:

- Iron Ore Triumphs: Enhancing Sales and Production Quality: Vale excels with a notable 6% YoY surge in iron ore fines and pellet sales, effectively closing the production-to-sales gap. Steadily progressing towards production goals, the company showcases unwavering commitment to quality improvement in Q3 2023.

- Energizing Transition in Metals: Copper production experiences a substantial 10% YoY boost, led by the successful ramp-up of Salobo III. Nickel production stays on course to meet targets, and the transition at Voisey’s Bay mine unfolds as planned. An active asset review seeks to unlock additional value for Vale.

- Financial Discipline at the Helm: Vale greenlights the payout of USD 2 billion in dividends and interest on capital on December 1st. The company stays true to its financial discipline with a consistent buyback program, reinforcing its commitment to sound financial strategies.

- Mining with a Sustainable Vision: Aligned with sustainable mining practices, Vale introduces Agera and formalizes a MoU with BluestOne. Notably, the emergency level of the B3/B4 dam is reduced to 1, underscoring Vale's dedication to dam safety.

- Fortifying the Core Operations: Vale initiates the commissioning of its inaugural iron ore briquette plant at the Tubarão Unit. Furthermore, collaborative agreements for Mega Hub development with Porto do Açu and H2 Green Ste are in progress, solidifying Vale's core operations.

- Financial Pinnacle: Robust Performance and Cost Control: In the financial realm, Vale reports proforma adjusted EBITDA of USD 4.5 billion in Q3, depicting a substantial 12% YoY increase and an impressive 8% QoQ rise. The Iron Solutions business witnesses an 18% YoY and 13% QoQ surge in EBITDA, attributed to heightened iron ore prices and sales volumes. The C1 cash cost of iron ore drops by 7% QoQ, aligning seamlessly with annual guidance.

- Cash Flow Mastery and Strategic Investments: Vale generates a commendable Free Cash Flow from Operations of USD 1.1 billion in Q3, reflecting a solid EBITDA to cash-conversion rate of 25%. Capital expenditures, including growth and sustaining investments, amount to USD 1.5 billion. Gross debt and leases remain stable QoQ at USD 14.0 billion, while the Expanded Net Debt increases by USD 0.8 billion QoQ to USD 15.5 billion, primarily due to shareholder interest payments.

- Strategic Ventures in Mining and Sustainable Practices: Vale's strategic ventures encompass supplying iron ore for the Green Steel Arabia project, collaborative studies on green industrial hubs, and the approval of the Pomalaa mine's development. The initiation of the 4th buyback program, along with various sustainable mining and decarbonization initiatives, underscores Vale's steadfast commitment to future growth and responsible practices.

Technical Observation (on the daily chart)

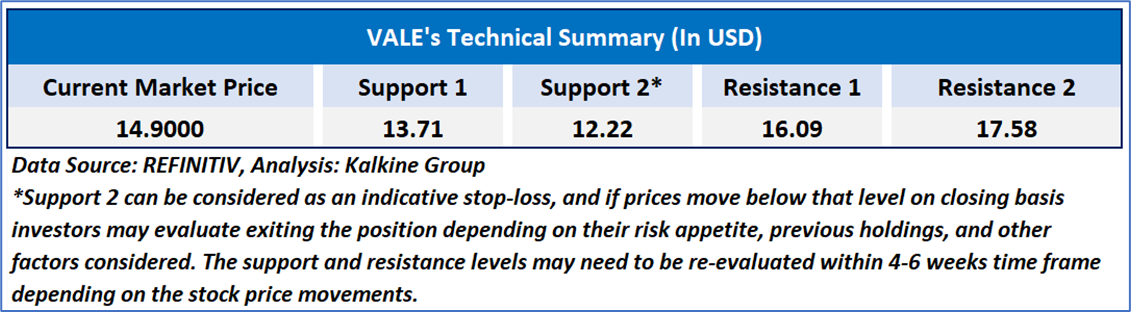

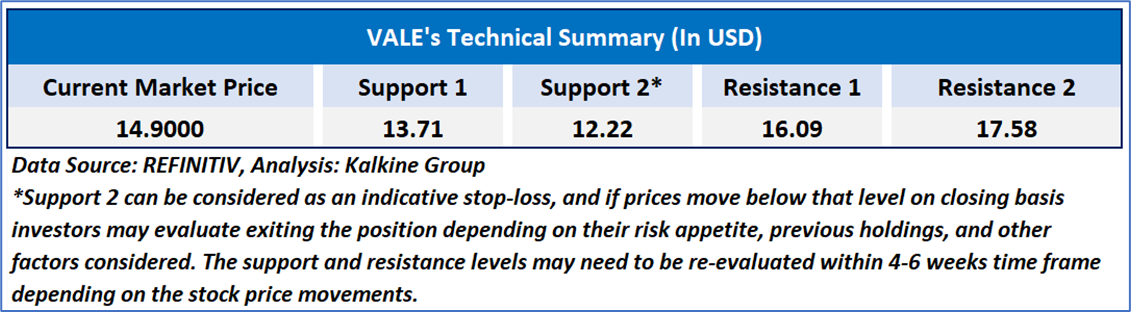

Presently, the stock has given a return of approximately 6.50% in the past three months, due to an upside momentum in underlying commodities prices. The Relative Strength Index (RSI) over a 14-day period stands at 53.57, recovering from overbought zone, with expectations of some consolidation or an upward momentum. Moreover, the price is currently positioned both both the 21-day SMA and 50-day SMA trend-following indicators, which may act as dynamic short-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a “BUY” rating is recommended for Vale SA, (NYSE: VALE) at its current market price of USD 14.90 as on December 04, 2023, at 07:40 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is December 04, 2023. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...