Kalkine has a fully transformed New Avatar.

Qantas Airways Limited (ASX: QAN)

.png)

QAN Details

Expects to report improved results: QAN has become the strongest national carrier over the last three years with its turnaround strategy in place and is a good yielding stock capable of driving healthy earnings in long-term. Despite the high fuel bill, the group is expected to report higher profit for the first half. Recently, BlackRock Group became a substantial holder of Qantas by holding 89,546,827 shares with 5.13% of voting power since 29 January 2018. As per the recent notification, foreign persons potentially hold relevant interests of about 43.60% of the issued share capital of Qantas. It is also worth noting that over 60% of the Group’s fleet is now debt-free.

.png)

Net Debt Structure (Source: Company Reports)

Meanwhile, ACCC has proposed to re-authorise a further five years’ coordination for three Asian based Jetstar branded joint ventures - Jetstar Asia, Jetstar Pacific and Jetstar Japan. This would allow Jetstar branded airlines to operate as a single fully integrated organisation on matters such as flight scheduling, sales and marketing and pricing. It is expected that this coordination will result in public benefits, but this re-authorisation does not extend to allow coordination between any of the other airline owners. Looking at the entire picture, group’s expansion efforts with any favourable oil price scenario can help the stock propel higher. We recommend a “Buy” on the stock at the current price of 5.27

.png)

QAN Daily Chart (Source: Thomson Reuters)

Bapcor Limited (ASX: BAP)

.png)

BAP Details

2017, a transformative year: 2017 was a very successful and a transformative year in terms of growth and profitability for Bapcor. The group has become a major participant in the Australian Automotive Aftermarket as revenues exceeded $1.2 billion. Now its business covers the end-to-end automotive aftermarket supply chain in Trade, Specialist Wholesale, Retail and Service segments with operations on both sides of Tasman. It is also now well into the process of integrating Hellaby Automotive which is now known as Bapcor New Zealand and has planned to deliver the benefits per annum of about $8m to $11m of EBIT by 2020.

.png)

Financial Performance Trend (Source: Company Reports)

In FY 17, its largest business segment, Trade delivered a revenue growth of 11% and increased its EBITDA by 22%. On all the measures, the performance of Bapcor since its IPO has been outstanding as it has grown sales from $340 million to over $1.2 billion and also increased its market capitalisation from $300 million to over $1.5 billion and the net profit increased by 340%. 2018 is also going to be a promising year as it will consolidate all its recent acquisitions and will continue to grow its network. Meanwhile, BAP stock has risen 7.96% in three months as on January 30, 2018. Based on the potential, we give a “Speculative Buy” recommendation on the stock at the current price of $5.84

.png)

BAP Daily Chart (Source: Thomson Reuters)

Transurban Group (ASX: TCL)

.png)

TCL Details

Completion of Entitlement Offer: Transurban recently completed its entitlement offer and the Retail Entitlement Offer raised gross proceeds of approximately $554 million from the issue of approximately 48.6 million of new securities at an issue price of $11.40 per new security. It represented the final stage of Transurban’s $1.9 billion entitlement offer which was announced on 12 December 2017. The settlement date for new securities which were issued under the Retail Entitlement Offer and under Retail Bookbuild is 1 February 2018. It is now looking forward to delivering the West Gate Tunnel Project and there are various other development projects which are in pipeline that will help to transform the transport network of the cities in which it operates. It recently announced that the Virginia Department of Transportation has accepted its offer to extend the I-95 Express Lanes to Fredericksburg under the existing 95 Express Lanes concession agreement and the financial close on US$565 million project is scheduled for the first half of 2019. Once it completes the projects, its Express Lanes Network in the Greater Washington Area will be the largest connected network in the United States.The group has also reiterated its FY18 dividend guidance including distribution of 28 cents for six months ending December 31, 2017.Given the income opportunity offered by the stock and a decent result expected in the near term, we give a “Buy” at the current market price of $12.02

.png)

TCL Daily Chart (Source: Thomson Reuters)

Collins Foods Limited (ASX: CKF)

.png)

CKF Details

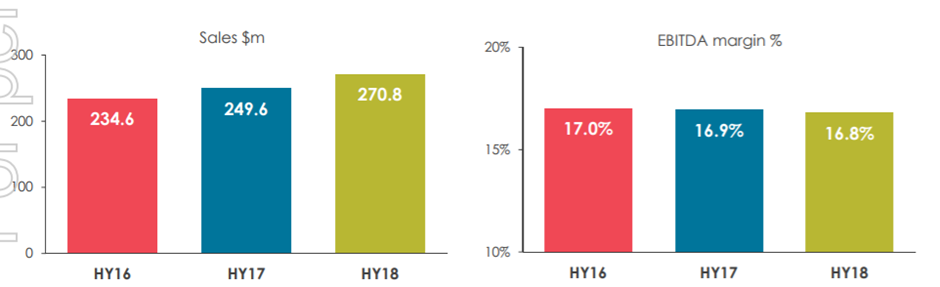

Completion of KFC acquisition: Collins recently announced that its wholly owned subsidiary, Collins Restaurant South Pty Ltd completed the acquisition of 14 KFC restaurants which are located in Tasmania from a subsidiary of Yum! Brands Inc. Post this acquisition there will be four restaurants of the original acquisition which was announced in June 2017. The group had indicated to complete the restaurants in Western Australia and South Australia shortly within few weeks from December 2017 onwards. Collins’ revenue for FY17 was up by 8.5% in Australia and reached to $270.8m as compared to prior year, while the group revenue is up 14%. It also released its 2018 half yearly update report and stated that its store count reached to 14 which reflects 2 closures since FY 17-year end.

Financial Performance Trend (Source: Company Reports)

Its net operating cash flow for first half of 2018 was $27.2 m which was up by $0.9 m as compared to first half of 2017. Its main priority for FY 2018 is to grow the core KFC Australian business. Trading at a decent dividend yield, we give a “Buy” recommendation on the stock at the current price of $5.30

.png)

CKF Daily Chart (Source: Thomson Reuters)

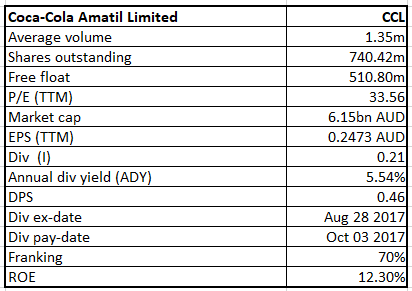

Coca-Cola Amatil Limited (ASX: CCL)

CCL Details

Leading Beverage Brand: CCL lately announced that Peter McLoughlin, Managing Director of Australian Beverages, will be stepping down and will take an extended period of sick leave while Mr Peter West will take his position on a permanent basis from 30 April 2018. In the interim, group Chief Financial Officer Martyn Roberts has been appointed as the Manging Director of Australian Beverages. The group is working on its product portfolio post the slip in customer satisfaction witnessed last year and has introduced some smaller portion sizes including 390ml of Coca-Cola, Fanta and Sprite. It also worked closely with Coca-Cola South Pacific to challenge and strengthen its plans on Accelerated Australian Growth.

Accelerated Growth Plan (Source: Company Reports)

The group expects to have FY17 underling NPAT in line with FY16. CCL has been positive on steady cash flow from core Australian and New Zealand franchises and growth opportunities from Indonesia and Alcohol & Coffee can drive more value while earnings are expected to be partly impacted by reinvestment of cost savings. We recommend to “Buy” the stock at the current price of $8.38

.png)

CCL Daily Chart (Source: Thomson Reuters)

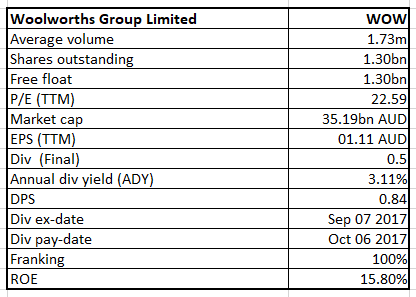

Woolworths Group Limited (ASX: WOW)

WOW Details

Appointment of new Managing Director: Woolworths recently appointed Steve Donohue as its new Manging Director who will start acting effectively from April 2018. WOW currently operates over 531 cities and has 12 sites in development. WOW sees a significant opportunity to improve the performance of BIG W while the group can benefit from margin expansion based on improved supplier support coupled with operating leverage. A better update is expected from the group given the Q1 FY18 results supported by good trading momentum. Particularly, Endeavour Drinks sales increased by 3.8% to $2.0bn in Q1 with comparable sales increasing by 3.3%. Hotels sales for the quarter were $441m, up 4.1%, and comparable sales increased by 4.1%. The trend in like for like sales, increasing customer satisfaction scores and focus on digital platform are expected to provide more room for improved performance. We give a “Buy” recommendation for the stock at the current price of $26.95

.png)

WOW Daily Chart (Source: Thomson Reuters)

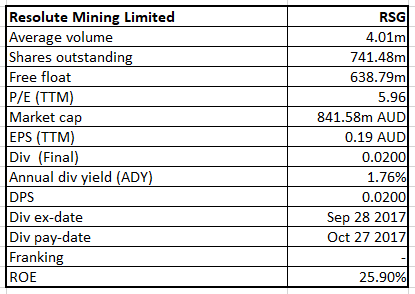

Resolute Mining Limited (ASX: RSG)

RSG Details

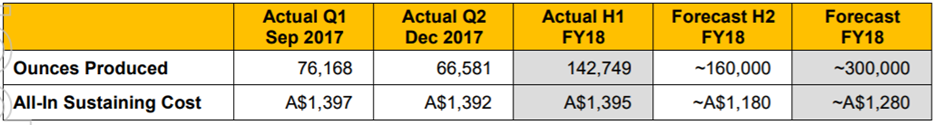

Positive Outlook for 2018: Resolute Mining’s FY18 guidance and forecasted gold production of 300,000oz with All-in Sustaining Cost (AISC) of A$1,280/oz has been maintained and this is quite encouraging. Improved production and cost performance in the second half of the financial year is anticipated by improved head grades for the Syama sulphide operations and also by an increase in ore production at Ravenswood. A definitive feasibility study outlined a plan for the new underground operations at Syama which will extend the mine life at Syama beyond 2028. The Syama Underground mine is currently underdevelopment and is due for project completion and the group will commence its full underground mining in December 2018. During the December quarter, Resolute paid a final dividend of 2 cents per share for FY 17 and the dividend payment of A$14.8M was equal to 2.7% of the total FY17 gold sales revenue of A$541M. It continued its innovative partnership with The Perth Mint so that it can offer its shareholders the opportunity to receive dividends in either cash or gold.

FY 18 Guidance (Source: Company Reports)

As a result, RSG stock has risen 9.66% in three months as on January 30, 2018 followed by a 3.1% rise on January 31, 2018. The stock is still trading at a very low P/E. We give a “Buy” recommendation on the stock at the current price of $1.17, given the potential to be witnessed in the coming months.

.png)

RSG Daily Chart (Source: Thomson Reuters)

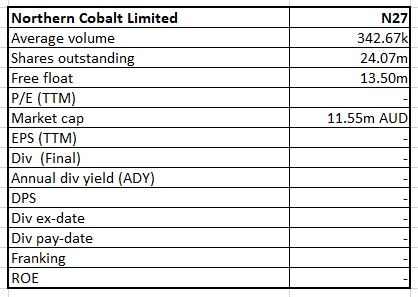

Northern Cobalt Limited (ASX: N27)

N27 Details

Encouraging Drilling Update: Northern Cobalt drilled 70 RC and 10 diamond core holes on its existing Stanton Cobalt resource which aimed to upgrade the existing inferred Mineral Resource of 500,000 tonnes of 0.17% Co, 0.09% Ni, 0.11% Cu and obtained material for metallurgy studies and for use in scoping studies. The Company has also flown a new aeromagnetic and radiometric survey which covered the Stanton Cobalt Deposit and a total of 3,685 line-km of high quality magnetic and radiometric data was acquired by Aerosystems Australia Pty Ltd. It also acquired 100% interest in nine prospective tenements in the Northern Arunta Pegmatite Province, Northern Territory and applications were made for 4 adjoining tenements. The share price has increased by 77.78% in past three months, and we recommend a “Speculative Buy” on the stock at the current price of $0.485

.png)

N27 Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.