Kalkine has a fully transformed New Avatar.

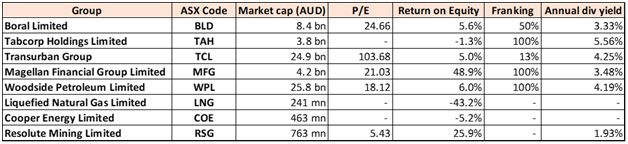

Boral Limited

Boosting capital position: Boral Limited (ASX: BLD)seems to benefit from the trends in the infrastructure sector going forward. The group is already witnessing strong markets in Australia, improving US markets, mixed conditions in Asia. Particularly, strong east coast markets in Australia with high infrastructure volumes and price gains in all major businesses are said to underpin revenue growth. BLD has now priced a dual tranche of US$450 million guaranteed senior notes with maturity on 2022 and US$500 million guaranteed senior notes with maturity on 2028.The notes maturing in 2022 have a fixed rate coupon of 3.00% while 2028 maturity notes have a fixed rate coupon of 3.75%. The group intends to use these proceeds for the Headwaters Incorporated acquisition. While there can be some currency revisions, FY18 earnings growth across all divisions with particular lift in Boral NorthAmerica andincreased Australian construction materials demand are expected to be key growth drivers. BLD stock rallied over 16.1% in the last six months (as of October 30, 2017) and we believe this momentum would continue. We put a “Buy” on this dividend yield stock at the current price of $7.15

.png)

BLD Daily Chart (Source: Thomson Reuters)

Tabcorp Holdings Limited

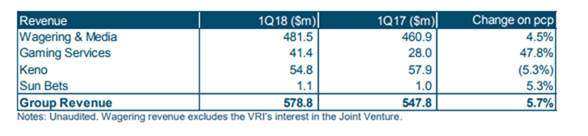

Positive first quarter of 2018 update: Tabcorp Holdings Limited (ASX: TAH)delivered a revenuerise of 5.7% year on year (yoy) to $578.8 million in the first quarter of 2018 on a yoy basis. The group’s Gaming Services division delivered a solid performance with revenue rising 47.8% yoy to $41.4 million, boosted by Intecq acquisition as well as TGS expansion benefits. Excluding Intecq, gaming services division rose 8.3% on a yoy basis.

Solid gaming services performance (Source: Company reports)

The group’s overall wagering turnover rose 3.5% yoy to $3,169.2 million, during the quarter while total TAB turnover (which excludes Luxbet) enhanced 4.5% yoy to $3,030.1 million. Digital channel business delivered a double-digit growth, rising 17% yoy to $1,133.3 million. The group forecasts an opex to revenue ratio of over 23% in first half of 2018, and is targeting an opex to revenue ratio of over 22.5% for the full year of 2018. Trading at a strong dividend yield and capable of benefiting from the dynamics of the Australian wagering and gaming environment, we give a “Buy” recommendation on the stock at the current price of $4.49

.png)

TAH Daily Chart (Source: Thomson Reuters)

Transurban Group

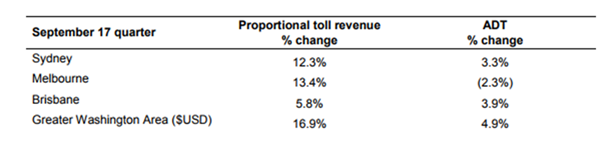

Strong toll revenue performance: Transurban Group’s (ASX: TCL)toll revenue enhanced 10.5% to $567 million during the September 2017 quarter against prior corresponding period (pcp).

Traffic and revenue performance (Source: Company reports)

Average Daily Traffic (ADT) enhanced 1.1% driven by Sydney, Brisbane and the Greater Washington Area offsetting Melbourne softness on the back of $1.3 billion CityLink Tulla Widening (CTW) upgrade. The CTW project was forecasted to open in late October, which is three months ahead of the schedule and budget. The group’s partnership with Victorian Government and Virginian Department of Transportation for new trials will help prepare vehicles and infrastructure as per the needs. We rate a “Buy” on this dividend yield stock at the current price of $12.13

.png)

TCL Daily Chart (Source: Thomson Reuters)

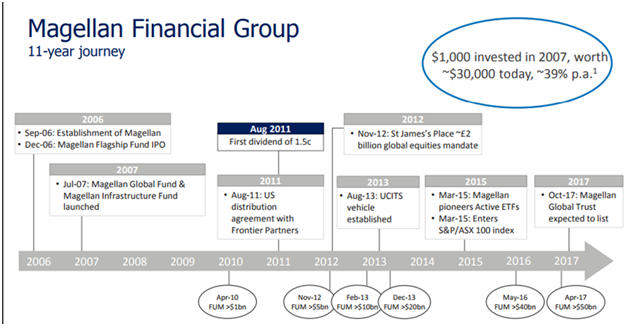

Magellan Financial Group Limited

Stable long-term player: Magellan Financial Group Ltd (ASX: MFG) reported for September 2017 FUM of A$51.6bn, which is up 2% on the prior month. MFG’s net inflows were of A$146m in the month while global equitystrategies saw net outflows of A$230m owing to unitholders switching tothe Magellan Global Trust.

Solid long-term performance (Source: Company reports)

For FY17, the group’s net inflows were ongoing, with Retail witnessing $1.7 billion while Institutional clients generated $2.3 billion. The Average funds under management surged 16% yoy to $45.7 billion during FY17. Management and services fee revenue enhanced 15% to $307.2 million. The Underlying profitability before tax and performance fees of the Funds Management business surged 15% to $226.8 million. MFG launched Magellan Global Trust and raised ~$1.57 billion with a lucrative 4% target cash distribution yield. We give a “Buy” on this dividend yield stock at the current price of $24.27

.png)

MFG Daily Chart (Source: Thomson Reuters)

Woodside Petroleum Limited

Ongoing focus on LNG: Woodside Petroleum Limited (ASX: WPL)reported a sales revenue of $914 million and sales volume of 21.1 MMboe for the third quarter of 2017. The group delivered an outstanding daily, weekly and monthly production at Pluto LNG. WPL implemented a portfolio LNG sales agreement for delivery of up to 12 cargoes between April 2018 and March 2020.

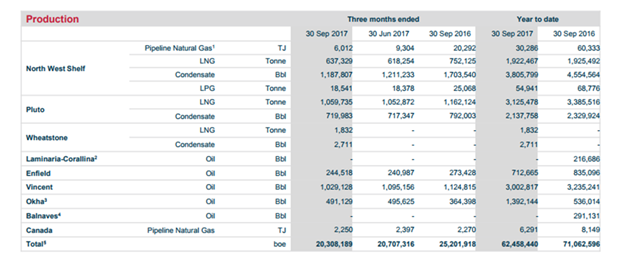

Production summary for third quarter of 2017 (Source: Company reports)

Production summary for third quarter of 2017 (Source: Company reports)

Wheatstone LNG started production subsequent to the quarter and is expected to reap benefits going forward. WPL stock rose over 2.9% in the last five days while we maintain our “Buy” recommendation at the current price of $30.73

.png)

WPL Daily Chart (Source: Thomson Reuters)

Liquefied Natural Gas Limited

Positive outlook: Liquefied Natural Gas Limited (ASX: LNG) recently reported that they are confident in signing offtake agreements with credit-worthy buyers later this year or early in 2018. The group signed an amended and restated equity commitment agreement with Stonepeak Infrastructure Partners for the Magnolia LNG project. The signing of a dredging servitude agreement for Magnolia LNG with Turners Bay, to deposit dredge spoils would recreate over 100 acres of Louisiana wetlands that were earlier destroyed by hurricanes. While the stock fell about 7.8% on October 31, 2017 post a 24% rise in last five days (as at October 30, 2017) owing to volatile conditions, we give a “Buy” on the stock at the current price of $0.47

.png)

LNG Daily Chart (Source: Thomson Reuters)

Cooper Energy Limited

Outstanding production performance: Cooper Energy Limited (ASX: COE) also lost 7.9% on October 31, 2017, in stock price post 10.5% rise in last five days (as at October 30, 2017). The group hadreported an outstanding quarterly production rise of 377% to 0.43 million boe as compared to 0.09 million boe in pcp. The revenue surged 194% yoy to $14.4 million. The group’s position with completion of $400 million debt and equity package will help it fund the Sole Project. The 2P Reserves were enhanced by 362% to 54 million boe. Further, COE made a tender for gas supply from Casino Henry from March 2018. Given the drivers for growth based on significant progress on organic growth projects and a favorable commodity scenario, we rate a “Buy” on the stock at the current price of $0.29

COE Daily Chart (Source: Thomson Reuters)

Resolute Mining Limited

Enhancement of Resources: Resolute Mining Limited (ASX: RSG) reported that the Syama Underground Mineral Resource Estimate currently has 5.7million ounces at 3.2 grams per tonne gold, which is a rise of 39% as compared to the earlier total underground resources. Syama Indicated Resources enhancement of 42% to 45.6 million tonnes at 3.2 grams per tonne gold for 4.7 million ounces. The Grade also rose 14% from 2.8 grams per tonne Au to 3.2 grams per tonne gold at 1.5 grams per tonne gold cut off. The group continues their drilling efforts at Nafolo as well as Syama. The completion of mining and optimisation studies at Syama can deliver mine life extensions and increased production.Trading at a very cheap price to earnings ratio, we rate a “Buy” on the stock at the current price of $1.03

.png)

RSG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.