Origin Energy Ltd

.png)

ORG Dividend Details

Outstanding dividend yield: Origin Energy Ltd (ASX: ORG) stock corrected heavily during this year and plunged over 44.70% during this year to date (as at December 02, 2015) as volatile commodity prices have been hurting the group’s performance. On the other hand, ORG reported a quarterly production increase by 13% to 47.8 PJe for its Integrated Gas business in September Quarter as compared to earlier quarter, driven by Australia Pacific LNG enhanced production and contribution from new Yolla 5 and Yolla 6 production wells in the Bass Basin. Therefore, the revenues during the quarter decreased only 1% as compared to the June quarter despite liquids prices and average gas prices pressure. Moreover, the group’s projects have been delivering positive results which might boost its prospects further. Origin’s joint venture of South Australian Cooper Basin with Senex Energy first gas exploration well was spudded last month and was cased and suspended for future. As per the Beach Energy’s November monthly drilling report, a six well development drilling campaign in Tirrawarra and Gooranie fields under the South Australian Gas development program (JV with ORG and Santos) has been completed with all wells cased and suspended while results from deep coal fracture stimulation program are expected in 3Q FY16. Further, two development drilling campaigns are underway in the Moomba Field. With regards to the South Australian Oil development (JV: Beach Energy, ORG and Santos), Merrimelia-64 was cased and suspended following intersection of oil shows throughout the Murta reservoir. Moreover, the Whanto East-1 well under the Queensland Gas exploration and appraisal program (JV: Beach Energy, ORG and Santos) was cased and suspended following intersection of gas pay as per the pre-drill estimates. Completion of pipelines for the 2015 Windorah-Marama development project with four wells connected and gas flowing, has been reported in Q1 FY16.

.png)

September quarter performance (Source: Company Reports)

Meanwhile, most of the upstream component of the APLNG CSG to LNG project is finished while the downstream component is 94% finished; and the LNG production has started and the first cargo would be delivered soon. Waitsia-1 appraisal well flow testing generated positive results, wherein the overall combined flow rate is more than 50 mmscf/d.

Origin Energy also has an outstanding dividend yield and we believe that investors need to leverage the correction to enter the stock. We reiterate our “BUY” recommendation on the stock at the current price of $5.55

.png)

ORG Daily Chart (Source: Thomson Reuters)

WorleyParsons Ltd

.png)

WOR Dividend Details

Realigned strategy to get back on growth track: Worleyparsons Limited (ASX: WOR) realigned its strategy on May 2015, and accordingly, the company is further developing its front end and several project delivery capabilities over its project execution phases. WOR is even boosting its integrated offerings to become a total asset management services provider. Worleyparsons is first targeting Advisian, its world class consulting business which is now the group’s standalone business line (since July 2015) having around 3,000 consultants spread across 19 countries with technical as well as management consulting capabilities. Worleyparsons is also positioning itself to become a major PMC (project management) provider of choice as well as enhanced its proficiency of its Improve business to offer a better integrated service in specific market. The group completed the acquisition of a management consulting firm, MTG that specializes in the oil and gas, petrochemicals and chemicals sectors. WOR even acquired a Canadian based consulting business Atlantic Nuclear, which focuses in nuclear technology comprise the CANDU technology. WorleyParsonsCord recently won a contract from Cutbank Ridge to offer cutback with pipe fabrication, module assembly and field construction services for its Partnership Program’s 03-07 Tower Sweet Gas Plant Project. WorleyParsonsCord estimates a revenue of over CAD164 million from this contract.

.png)

Performance by segment (Source: Company Reports)

On the other hand, the group’s shares plunged over 44.92% (as of December 02, 2015) over the last six months as falling commodity prices led to investments cut by WOR clients across the sectors. Consequently, WOR underlying revenue declined by 1.8% yoy to $7,227.5 during fiscal year of 2015. The stock is currently trading close to its 52-week low price.

However, the heavy correction in the stock placed WOR at attractive valuations. WOR also has an outstanding dividend yield of over 9.5%. We reiterate our “BUY” recommendation on the stock at the current price of $5.40

WOR Daily Chart (Source: Thomson Reuters)

Sundance Energy Australia Ltd

.png)

SEA Details

Enhanced operational efficiency to offset commodity pressure: Sundance Energy Australia Ltd (ASX: SEA) stock plunged over 47.12% (as of December 02, 2015) in the last six months due to commodity pressure. Therefore, to offset the mounting pressure, SEA has cut cash operating costs to $14.50/ Boe for the nine months ended on September 2015 as compared to $20.39 / Boe for the nine months ended on September 2014 (that is about 29%), driven by 3.90 per Boe decrease in G&A expenses. Accordingly, the group’s realized adjusted EBITDAX reached $52.9 million during this year-to-date and delivered $11.8 million for the third quarter even though the realized pricing plunged over 50% during the period. Sundance Energy spent over $18.1 million for its field optimization projects which would further decrease lease operating expenses. Meanwhile, to offset the commodity prices pressure, the group has a total of 1.5 million bbls hedged through 2019 having a weighted average floor of $56.15 and ceiling of $80.24. Sundance Energy also enhanced its net oil, natural gas and natural gas liquids production by 35% yoy to 1,980,031 Boe, or 7,934 Boe/d during this year-to-date. As per the November drilling update for the Washington-1 unconventional exploration well in PEL 570 (JV between Santos, Drillsearch and SEA), all three formations with a five-stage hydraulic stimulation campaign have been tested with encouraging initial gas flow rates.

We believe Sundance Energy would continue to benefit from its operational efficiency, hedging and rising production, which could partly offset the commodity prices pressure. We place a “BUY” on SEA at the current price of $0.27

.png)

SEA Daily Chart (Source: Thomson Reuters)

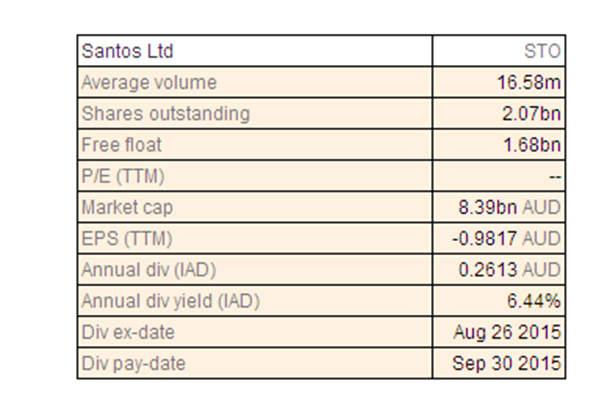

Strike Energy Ltd

.png)

STX Details

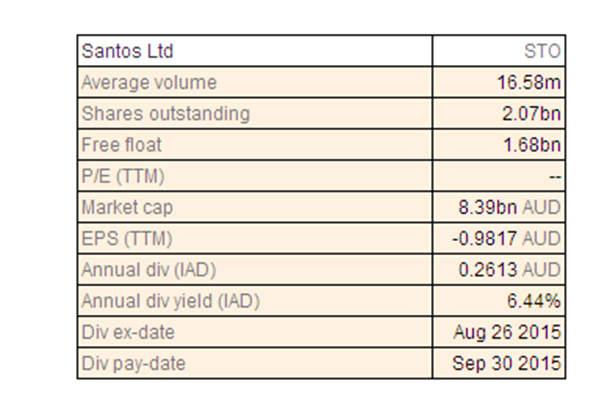

Building Southern Cooper Gas Project as a long-term resource: With regards to the update on the Southern Cooper Basin Gas Project in PEL 96 (JV with Energy World Corporation), Strike Energy Ltd (ASX: STX) recently reported that it has successfully completed the workover operations at Klebb 1 to replace the downhole pump unit and flow testing was to be recommencing on November 03, 2015. In September, the company announced that its Klebb Phase 3 Flow Testing Program had started while Klebb 2 and 3 have been performing more effectively while constraining the Klebb 1 drainage area than expected. Gas flows measured at the Klebb pilot location have increased during the quarter. STX also built a decent capital position with a cash of $9.6 million by the end of the September quarter to well position itself, to achieve its target of enabling Southern Cooper Gas Project as a long-life resource.

.png)

Southern Cooper Gas Project Strategic objective (Source: Company Reports)

Meanwhile, the shares of Strike Energy surged about 30% (as of December 02, 2015) in the last three months driven by its positive quarter results, and we believe that the positive momentum in the stock would continue in the coming months. Accordingly, we place a “BUY” recommendation on the stock at the current price of $0.13

STX Daily Chart (Source: Thomson Reuters)

Horizon oil Ltd

.png)

HZN Details

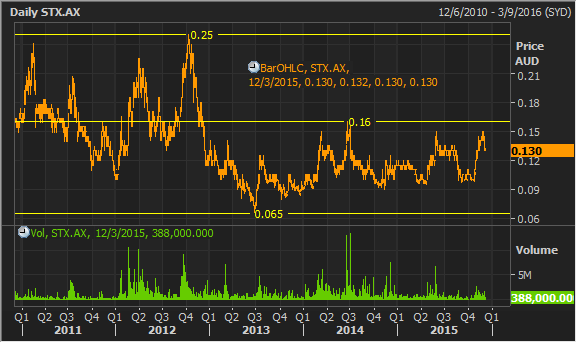

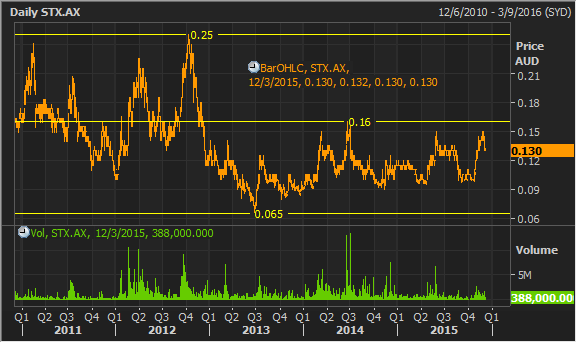

Hedging efforts coupled with better production and efficiency would add support: Horizon Oil Ltd (ASX: HZN) reported a revenue decline by 17% yoy to US$20.8 million during first quarter of 2016, as compared to US$25.08 million in fourth quarter of 2015 due to commodity prices pressure coupled with lower production revenue from Block 22/12 (Beibu Gulf) at China. Accordingly, the shares of Horizon Oil plunged around 45.95% (as of December 02, 2015) in the last fifty two weeks as falling crude oil prices lead to lower average realized prices impacting the group’s revenues. On the other hand, Horizon Oil is improving its production and delivered a 354,063 bbls production during the first quarter of 2016, with Crude oil production from PMP 38160 (Maari and Manaia) improving by 15.9% in 1Q16, as compared to the previous quarter. Through the Horizon Oil’s cost recovery oil entitlement for Block 22/12 China, the group raised over US$97.3d million as at September 2015, with which it is enhancing its production entitlement from the field from 26.95% to over 35% in 2016.

First quarter production highlights (Source: Company Reports)

The group is also boosting its balance sheet by purchasing and cancelling of US$21.2 million of 5.5% convertible bonds which are maturing in mid- 2016. This would decrease the group’s outstanding bonds to US$58.8 million of initial $80 million. Meanwhile, Horizon Oil recently reported that its WZ 12-8W-A6P1 appraisal well at Beibu Gulf, at China had spudded. HZNis focusing on operational efficiency to partially offset the falling oil prices pressure and accordingly cut its Opex by over 20% during this year to date at Block 22/12 as well as reducing its Capex to less than US$50 million during FY16.

HZN hedged 842,500 mmboe during 2015 Jan to mid-2016 at average of US$95/bbl to offset the pricing pressure, which would decrease the falling prices impact on cash flows.The heavy correction in the stock also placed Horizon Oil at very cheaper valuations with a relatively lower P/E of about 5x. Based on the foregoing, we give a “BUY” recommendation on the stock at the current price of $0.098

HZN Daily Chart (Source: Thomson Reuters)

Oil Search Ltd

OSH Dividend Details

Drilling updates and rejection of Woodside bid: Oil Search Limited (ASX: OSH) updated about the drilling of the Antelope 4 ST1 well up to a depth of 2,326 meters while the wireline logging was complete during the month of November 2015. The company also reported that drilling on Antelope 6 and production testing of Antelope 5 is expected to start soon. The company also continues to be on track with regards to the proposed LNG projects globally. OSH received $8.3 billion worth of merger proposal from Woodside Petroleum, wherein Oil Search shareholders would have received all scrip consideration of 0.25 Woodside shares for every Oil Search share and representing a 31.7% shareholding in the combined entity. But, Oil Search rejected Woodside Petroleum proposal citing that the deal value is lower than the group’s actual worth. As a result, the shares of Oil search have rallied over 24.51% (as of December 02, 2015) in the last three months, contrary to its peer’s performance which were under pressure on the back of challenging commodity prices environment.

WPL bid for oil search gave an insight on how much Oil search’s world class portfolio at Papua New Guinea and Australia could be worth of. We believe the stock would continue to maintain its positive momentum in the coming months, and accordingly give a “BUY” at the current price of $8.10

OSH Daily Chart (Source: Thomson Reuters)

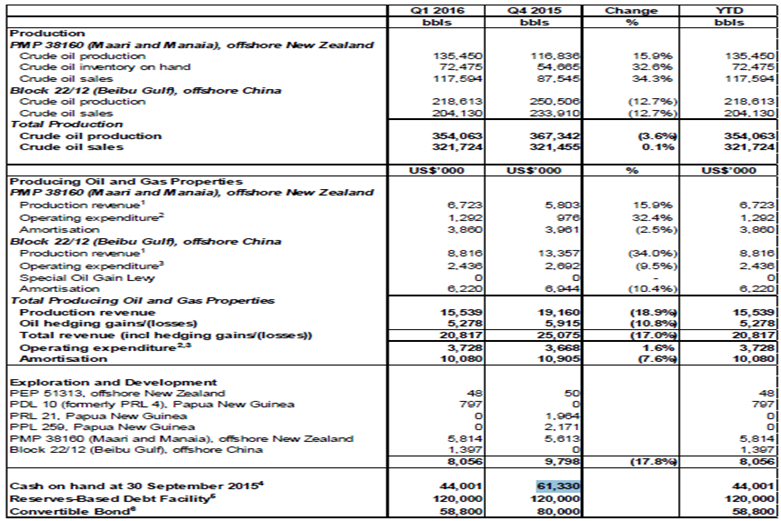

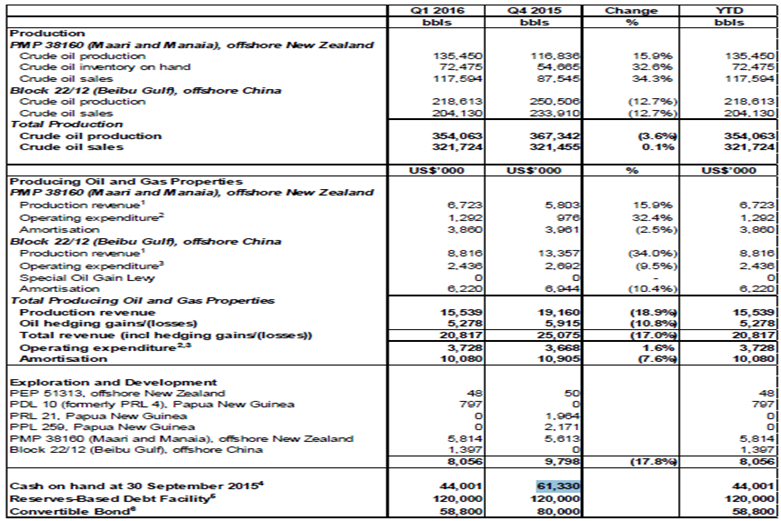

Santos Ltd

STO Dividend Details

Boosting capital position: Santos Ltd (ASX: STO) stock declined over 43.97% (as of December 01, 2015) in the last six months as falling oil prices impacted STO top line despite improving production and volumes. The group’s revenues plunged over 15% yoy to $1.6 billion in the first half of 2015 financial year, while reported a 24% yoy decline in the third quarter. On the other hand, Management reported that its PNG LNG as well as Darwin LNG performed well during the quarter, and with GLNG’s first production delivery, Santos estimates a solid fourth quarter LNG sales volume performance as well. Recently, STO’s 50% interest in Kingfish formation, sole field, offshore Gippsland Basin project improved its Contingent resources by 15 PJ to 121 PJ (JV partner’s Cooper energy share). The group’s cost cutting efforts are also on track, and STO even decreased its capital expenditure guidance for 2015 by 10% to $1.8 billion. Meanwhile, Santos issued a Production guidance of 57 to 59 mmboe during 2015 as compared to its earlier estimated production range of 57 to 64 mmboe. With Santos rejecting the Scepter Partners acquisition proposal, the sentiment towards the group enhanced further given its solid strategic decisions for the benefits of the shareholders. STO is also boosting its capital position and accordingly undertook initiatives to raise over $3.5 billion capital. The group is targeting to raise over $2.5 billion via retail entitlement offer and recently finished acceptances of 201 million new shares worth over $775 million, which represents 57% of the new shares that are available on the retail entitlement offer. It has also completed its retail shortfall bookbuild with the launch of an offer for about $585 million in new shares that have not been taken up by shareholders in the retail leg of the $2.5 billion equity raising. Santos also has a solid dividend yield.

We maintain our positive stance on the stock and reiterate our “BUY” recommendation at the current price of $4.13

STO Daily Chart (Source: Thomson Reuters)

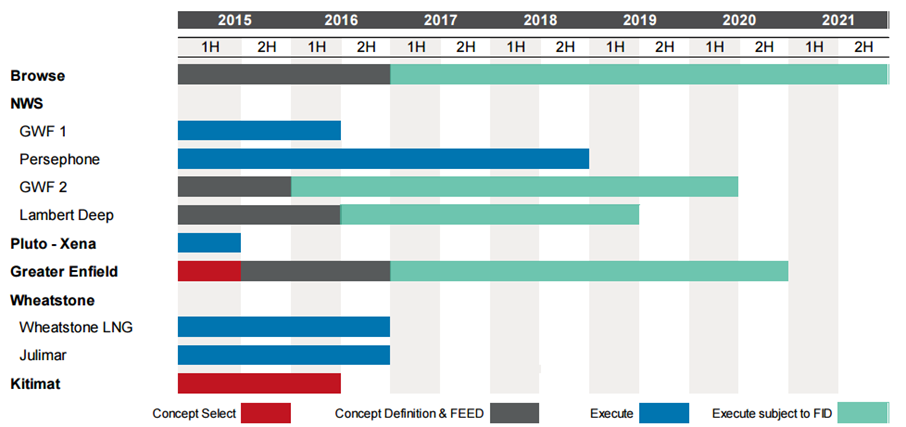

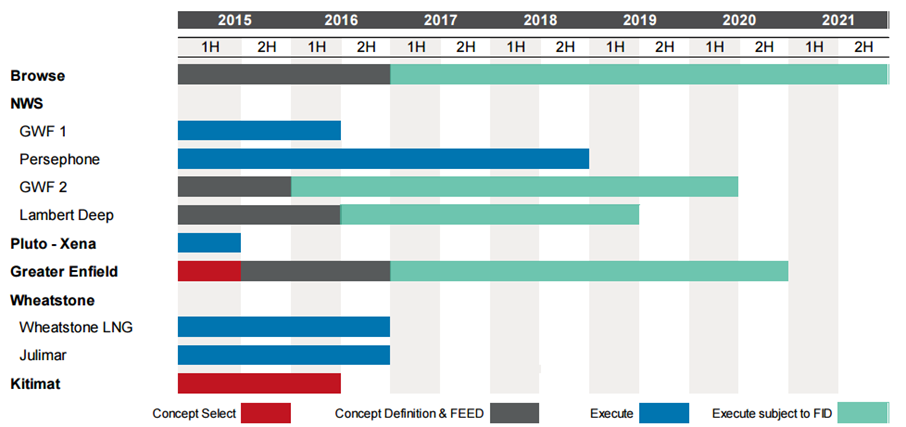

Woodside Petroleum Ltd

.png)

WPL Dividend Details

Outstanding dividend yield: The shares of Woodside Petroleum Limited (ASX: WPL) have been under pressure this year and corrected over 15.20% (as of December 02, 2015) in the last six months on the back of falling oil and LNG prices pressure coupled with Oil search rejection of Woodside Petroleum merger proposal. Moreover, WPL has revised its production target range for the full year of 2015 to the range of 88 to 93 MMboe as compared to its earlier production range of 86 to 94 MMboe. On the other hand, WPL is building a solid assets pipeline to drive growth in the long term. Woodside expects a solid Pluto performance (which even comprises completion of the major turnaround ten days ahead of schedule) as well as over 1.3 MMboe contribution on the back of better performance range from the Vincent Phase IV in-fill well which was drilled this year along with better facility performance. In Australia, the group finished the primary resource evaluation for the Pyxis-1 gas discovery, at Production Licence WA-34-L, with which the group added 68 MMboe of net contingent recoverable resources (2C).

Solid development pipeline ahead (Source: Company Reports)

WPL executed the Torosa Apportionment Deed of Agreement for Australia Browse FLNG project in July. The first gas might start by the second half of the next year in Wheatstone LNG Project. The group’s operated Julimar Project (which has Julimar and Brunello fields) is targeted to start by the second half of 2016. Moreover, WPL is trading at very attractive valuation with a cheaper P/E of about 9x, as well as has a strong dividend yield of 8.97%.

Based on the foregoing, we reiterate our “BUY” recommendation on Woodside Petroleum stock at the current price of $29.46

WPL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...