Magellan Financial Group

-

Solid funds under management performance: Magellan Financial Group Ltd (ASX: MFG) funds have a track record of generating better returns as compared to the broader index , while its funds management business delivered a solid increase of revenues to $255.9 million during the fiscal year of 2015, against $139.1 million in the last fiscal year. Magellan Global Fund delivered 29.5%, after fees, during the twelve months to 30 June 2015, beating the MSCI World Net Total Return Index (AUD) by 4.9%. The Magellan Infrastructure Fund also witnessed a solid performance delivering 12.3%, after fees, during the 12 months to 30 June 2015, surpassing the Global Infrastructure Benchmark by 4.8%. Meanwhile, the group also launched the ASX quoted version of our Global Equities strategy, Magellan Global Equities Fund during the period.

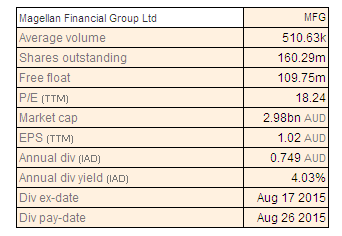

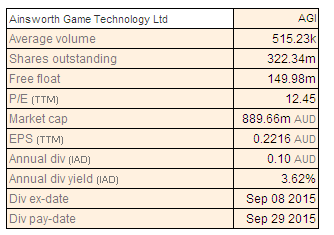

Magellan Financial Dividends (Source - Thomson Reuters)

Magellan Financial Dividends (Source - Thomson Reuters)

-

The Magellan Global Equities Fund had funds under management of $205 million as at 30 June 2015. Moreover, Magellan Financial Group shares generated a year to date returns (as at Sep 11) of 12.5% against the broader index decline of 6.3% during the same period. The shares have been relatively firm despite the recent volatility in the markets, and rallied by 3.7% in the last five days (as at Sep 11) as compared to the broader index return of 0.6%. We believe MFG is among undervalued companies trading at a relatively cheaper P/E of 18.2x, as compared to its peers. The group has a decent dividend yield of 4%. We remain bullish on the stock and recommend a “BUY” to investors at the current price of $18.52.

.png)

Retail Global equity Strategy FUM and Net Inflows (Source: Company Reports)

Webjet Limited

-

Outstanding transactional value Performance: The shares of Webjet Limited (ASX: WEB) rallied over 20.4% over the last three months as well as delivered a year to date returns of 34.6% (as of Sep 11), as compared to the broader index S&P/ASX 200 decline of 8.6% over the last three months and 6.3% year to date. The group’s overall transactional value (TTV) delivered an outstanding performance surging by 31% year over year to $1.26 billion for the fiscal year of 2015.

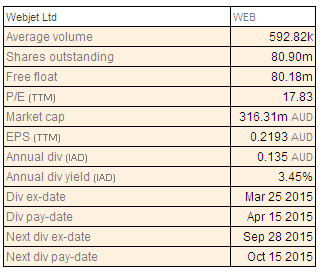

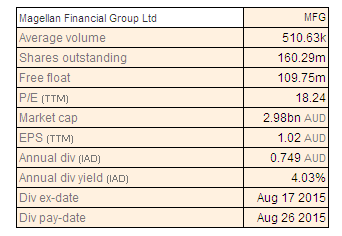

Webjet Dividends (Source - Company Reports)

Webjet Dividends (Source - Company Reports)

-

Accordingly, the revenue improved by 21% yoy. However, the higher effective tax rate of 24.5% in FY15 (as compared to 9.3% in FY14) posed pressure on profit after tax which fell by 8.5% yoy during the period. WEB’s TTV also had a positive start during the fiscal year of 2016. Management is also pursuing acquisition opportunities to expand in Asia and America regions. We recommend a “BUY” on Webjet at the current levels of $4.04.

G8 Education Ltd

-

Delivered solid like for like growth, ending investors’ concerns:G8 Education Ltd (ASX: GEM) stock fell over 20.9% year to date (as of Sep 11), on investors’ concerns over its dependence on acquisitions to drive its growth. But the group delivered a revenue growth of 5.6% yoy during the first half of 2015, driven by the like for like growth. GEM also improved its center EBIT margin to 21.4% during the period, as compared to 19.4% in pcp. The growth inchildcare services would continue to drive the group’s performance and GEM is focusing on acquisitions as well as internal performance to achieve growth in the coming periods.

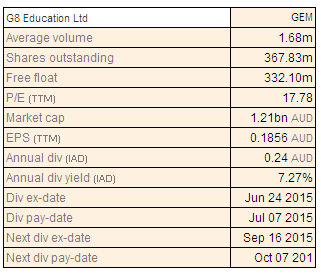

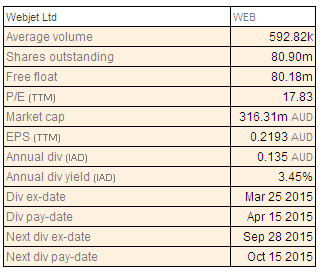

G8 Dividends (Source - Thomson Reuters)

G8 Dividends (Source - Thomson Reuters)

-

Better than estimated results drove the shares of GEM higher during this month, generating a returns of over 5.1% (as of Sep 11) despite the broader S&P/ASX 200 index decline of 5.8% in the same period. The group is also trading at a cheaper P/E of 17.8x, and has a solid dividend yield of 7.3%. Investors hunting for bargain opportunities could consider adding GEM in their portfolio, and based on the foregoing, we reiterate our “BUY” recommendation on the stock at the current levels of $3.33

.png) Acquisitions by year (Source: Company Reports)

Capitol Health Limited

Acquisitions by year (Source: Company Reports)

Capitol Health Limited

-

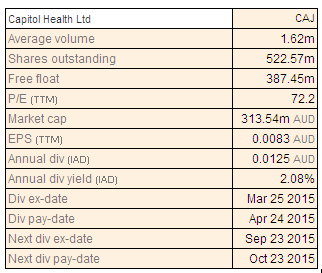

MRI market focus coupled with acquisitions to support growth: Capitol Health Ltd (ASX: CAJ) revenues soared by 23% yoy to $111.2 million in FY15, boosted by improving market share, organic growth, synergies from SR and IOP acquisitions and government regulatory changes to MRI referral rights. The federal government declared a Diagnostic Imaging Review Reform Package of around $100 million to enhance availability as well as affordability of MRI services in Australia in 2012. The group’s underlying net profit before tax soared 59% yoy to $16.2 million, supported by the better operational efficiencies.

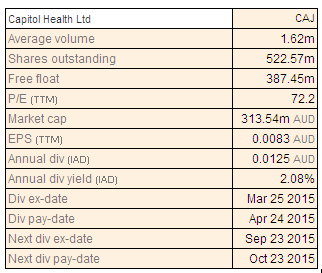

CAJ Dividends (Source - Thomson Reuters)

CAJ Dividends (Source - Thomson Reuters)

-

Consequently the group’s NPBT margin surged by 325 basis points to 14.5% in FY15, from 11.3% in FY14. CAJ’s EPS rose by 48% to 2.5 cents in FY15, against 1.68 cents in FY14 and accordingly, the group improved its dividend per shares by 39% to 1.25 cents in FY15, from 0.9 cents in FY14. On the other hand, CAJ stock plunged over 41.5% in the last six months (as of Sep 11), against the broader S&P/ ASX 200 decline of 13.3%. But the recent financial performance coupled with support by the government to players who are focusing on MRI market is estimated to drive the stock further. Capitol health clinics has seven Medicare-funded MRI licenses. Rising ageing population and sub-specialty radiology focus would also continue to be the key drivers ahead. Based on the foregoing, we suggest a “BUY” on CAJ at the current stock price of $0.62.

.png) Improving performance over the years (Source: Company Reports)

Ainsworth Game Technology Limited

Improving performance over the years (Source: Company Reports)

Ainsworth Game Technology Limited

-

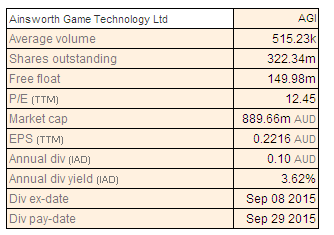

Positive Outlook: Ainsworth Game Technology Limited (ASX: AGI) reported a 14% yoy rise in audited profit after tax of $70.4 million for the fiscal year of 2015, despite 1% yoy decline in revenues (to 240.6 million). This increase was partly driven by the positive foreign currency gains of $25.6 million ($17.9 million after tax) during the period on the back of falling Australian dollar. Accordingly, Earnings per share (EPS) increased by 16% yoy to 22 cents per share. Better America’s region revenue performance (+47% yoy growth) partly offset the domestic operations pressure which fell by 35% on a year over year basis. However, management commented that its product launches like A600 coupled with strong organic sales would drive its profits in next fiscal year.

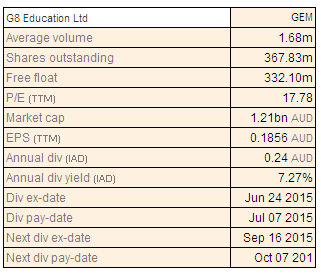

AGI Dividends (Source - Company Reports)

AGI Dividends (Source - Company Reports)

-

Americas region performance is estimated to continue in the coming periods while the group’s new facility opening in 2016 at Las Vegas might also offer support in future. AGI shares generated a year to date returns of around 17% this year (as of sep 11), despite broader index S&P/ASX 200 pressure of 6.3%. Still the stock is trading at an attractive P/E of 12.5x, and has a decent dividend yield of 3.6%. Based on the foregoing, we suggest a “BUY” on AGI at the current stock price of $2.83.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...