Kalkine has a fully transformed New Avatar.

Stocks’ Details

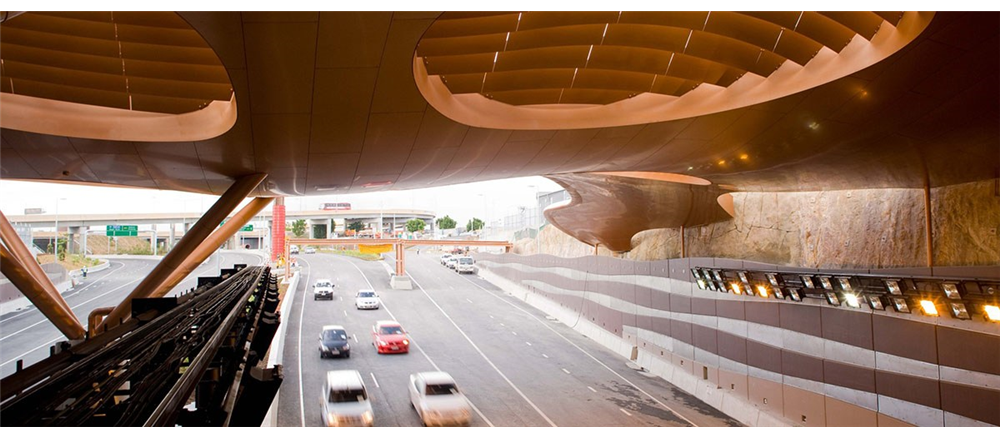

Transurban Group Limited

Dividend to be paid on 15 Feb.:Transurban Group Limited (ASX: TCL) is engaged in managing and developing urban toll road networks in North America and Australia. Recently, TCL has entered into an agreement with Virginia Department of Transportation for the extension of the 495 Express Lanes for 3.2 km towards the Maryland border, the construction of which will start after the closure of FY21. Further, the company will be paying a dividend of 29 cents per share on 15 February 2019.

FY18 Financial highlights (Source: Company Reports)

During FY18, the company reported higher than industry EBITDA margin of 50.6% as compared to the industry median of 48.4%. Further, the returns generated for the shareholders have improved over the years as the ROE was 6.0% in FY14 which has improved to 10.1% in FY18 with an average growth of 1.025% per annum. It is able to convert its inventory to cash in a more efficient way than its peers as its cash conversion cycle stood at 29.4 days for FY18 as compared to the industry median of 36.4 days.

Over the past three months, the stock has generated a positive yield of 9.07%. The Relative Strength Index along with the Bollinger band is visible in a neutral position. With the signing of new agreements, dividends to be paid on 15 Feb., higher than industry EBITDA margin, improving ROE and lower than industry cash conversion cycle,we give a“buy” recommendation on the stock at the current market price of $12.040 (down by 0.824% today).

Boral Limited

1H19 results to be declared on 25 Feb.:Boral Limited (ASX: BLD) is an Australia-based material company engaged in manufacturing and supplying building and construction materials. For FY19, the company expects an EBITDA growth of 15% in USD from Boral North America and slightly lower profits from USG Boral. Also, the EBITDA from Boral Australia (excl. Property) is expected to be similar to FY18. The company will be declaring its 1H FY19 results on 25 February 2019.

Financial Calendar (Source: Company Reports)

Over the past five years,the margins of the company have improved but are reported below the industry medians. During FY18, the company reported EBITDA and Net margin of 15.6% and 6.9% respectively as compared to the industry median of 20.2% and 9.5% respectively.It reported a higher than the industry dividend yield of 5.82% as compared to the basic material industry median of 3.6% representingmore income for its shareholders.

Over the past three months, the stock has generated a negative yield of 17.27%. The RSI along with the Bollinger band is visible in a positive territory. By looking at its improving but lower than industry margins and the latest update for FY19 being lower than the expectations, we recommend a ‘Hold’ position on the stock at the current market price of $4.650 (up by 2.198% on 5 February 2019).

Downer EDI Group

Decent FY19 outlook: Downer EDI Group (ASX: DOW) is engaged in building, designing, and sustaining infrastructure, assets, and facilities for its clients in New Zealand and Australia. As per its FY19 earnings guidance, DOW is targeting NPATA of $335 million before minority interest with an increase of 13% over pcp. Further, it has been selected by the New South Wales Government to build Stage 1 of the Parramatta Light Rail Project which will generate a revenue of $420 million.

FY18 Financial highlights (Source: Company Reports)

Over the past 5 years,the revenue of the company has grown at a CAGR of 13.02% (FY14-FY18). During FY18, it reported a higher than industry gross margin of 44.6% as compared to the industry median of 36.2%.The company has a favourable capital structure with a debt to equity ratio of 0.53x in FY18. Further, the asset turnover ratio of 1.56x was above the industry median of 0.8x showing thatthe company is utilizing its assets in a better way than its peers to generate revenue.

During the last month, the stock has generated a positive yield of 12.42%. By looking at its decent FY19 outlook, revenue growth of 13.02% CAGR over the past 5 years, favourable capital structure, and better utilization of assets, we, therefore, maintain our ‘Buy’ recommendation on the stock at the current market price of $7.390 (up by 0.819% today).

James Hardie Industries PLC

3Q FY19 updates: YTD James Hardie Industries PLC (ASX: JHX) is an Ireland-based building material company which specialises in fibre cement products. The company will be paying a dividend of US 10 cents per share to CUFS holders on 22 February 2019. Further, it reported a 441% growth in Net tangible assets per ordinary share for YTD 3Q19 (US$1.33) over YTD 3Q18 (US$0.39). It expects the single-family new construction market to grow at a lower rate in FY19 than in FY18 and expects a net operating profit in the range of US$295 million to US$315 million.

YTD 3Q19 Financial highlights (Source: Company Reports)

During YTD 3Q19, the gross profit increased by 15.08% over pcp and was reported at US$620.4 million. Similarly, the net operating profit also increased by 11.93% on pcp and was reported at US$228.0 million. There was a growth in the volume as well by 32.95% over pcp and stood at 2,727.8 mmsf.

During the last one month, the stock has generated a positive yield of 0.20% and is trading at lower price levels. By looking at its FY19 outlook, decent YTD 3Q19 performance, and price trading at lower levels, we have a ‘wait and watch’ stance on the stock at the current market price of $15.980 (up by 5.618% on 5 February 2019) and we suggest to investors that they should wait for a few more trading sessions to get the better entry levels.

Stock Price Comparative Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.