Kalkine has a fully transformed New Avatar.

.png)

Stocks’ Details

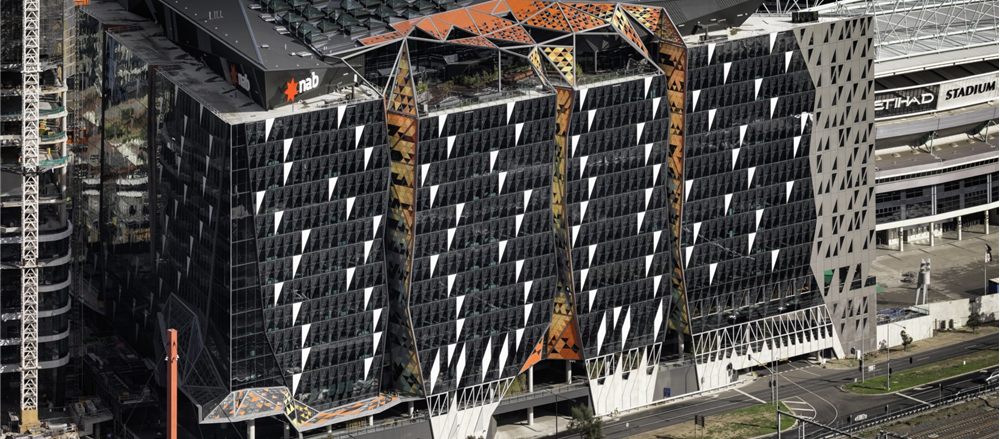

National Australia Bank Limited

Witnessing Higher Liquidity Coverage Ratios: National Australia Bank Limited (ASX: NAB) is one of the leading banks in Australia. Major segment includes Business & Private Banking, Consumer Banking & Wealth Management, etc.

NAB recently announced that it has become an initial substantial holder in Nine Entertainment Company Holdings Limited with the voting rights of 5.112%.

.png)

Results 1HFY19 (Source: Company Reports)

The reported net profit for the bank posted a growth of 4.3% to $2,694.0 million in 1HFY19 and an increase of 1.0% excluding the impact of discontinued operations.

The cash earnings of the company came in at $2,954 million,includes the impact of customer-related remediation of $325 million in the March 2019 half year and restructuring-related costs of $530 million in the prior corresponding period. The common equity tier 1 ratio increased to 10.40% by 20 bps as compared to September 2018 and is well placed to exceed APRA’s strong target of 10.5% by January 2020. The liquidity coverage ratio stood at a quarterly average of 130.0% along with a net stable funding ratio of 112%.

Although the asset quality metrics was impacted by higher arrears for Australian housing lending, however, the company was able to keep the loss rates of the portfolio to as low as 2 bps.

The company reduced its dividend by ~16%, primarily due to the more difficult operating environment and to improve capital generation. 1H19 dividend pay-out ratio was 77% of cash earnings (70% excluding customer-related remediation). Moreover, NAB has a potential to grow the dividend in the medium term. The company has recently announced to pay a dividend of AUD 0.830 on ordinary fully paid shares with the payment date of July 3, 2019. The current dividend yield stood at 6.83%.

Guidance on Expense Growth: Going forward, NAB expects to continue to target broadly flat expense growth for FY19 and FY20, excluding large notable expenses like customer related remediation and restructuring-related costs.

The stock has yielded a YTD return of 12.74%. NAB exhibited decent operational performance coupled with strong key ratios as per the industry standards. Moreover, with the key financials improving over the half yearly period, we expect NAB to perform better, going forward. Hence, we give a “Buy” recommendation on the stock at the current market price of $26.750 (up 0.413% on 06 June 2019).

Westpac Banking Corporation

Sound Credit Quality: Westpac Banking Corporation (ASX: WBC) is engaged in the banking and financial services related activities.

.png)

1HFY19 Results (Source: Company Reports)

Net profit for Westpac Banking Corporation for the first half of 2019 stood at A$3,173 million, a decrease of A$1,025 million or 24% as compared to 1HFY18. The first half 2019 included significant provisions for estimated customer refunds, payments and associated costs, and costs associated with the restructuring of the wealth business, which together reduced net profit after tax by $753 million.

Net interest income decreased by A$15 million to A$8263 million as compared to First Half 2018. Average interest-earning assets grew 4%, mostly from total loan growth but this was more than offset by a net interest margin decrease of 7 basis points to 2.09%.

The credit quality remained sound, with key metrics relatively stable over the half and over the prior corresponding period. Stressed exposures to total committed exposures were changed little at 1.10% at March 2019, up 2 basis points from September 2018.

The Common equity Tier 1 capital ratio stood at 10.64% which is above APRA’s unquestionably strong benchmark. Net interest margin (excluding Treasury & Markets) was down 12bps from prior corresponding period due to provisions for customer refunds and higher short-term funding costs.

The company will pay an interim ordinary dividend on 24 June 2019. After allowing for the interim dividend, the Group’s adjusted franking account balance was $1,234 million. The company has an annual dividend yield of 6.81%.

What To Expect Going Forward: The prices are likely to remain soft and home building is set to reduce through 2019 and into 2020. The company expects system housing credit growth to slow to 3% in the current bank year and fall further next year to 2.5%. That would imply total credit growth slowing to 3% this year and 2.8% next year. Although the second half will continue to be challenging, the company believes that its service-led strategy will remain the best way to create value for shareholders.

The balance sheet remained healthy for the company, with a strong common equity Tier 1 capital ratio in a low growth environment, allowing the company to absorb the significant impact of customer remediation provisions and the costs of the wealth reset. The liquidity & funding metrics of the company remained above the regulatory requirements with a sound credit quality of its loan book. Hence, considering the above-mentioned facts, we recommend a “Buy” rating on the stock at the current market price of $27.830 (Up 0.76% on 06 June 2019).

G8 Education Limited

High EBITDA To Cash Conversion Ratio: G8 Education Limited (ASX: GEM) provides high quality developmental and educational child-care in Australia.

.png)

CY18 Results (Source: Company Reports)

The 2HCY18 dividend of 8.0 cents, represents a ~75% pay-out of NPAT (Net Profit After Tax), was paid in April 2019. The company has an annual dividend yield of 6.12%.

Acquisitions contributed net earnings of $17.5 million in FY18, up 14% Y-o-Y. However, the performance of prior year acquisitions was mixed, and the results were below expectations in 2HCY18. Importantly, occupancy has continued to trend in the right direction and where necessary, action plans that have been put in place are yielding positive early signs. The revenue increased by 8.0% to $857.75 million.

The Group has a strong cash flows with reported EBITDA to cash conversion of 107% and underlying cash conversion of 98%as well as the successful completion of the balance sheet refinancing ensures that G8 is well positioned to execute on its strategic initiatives, while remaining conservatively geared.

Outlook Moving Ahead: The occupancy growth of the group in the latter part of 2018, when combined with a slowdown in supply growth over the same period, are positive signs that the operating environment will be more favourable in 2019. While the maturing of centres that were opened during 2017 and 2018 are forecasted to put pressure on market occupancy levels in 2019, the new childcare subsidy regime that was introduced in July 2018 is expected to offset this increased supply, although the extent and timing are not certain.

The stock has generated a YTD return of 8.09% and is trading slightly towards its 52-week high price of $3.635 with PE multiple of 18.53x. Based on the acquisitions of 3 centres post 31 December 2018 and decent financial performance including robust cash flows, GEM is placed well for decent growth, going ahead. Considering the aforesaid facts and current trading level, we recommend to “Hold” the stock at the current market price of $2.990 (up, ~1.70% as on 06 June 2019).

Comparative Price Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.