Kalkine has a fully transformed New Avatar.

.png)

Stocks’ Details

Santos Limited

Moomba South Appraisal Phase 1 Completed: Santos Limited (ASX: STO) recently announced the successful completion of the Moomba South Patchawarra Formation phase 1 appraisal program in the Cooper Basin. The company’s top management stated that Santos is investing in Cooper Basin to find more gas for east coast domestic market. For FY 2018, the Sales revenue was up 18% and came in at $ 3,660 Mn. This rise was witnessed on the back of strong operating performance and higher commodity prices.

The company’s underlying profits rose by 129% to come in at $727 million. This profit performance was achieved on the back of continued cost efficiencies which were mainly driven on the back of decline in production costs as these fell by 6% to $7.62/boe.

What To Expect From STO: As regards the outlook, the management has provided 2019 upstream unit production cost guidance of $7.50-8.00/boe.For FY 2019, the management has provided capital expenditure guidance of ~$1.1 billion, sales volumes guidance of 88-98 mmboe, and production guidance of 71-78 mmboe.

.png)

STO’s Financial Highlights (Source: Company Reports)

On the analysis front, the company has a robust balance sheet with $3.3 billion in cash and committed undrawn debt facilities which are sufficient enough to fuel its growth plan in the upcoming future.

The stock has delivered a YTD returns of 29.17% and is trading close to 52-week higher level of $7.480. Based on the foregoing and current trading level, we have a “Hold” recommendation on the stock at the current market price of A$7.020 per share (up 2.933% on April 9, 2019).

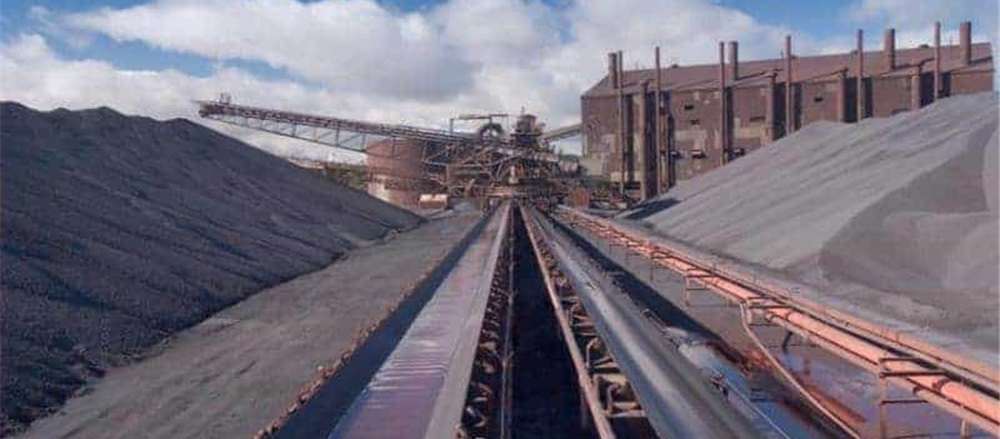

South32 Limited

South32 Delivers Earnings Growth: South32 Limited (ASX: S32) has reported its 1HFY19 results in which it reported a revenue of US$3.811 billion vs. US$3.4 billion reported in 1HFY18 reflecting a rise of 9%.Further, the underlying earnings came in at US$642 million registering a healthy 18 per cent growth on pcp basis. The high production at Australia Manganese, higher commodity prices, and strong operating performance supported profit after tax for the half year. The underlying earnings per share growth of 20 per cent was supported by the on-market share buy-back activity.

What To Expect From S32: As regards the outlook, the group’s production volumes are expected to rise by 5% in FY19, or 7% on a per share basis as the company benefits from its ongoing on-market share buy-back program. The company has lowered FY19 guidance for sustaining capital expenditure, including EAI, by US$30 million to US$545 million.

.png)

Operating Margin Analysis (Source: Company Reports)

The stock has delivered a positive return of 17.74% in the past one year. However, in the past three months, the stock posted 14.96% return, showing decent return over the said period. Hence, considering the strong operating performance along with decent returns over the period of one year, we maintain our “Hold” recommendation on the stock at the current market price of A$3.770 per share (down 2.835% on April 09, 2019).

Syrah Resources Limited

Production Beats Guidance at Balama: Syrah Resources Limited (ASX: SYR) had, in a recent announcement, stated that the UBS Group AG and its related bodies corporate has increased its voting power from an erstwhile 7.48% to 8.50% represented by 29,280,462 Person’s Votes as on 3 April 2019.

The company has also released Balama graphite operation Q1 2019 preliminary update. As per the same, the company has exceeded its graphite production guidance, as the production came in at 48kt vs the guided figure of ~45kt. The sales volume was within the guided range of 45kt -50kt. The weighted average price achieved has been within the upper end of the guided range of US$460 – US$470 per tonne. The company had cash of US$62 million in hand as at 31 March 2019.

The company released its annual report for the period ended December 31, 2018, in which it stated that the loss after income tax stood at $29.0 million as compared to $12.3 million in the pcp.

The company’s total assets at the end of December 2018 stood at $473.8 million as compared to $418.5 million in the previous year. The rise in total assets was mainly due to completion of fully underwritten $68 million (A$94 million) institutional placement as well as subsequent Share Purchase Plan to the eligible shareholders which helped in raising additional $6 million (A$9 million) at A$2.23 per share.

.png)

FY18 Income Statement (Source: Company Reports)

What To Expect From SYR: With respect to Balama Graphite Operation, the company is expected to witness production ramp up and optimisation and is targeting natural flake graphite production for 2019 of approximately 250,000 tonnes with the ramp up on the back of market fundamentals, achieving appropriate pricing margins and ongoing production improvement plan. With regards to Battery Anode Material Project, the company stated that phase 1 commercial scale feasibility capital efficiency review is underway, and the company would continue the assessment of strategic relationship options in downstream production.

Syrah Resources is looking pretty much attractive as its P/B ratio stood at 0.72x as compared to the peer median of 2.39x reflecting that the company is undervalued at the current juncture. However, the stock can be considered as volatile as it delivered return of 12.50% in the past one month while, in the span of previous three months, the return was -26.48%.

Considering the above factors, we maintain our “Speculative Buy” recommendation on the stock at the current market price of A$1.265 per share (down 3.065% on April 09, 2019).

Comparative Price Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.