National Australia Bank Ltd

.png)

NAB Dividend Details

Strong dividend Yield: National Australia Bank Ltd.’s (ASX: NAB) stock has corrected over 21.47% in the last six months (as at January 22, 2016). The bank recently announced that it is proceeding with the demerger and proposed initial public offer (IPO) to institutional investors of CYBG PLC (CYBG). NAB is pursuing a demerger of 75% of CYBG to NAB shareholders and a divestment of the remaining 25% by IPO to institutional investors. Furthermore, the bank announced commencement of marketing and price range of the IPO with a global marketing roadshow in London and price range to be in between 175 pence and 235 pence per CYBG share resulting to a market capitalization of around A$3.19 billion to A$4.29 billion. The CYBG shares will be listed on the London Stock Exchange’s main market for listed securities (LSE: CYBG) and commence trading on 2 February 2016 on a conditional basis.

.png)

Core business in better shape (Source: Company reports)

For full year 2015, on a statutory basis NAB recorded net profit attributable to the owners of the company at $6.34 billion, an increase of 19.7% from year ago period while cash earnings stood at $5.84 billion, an increase of 15.5%.

The bank maintains a common equity tier 1 ratio (CET1) of 10.2% as of September 2015, expansion of 137 basis points from March 2015, indicating a strong balance sheet. With a strong dividend yield and reasonable PE ratio, we rate the stock a “BUY” at the current share price of $26.92.

.png)

NAB Daily Chart (Source: Thomson Reuters)

Australia and New Zealand Banking Group Ltd

.png)

ANZ Dividend Details

Growing customer base as well as strengthening balance sheet: For financial year 2015, Australia and New Zealand Banking Group Ltd (ASX: ANZ) reported CET1 ratio of 9.6% as compared to 8.8% in 2014 indicating strong capital. Meanwhile, balance sheet is growing with total assets at $889.9 billion in 2015 compared to $772.1 billion in 2014. Cash profit stood at record $7.2 billion compared to $7.1 billion in 2014. In 2015, net loans and advances increased 9% to $570.2 billion while customer deposits was up 10% to $444.6 billion from 2014 levels. In 2015, the bank recorded a 20% profit uplift in Greater China, its third largest market. Meanwhile, the number of bank's retail customers in Australia recorded more than 150,000 in 2015.

.png)

Financial Highlights (Source: Company reports)

Looking ahead into 2016, there are significant opportunities for ANZ based on the strength of customer franchises in Australia, New Zealand and in 32 countries in Asia, the Pacific, Europe and America. ANZ stock corrected over 12.48% (as of January 22, 2016) in the last four weeks. Lower economic growth, the growing cost of regulation and market volatility present challenges for all banks however the bank management believes that ANZ is well positioned to maintain its momentum and to deliver growth and value to shareholders over the medium term. With a good dividend yield and low PE ratio, we rate this stock as a “BUY” at the current share price of $23.35

.png)

ANZ Daily Chart (Source: Thomson Reuters)

Commonwealth Bank of Australia

.png)

CBA Dividend Details

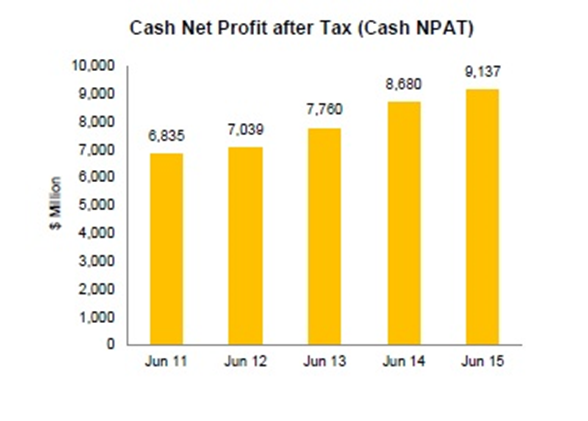

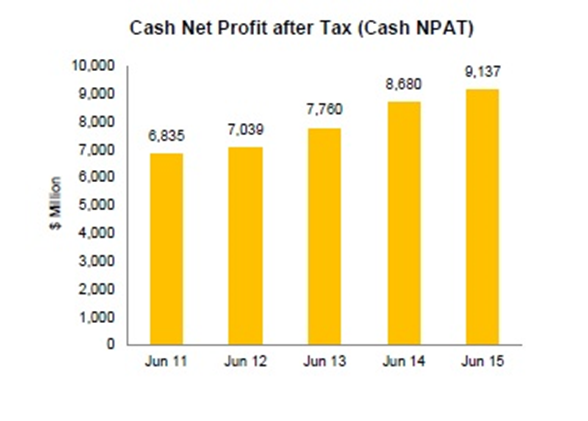

Higher Valuations:For the full year 2015, Commonwealth Bank of Australia (ASX: CBA) reported a net profit after tax on a cash basis of $9,137 million, an increase of 5% from the previous year. Earnings per share on a cash basis increased 5% on the prior year to 560.8 cents per share and return on equity, also on a cash basis, decreased 50 basis points on the prior year to 18.2%. In line with the bank's dividend policy, the final declared dividend stood at $2.22 per share representing a dividend payout ratio on a cash basis of 80.5%. This brings the total dividend for the year ended 30 June 2015 to $4.20 per share, an overall dividend payout ratio of 75.1%. Looking ahead, the bank remains positive about the long-term performance of the Australian economy although there are inevitably short-term economic challenges. The bank remains conservative and aims to focus on key long-term strategic priorities – people, productivity, technology and strength.

Historical Financials (Source: Company reports)

Recently, CBA launched an Innovation Lab in Hong Kong and announced plans to launch an Innovation Lab in London later 2016. This innovation network is a natural extension of the Bank’s successful Innovation Lab in Sydney and creates a global approach to innovation that connects customers, employees and start-up communities to the latest FinTech developments.

On the other hand, we believe that the stock is still trading at higher levels and corrected over 6.26% (as of January 22, 2016) in the last one month. With a higher PE ratio against its peers, we rate the stock "Expensive" at the current share price.

CBA Daily Chart (Source: Thomson Reuters)

Westpac Banking Corp

.png)

WBC Dividend Details

Efforts to address client’s needs:For 2015, Westpac Banking Corp (ASX: WBC) announced statutory net profit for the 12 months to 30 September 2015 of $8,012 million, up 6% over the prior year. Cash earnings grew 3% to $7,820 or 249.5 cents per share, up 2%, while cash return on equity was down 57 basis points to 15.8%. Net interest income increased 6%, lending was up 7% and customer deposits was up 4%. Looking ahead, Westpac is positive about the future and believes that it is strongly positioned for the number 1 or number 2 position in all key markets. This is mainly driven by a distinct portfolio of brands, a market-leading online and mobile platform, and a high quality management team. A recent New Westpac research release revealed saving money is a top priority for Australians. Over two million Australians intend to make a New Year's resolution about saving money in 2016, with a total savings target of $21 billion. The Westpac New Year Resolutions Report shows almost 85% of those who are making a New Year savings resolution have a specific savings target in 2016, on average aiming to save $11,234 for the coming year. However, we believe that the stock is still "Expensive" at the current share price.

WBC Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...