Metals X Limited

Quick Look at Quarterly Results: Metals X Limited’s (ASX: MLX) copper division generated EBITDA (Earnings before interest, tax, depreciation and amortization) of ($5.5) million in the September 2018 quarter. During the same period, the company witnessed a rise in the production as in the current quarter it was 4678 tonnes while in the previous one it was 3850 tonnes. The concerns related to the production as well as grade dilution which were witnessed in the previous quarter in Copper division were resolved gradually in September 2018 quarter.

.png)

Tin division’s production and costs (Source: Company Reports)

The company’s Tin division witnessed a rise in the EBITDA as well as net cash flow in September 2018 quarter as compared to the previous quarter. In September quarter, EBITDA amounted to $7.2 million while the net cash flow amounted to $3.6 million. However, in the previous quarter EBITDA was $6.8 million and net cash flow was $1.7 million.

What Risks Metals X is exposed to: Metals X Limited might witness unforeseen environmental risks moving forward. The environment laws and regulations in Australia might impact the company. Another risk which the company might encounter is the risk related to the volatility in the commodity prices. The company’s cash flows as well as revenues are related to the commodity prices. The global macro factors (like geopolitical tensions) impact the commodity which might adversely affect the company’s financial position. In the Tin division, its ore sorter might increase the annual production of tin at Renison by 15-20%. Under the same division, the company stated that its strategy related to ore sorter revolves around to increase the underground ore production. On the other hand, any rise in commodity prices will also boost the stock.

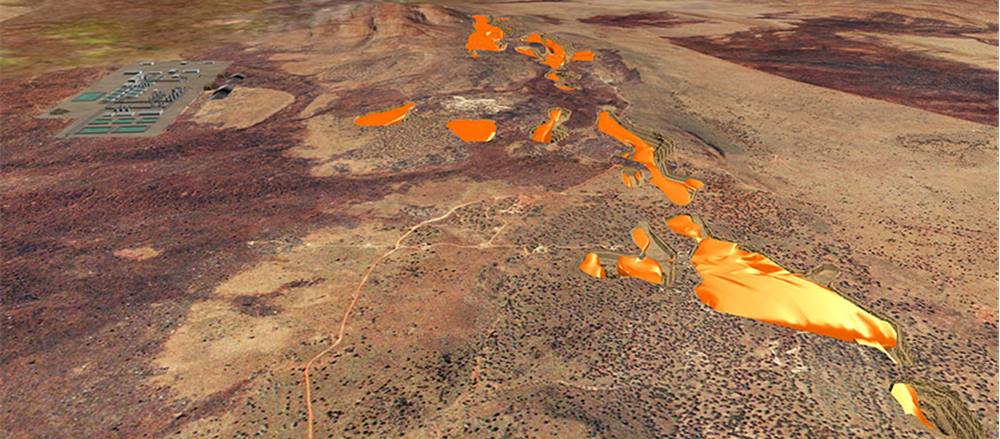

Technical Overview: Exponential Moving Average or EMA has been applied on the daily chart of Metals X Limited by using the default values. It is expected that the stock price would cross the EMA and might move upwards. In fact, on October 17, 2018, the stock rallied 6.897%. Therefore, we maintain “Speculative buy” rating on the stock at the current price of $ 0.465 considering the low levels and prospects from mine such as the Pilbara-based copper mine, Nifty.

Westgold Resources Limited

Mixed Yearly Results: Westgold Resources Limited (ASX: WGX) ended FY 2018 with total revenues amounting to $372 million which implies the YoY increase of 21%. The company’s after-tax operating loss stood at $1.2 million and its cash flow was $14.7 million with respect to the operations during the same period. The management of the company reflected favourable views for 2018 and the company has made deployments which could help it in witnessing long-term growth. The management refers 2018 as “transformational year” because, in Murchison region, the company has 3 operating processing plants. The management of the company stated that it has deployed substantial capital towards the business sectors. As a result, platform which could boost the growth prospects with respect to the gold assets has been developed. Moving forward, this could also help the shareholders of the company.

Income Statement (Source: Company Reports)

Technical Overview: Relative Strength Index or RSI has been applied on the daily chart of Westgold Resources and default values are considered. The 14-day RSI is near its oversold region and might witness a rebound. As a result, based on foregoing and prevailing trading level we maintain a “Speculative buy” on the stockat the current price of $ 1.135.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

Please wait processing your request...

Please wait processing your request...